The market is down today but for how long? To say this is another top in the market and now there is going to be a retest or break of the February lows is insanely premature. Heck, no one can even say for certain that this market is going to even be willing to close

Technical Outlook: SPX rose for the fifth straight day, being saved in the last 5 minutes of trading with a nice pop. The 5-day moving average continues to hold strong since last Tuesday’s mega-rally. SPY rallied straight into resistance yesterday at $200’s but didn’t break higher. Volume was low and back to the levels

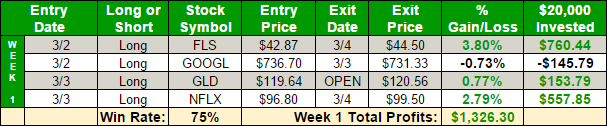

March is off to a strong start for the Splash Zone. Learn to consistently profit in your own portfolio by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as

I’m not against buying stocks still but at this point, the price action needs to be reigned in a bit. I’m not looking for price action to go back down to the February lows, not now at least, it may later, but that isn’t for the here or now to really consider. What I am

Technical Outlook: SPX finished higher for a third straight week and the first time it has pulled off such a streak since last November/December. Interestingly enough SPX closed at 1999.99 on Friday, which came at the chagrin of many holders of weekly call options at 2000. The tendency of late has been for any

March is off to a strong start for the Splash Zone. Learn to consistently profit in your own portfolio by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as

My job as a trader isn't to match the market dollar for dollar on every move it makes. Sometimes my moves will be more and sometimes it will be less. The key though is to be consistently profitable. And that is something I pride myself on as a trader. Yes, this week the market went

It has always amazed me how upset traders get when it comes to their views on the market or on a stock being opposed by someone else. Holding dear to a viewpoint that you have on either a stock or the market in general is not going to yield you a single dime in profits.

Technical Outlook: Another melt up into the close while lagging throughout the morning. This has been the trend over the past two days, where the market is unable to garner any traction throughout the trading sessions until the afternoon when the buyers come in during the afternoon and drive the market higher. Yesterday’s volume was

Market and stock analysis including $SPX $SPY $QQQ $IWM $COMPQ $STT $FB $AMZN $NFLX $GOOGL $USO Enjoy!