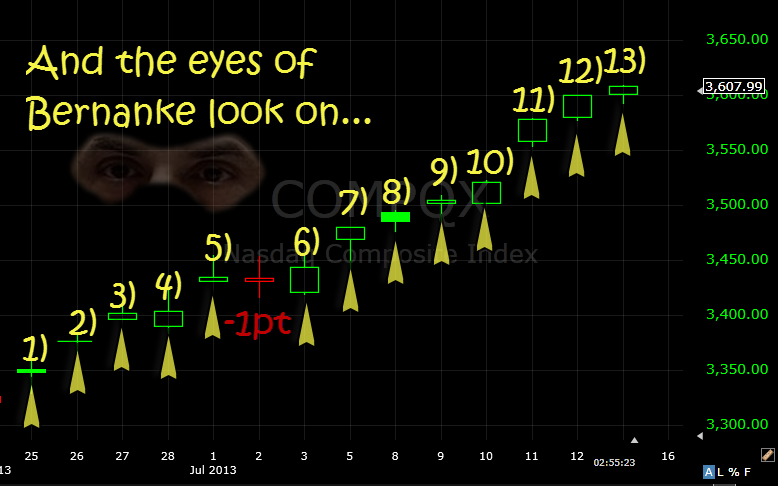

Probably the most spectacular bullish streak I have seen this entire year in the markets….just utterly unfathomable. .Ben Bernanke sends his regards.

The only way to explain this is that entitlements are funding corporate profitability… Quick Glance at the Market Heat Map and Industries Notables: Tech finally was amazing… even Apple (AAPL) was on board with the rally. Financials had more weakness than I would have liked. Consumer Goods and Services were solid. A large chunk of

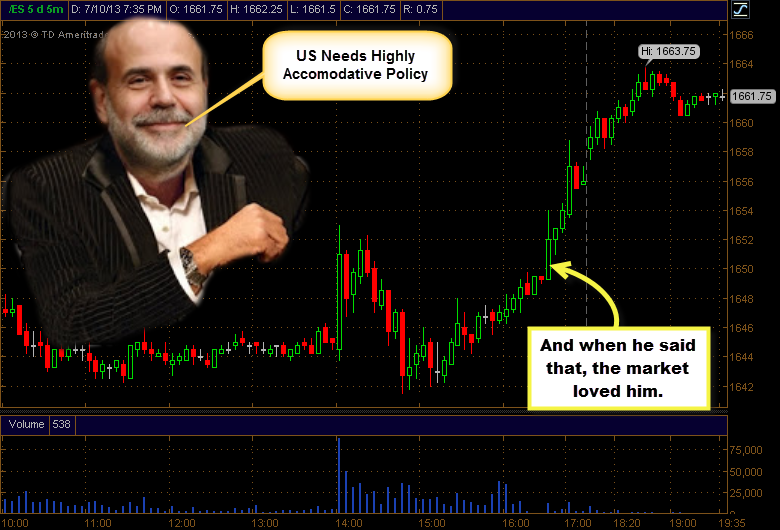

He's Got the Whole Market In His Hands... Forget Earnings Season, its been Bernanke Season for five years now. Industry Notes: Banks clearly led the way lower - followed by materials. Tech was scatter-brained again - but more strength than not. Still a lot of capital flowing into utilities. Consumer Goods remained steady. SharePlanner Market Compass:

Down Goes the Euro… Quick Glance at the Market Heat Map and Industries Notables: Materials were on fire. Tech still unable to find continuity among its masses. Utilities remain strong. Be sure to check out my latest swing trades and overall past performance

