It was an awesome month of trading in The Splash Zone and ready for another great month in March. The market finished down a 0.5% for the month while SPX was up +2.5%! Bring some stability to your own portfolio by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you

I like this ole’ setup here in Skyworks (SWKS). There is a massive amount of resistance overhead going back about six months that it is finally breaking through. There is support at the 50-day moving average that you can put your stop-loss below providing a solid reward-to-risk ratio. Here’s the trade setup:

Oil is stabilizing. You have three recent lows dating back to January that form the outline of an inverse head and shoulders pattern that could play out strong in the days ahead. You have a downtrend that has finally been broken. You have an ascending triangle breakout. But…

Technical Outlook: Mild rally but quality follow through after the epic rally on Tuesday. SPX is headed for a showdown with key price resistance at the 1990 level. A break through of that level likely sends price up to around the 2020 level. Volume was extremely light on SPY and the lightest since 2/18.

It was an awesome month of trading in The Splash Zone and ready for another great month in March. The market finished down a 0.5% for the month while SPX was up +2.5%! Bring some stability to your own portfolio by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership,

Technical Outlook: Massive breakout above stubborn resistance at the 1947-50 level that resulted in almost the biggest rally of the year. Such a massive rally on already extreme overbought conditions is unusual. Such a rally usually takes place in an oversold environment following a massive sell-off. SPX managed to bounce off of the rising trend-line

It was an awesome month of trading in The Splash Zone and ready for another great month in March. The market finished down a 0.5% for the month while SPX was up +2.5%! Bring some stability to your own portfolio by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership,

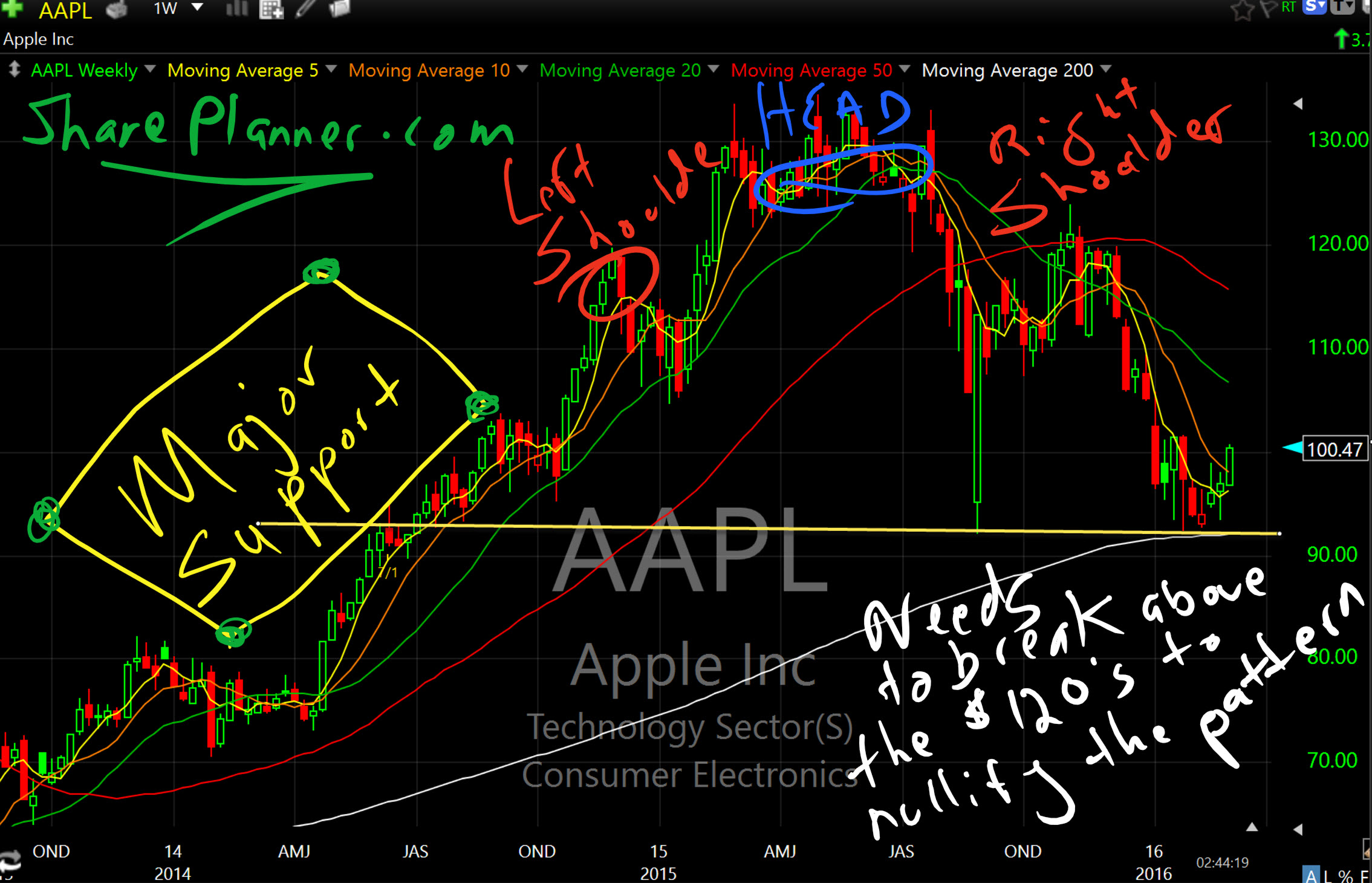

Great day for the Apple (AAPL) stock, but the weekly still poses some major issues. First there is still a full-fledged head and shoulders pattern that is still playing out, and if the weekly chart ever closes below $92, it will be doing so below a MAJOR support level that will likely push price even

Rip-Roarin’ rally today that has SPX shattering resistance levels with authority. Quite honestly, it is embarrassing to be posting a list of short setups on a day like today where the market makes it entirely nonsensical to be playing any of the shorts below. But it is Tuesday, and that is when I post this

Technical Outlook: SPX pulled back yesterday hard and into the price range that has plagued the market for all of 2016 so far – between 1810 and 1950. With it, the price action closed just slightly below the rising trend line off of the 2/11 lows on the 30 minute chart. Some may even