Couldn’t have said it better myself…

30-minute Head & Shoulders Pattern confirmed as foretold. Original Thesis: The Result: Quick Glance at the Market Heat Map and Industries Notables: The market got scorched…literally Consumer Goods had no survivors some pockets of strength in materials…surprisingly. Be sure to check out my latest swing trades and overall past performance

A heaviness felt upon the stock market today Quick Glance at the Market Heat Map and Industries Notables: Tech remains the most bullish of late. Healthcare and Consumer Goods hit hardest. Services not too far behind. Be sure to check out my latest swing trades and overall past performance

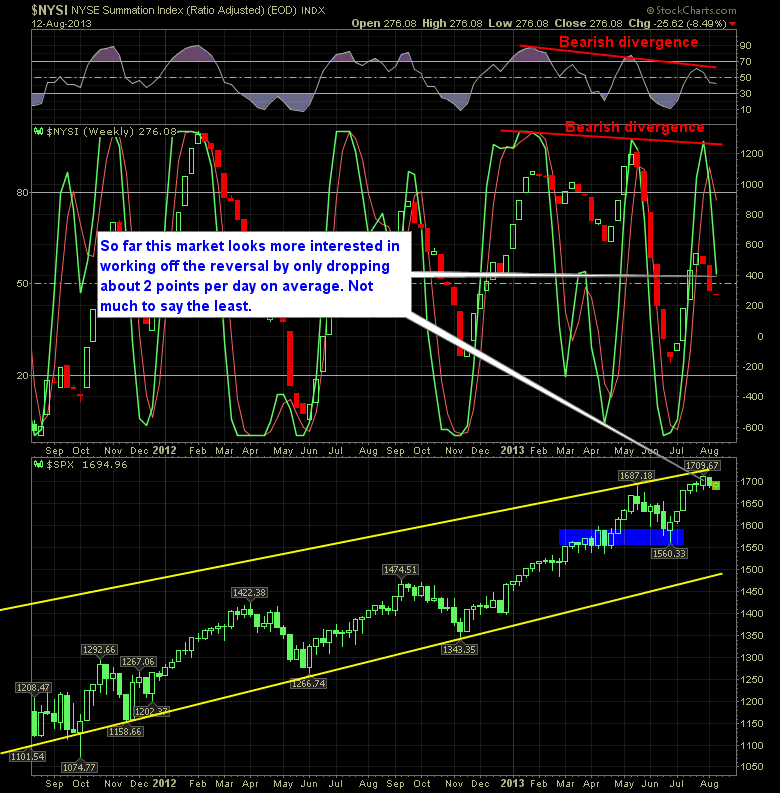

Typically a divergence on an indicator, especially as drastic as that on the T2107 foretells of a looming reversal in the market. The T2107 measures the number of stocks trading above the 200-day moving average. What’s funny is that the SPX is so far above the 200-day moving average and hasn’t traded below it

’bout time this stock finally broke out…long from 13.86 Quick Glance at the Market Heat Map and Industries Notables: It’s amazing what a little bit of Apple (AAPL) can do for the market. Banks stabilized, but plenty of weakness in the REITs Utilities continue to struggle. Materials were mixed with no clear direction. Be

’bout time this stock finally broke out…long from 13.86 Quick Glance at the Market Heat Map and Industries Notables: It’s amazing what a little bit of Apple (AAPL) can do for the market. Banks stabilized, but plenty of weakness in the REITs Utilities continue to struggle. Materials were mixed with no clear direction. Be

If you are growing bored with this market, don’t worry you have plenty of company. If you are a bear, well you are just royally frustrated and I extend to you my sympathies. It has been one too many missed opportunities to say the least for the bear crowd. With that said, the optimal opportunity

If you are growing bored with this market, don’t worry you have plenty of company. If you are a bear, well you are just royally frustrated and I extend to you my sympathies. It has been one too many missed opportunities to say the least for the bear crowd. With that said, the optimal opportunity

Needs to break through the 200-day moving average or things could get messy… Quick Glance at the Market Heat Map and Industries Notables: Banks – were miserable for a third straight day. Services reversed yesterday’s slight strength into the market’s main loser today. Materials stayed afloat, and utilities stopped their bleeding as well. Be sure

Needs to break through the 200-day moving average or things could get messy… Quick Glance at the Market Heat Map and Industries Notables: Banks – were miserable for a third straight day. Services reversed yesterday’s slight strength into the market’s main loser today. Materials stayed afloat, and utilities stopped their bleeding as well. Be sure