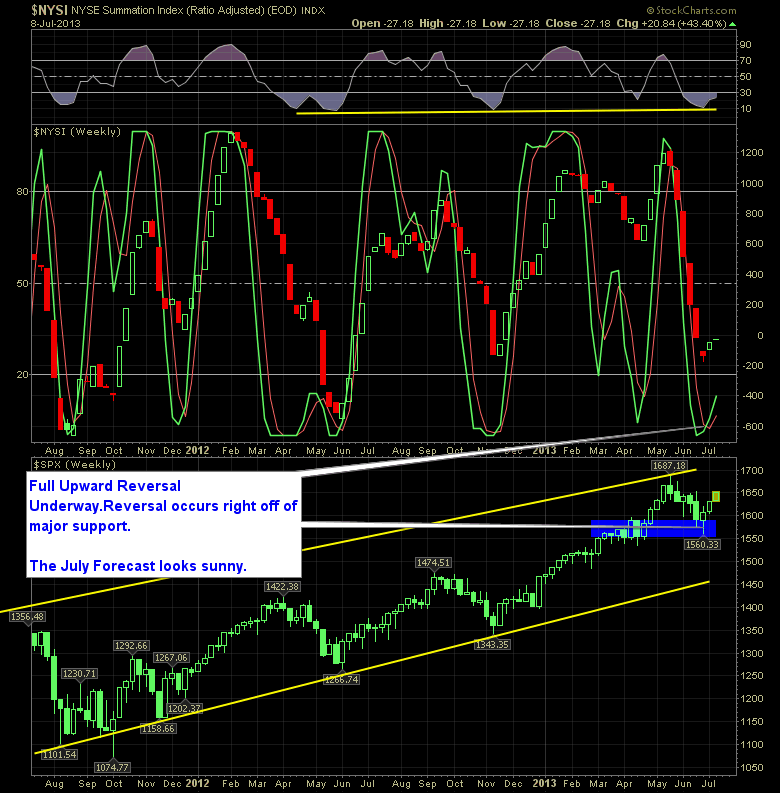

Reversal at June Lows Bodes Well For Markets These are exciting times to get long on the market, because if it plays out like we’ve see for the past year or so, the gains should respresent a substantial part of the year’s returns. It is early on in the reversal process and there should be

Welcome to Second Quarter Earnings Season… Quick Glance at the Market Heat Map and Industries Notables: What is wrong with Tech today?… Slackers! Banks held strong, GS still struggles. Utilities show interest…safety rotation? Be sure to check out my latest swing trades and overall past performance

A lot of people have said for years that I was crazy for saying Gold and Silver was in a huge commodity bubble (similar to the housing market 10 years ago) and way overvalued. But now we are finally starting to see the writing on the wall and it doesn't look good at all for

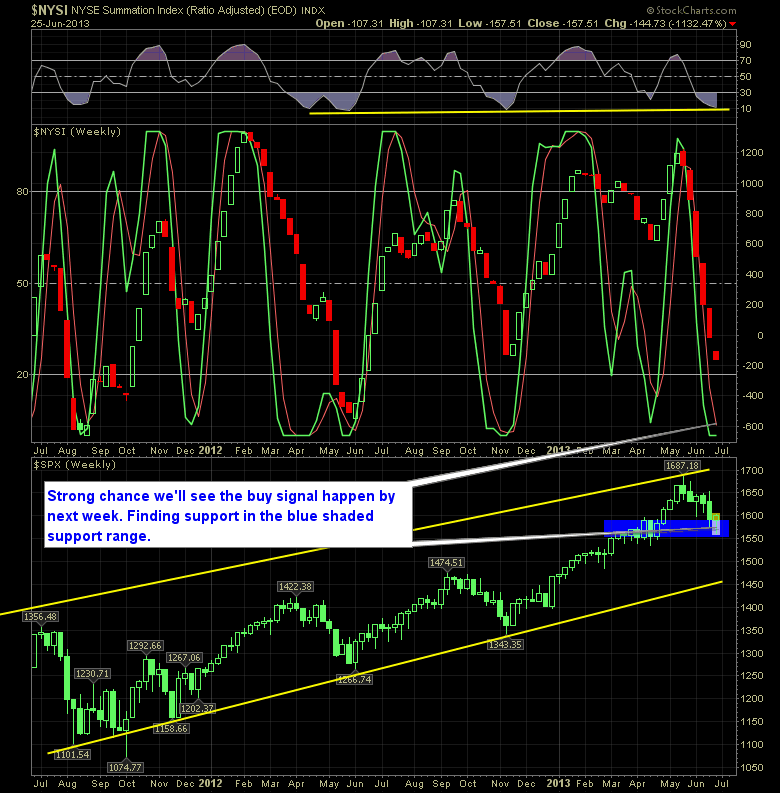

Reversal Indicator Looks Optimistic for Stocks Its been a rough going for stocks this month, and the way things are shaping up, it looks like stocks will probably have its first down month of 2013, and the first in eight months. If it wants to get back in the Green, it will need to close

Chart of the Day… You have to consider if the same pattern of bouncing to new highs will play out once again. It is important to know your history. Quick Glance at the Market Heat Map and Industries Notables: BANKS BANKS BANKS – they led the way – that was huge. Technology still cannot move