This week’s market wrap up, trade setups for next week and general thoughts and approaches in trading success.

Technical Outlook: One of the most volatile quarters ever ended on a quiet note yesterday pulling back ever so slightly. Today’s morning weakness is looking at a respectable gap down. These gaps downs how been difficult for the bears to do anything with, often times leading to eventual, same-day, market rallies. Last April had a

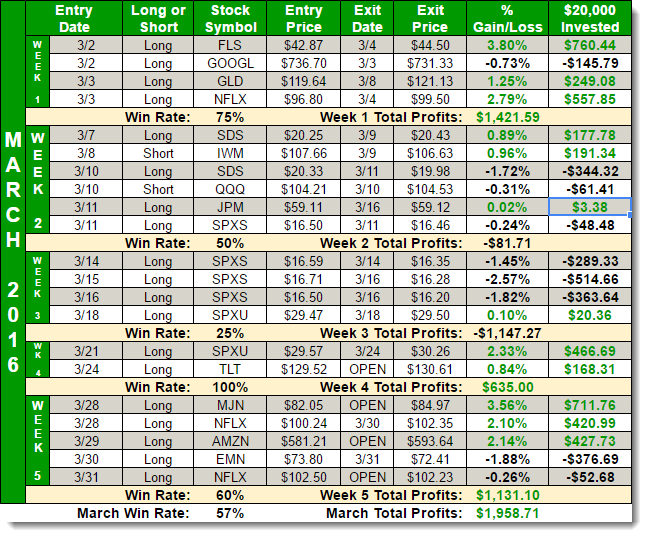

Well… that was one crazy month…one crazy quarter! In fact it was the first time a quarter sold off more than 10% and finished in the green overall. To say the least, it was a historic quarter, and highly unlikely we’ll see anything remotely close to it for the rest of the year. That doesn’t

USO chart so far is really interesting to me. Yes, it has lost all of its short-term moving averages that include the 5-day, 10-day and 20-day, but overall, the pullback that has, until today, lasted six straight days and seven of the last eight days, has only given up 38.2% of its recent gains, which

Technical Outlook: Gap up yesterday held on but not in an overly convincing manner on the SPY – finishing slightly lower than its opening price. Volume trailed off from the day prior and is still well below recent averages. Potential bull flag pattern forming on the SPY 30 minute chart. Yesterday’s price action represented

Learn to consistently profit in your own portfolio by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I trade in each day. Click Here

Technical Outlook: SPX had a solid day yesterday following dovish remarks about future rate increases from Janet Yellen. Her dovish outlook as it pertains to rate hikes has been, in large part, the reason for the massive rally off of the February lows. Volume yesterday on the SPY was notably higher than recent days,

Learn to consistently profit in your own portfolio by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I trade in each day. Click Here

Any time you are trading on a roll, it is easy to start watching the dollars in the account. For example, today, I bought into Amazon (AMZN) at $581, it is now at $594. I bought Netflix (NFLX) yesterday at $100.24 and now it is at $104. Not to mention Mead Johnson Nutrition

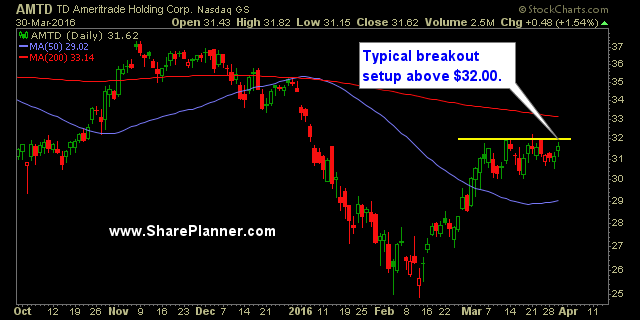

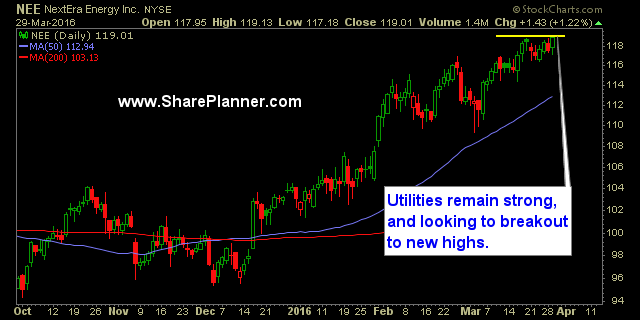

The chart is beautiful, and there is little resistance overhead. I’ve already added one new swing trade to the portfolio today and I like my positions and long exposure where they current are. As a result, I don’t want to add any new long positions to my portfolio right now.