Let’s face it, the Central Bank Bubble is still on the up and up. Yes, it was off to a rocky start this year, and last year, well, last year was a total bore. But the the Fed, ECB, BOJ, and PBOC are clearly doubling down on their desire to keep the rally from 2009

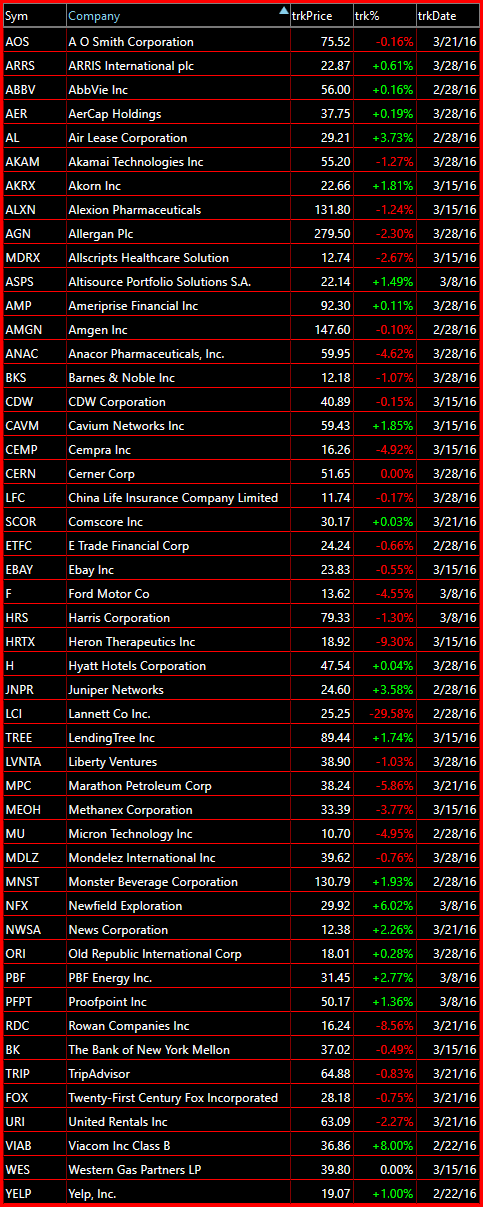

Technical Outlook: SPX traded flat yesterday on extremely weak volume – the weakest volume day of the year. SPY volume was only 10% higher than what was seen on Christmas eve. For the bulls the recent selling isn’t overly concerning as it extremely shallow and light volume. The 5-day moving average yesterday was tested

Learn to consistently profit in your own portfolio by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I trade in each day. Click Here

The market pulled back nicely last week… it pulled back orderly, and after seeing the three day pullback there is little concern at this point for the bulls. Sure the selling could pick up, but as it stands right now, this market looks like a light volume pullback that the bulls are going to buy

Technical Outlook: Thursday marked the third straight day of selling for the S&P 500 (albeit barely), but the day’s results saw a hard bounce off of the morning lows. Potential higher-low established on Thursday for the current trend off of the 2/11 lows. Last week marked the first time in six weeks that SPX

Learn to consistently profit in your own portfolio by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I trade in each day. Click Here

Technical Outlook: SPX finally saw a respectable sell-oiff yesterday for the first time in the last 10 trading sessions, and only the second time in the last 16 trading sessions. More weakness at the open, but if there is one thing that is true with this current market, that the bears struggle when there is

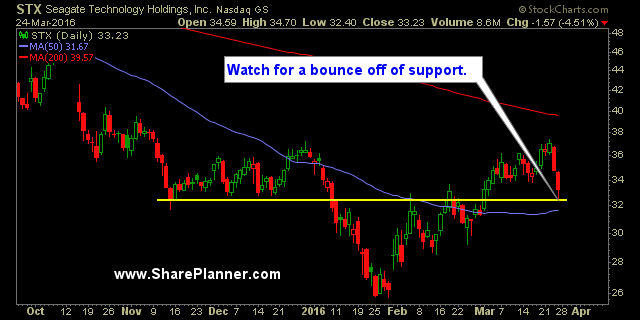

After breaking out of its recent base, oil has been on a roll, breaking out of its rising channel and crushing the hopes and dreams of bears wanting to see $20 oil. Now the question is, does the bears have a renewed sense of hope here with a possible break in the rising trend-line? We

I’m actually net short on this market – that is 10% short, 90% cash. I honestly see the reward being to the downside, while the market to the upside has hardly no reward until the market does in fact pullback. Basically the market is stuck in a conundrum. Bulls want this market to go higher,

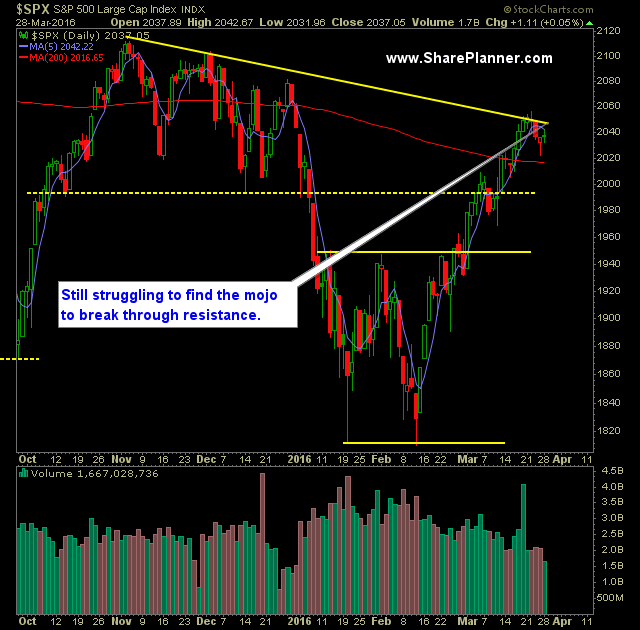

Technical Outlook: If you thought Monday was a boring trading session, yesterday just about had it beat. Volume was a bit higher, but way below recent averages. SPX is essential coiling here at recent highs in a manner similar to a bull flag pattern. Dow Jones Industrial, has hit long-term declining resistance off