My Swing Trading Approach

I will continue tightening my stops on existing trades so that the majority of profits are locked in. Also, I want trades with tight risk parameters, so that any new long positions avoid major impacts to the portfolio if the overall market reverses.

Indicators

VIX – Likely it will see a sub 10 reading today.

T2108 (% of stocks trading below their 40-day moving average) – Back over 60% finally. Huge improvement since the beginning of August. Long-term is still in a well defined down trend of lower highs.

Moving averages (SPX): Above all the MA’s now – follow the 5-day MA for short-term direction.

Industries to Watch Today

Industrials remains very strong, Energy continuing the rebound, Basic Materials looks top heavy, Technology, Consumer Defensive and Utilities all equals in their unfettered march to the upside.

RELATED: Patterns to Profits: An Intro Trading Course

My Market Sentiment

Weary of the overnight risk that NoKo poses, not so much from a missile launch perspective but from failed Diplomacy that could lead to a military strike. As a result, I am still cautious about becoming too heavily long in this market.

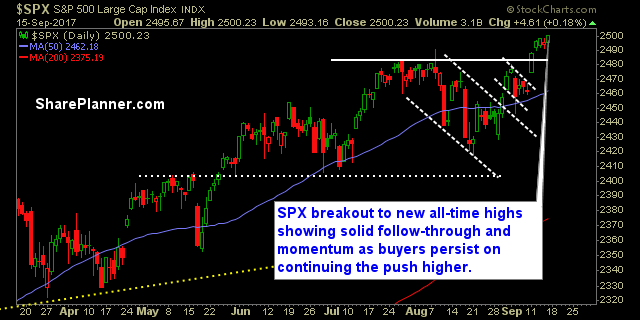

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 6 long positions

Recent Stock Trade Notables:

- Netflix (NFLX): Long at 177.75, closed at 182.30 for a 2.6% profit.

- Micron (MU): Long at $31.12, closed at $31.94 for a 2.6% profit.

- WYNN Resorts (WYNN): Long at 138.20, closed at $141.37 for a 2.3% profit.

- Netflix (NFLX): Long at $168.69, closed at $173.06 for a 3% profit.

- PSQ: Long at $39.28, sold at $38.34 for a 2.3% loss.

- SPXU: Long at $14.68, closed at $15.42 for a 5.0% profit.

- Tesla (TSLA): Long at 365.09, closed at 356.15 for a 2.4% loss.

- United Parcel Service (UPS): Long at 113.58, sold at $114.74 for a 1% profit.

- First Solar (FSLR): Long at $48.07, sold at $49.10 for a 2.1% profit.

- Facebook (FB): Short at $168.31, covered at $170.62 for a 1.3% loss.

- SDS: Long at $49.81, closed at $48.88 for a 1.8% loss.

- SPXU: Long at $14.51, closed at $15.25 for a 5.1% profit.

- Zayo Group (ZAYO): Long at 32.91, closed at 33.83 for a 2.8% profit.

- JP Morgan Chase (JPM): Long at $94.91, closed at $93.83 for a 1.1% loss.

- Bank of America (BAC): Long at $24.48, closed at $25.01 for a 2.2% profit.

- Alibaba Group (BABA): Long at $151.69, closed at $153.43 for a 1.2% profit.

- Salesforce (CRM): Long at $90.86, closed at $89.43 for a 1.5% loss.

- Autodesk (ADSK): Long at $106.45, closed at $111.34 for a 4.6% profit.

- