Learn to consistently profit in your own portfolio by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I trade in each day. Click Here

Technical Outlook: Another low volume and tight trading range for SPX yesterday. Volume was on par with yesterday’s light reading and well below recent averages. Price closed below the declining trend-line as well as below the 200-day moving average for SPX. Market behavior over the last two trading sessions and a few others before

March is off to a strong start for the Splash Zone. Learn to consistently profit in your own portfolio by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as

Yeah, I know, the bulls, even with today’s weakness, still have a firm hold on this market. But there are some conditions underneath the surface that suggests conditions are weakening a bit. Look no further than the small caps which has led this market higher all along. Today they are hitting new low after new

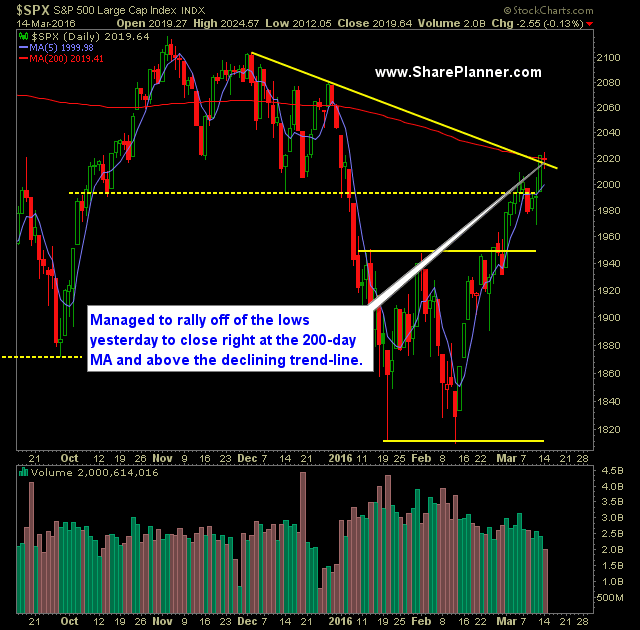

Technical Outlook: Dip buyers remained in control yesterday and rallied the market after the morning sell-off, to hit new intraday highs on the current rally. Though the rally is still steep, it is starting to flatten out some. A lot of resistance exists between 2020 and 2040 going forward and will pose difficulties for the

March is off to a strong start for the Splash Zone. Learn to consistently profit in your own portfolio by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as

This is really a “choose your poison” type of moment for the markets. Here is what it boils down to:

The big banks appear to be setting up for a bigger move here. I am already long in JP Morgan (JPM), but all four of these charts are posting solid reward/risk ratios with the potential to break higher any day now. Take a look at each chart, you’ll see that over the past two

Here’s a compilation of stocks that I am following this week. There’s a huge chunk of them. But there is also an extremely overbought market that will likely stifle any additional major moves to the upside until these conditions are worked off some. So, like last week, I still want to see these conditions get

Technical Outlook: Big day for the market on Friday, breaking through the 200-day moving average and the declining trend-line off of the December highs. Volume was still below average and below the levels seen on Thursday for SPY. This week is the FOMC Meeting that comes out at 2pm on Wednesday, which will no doubt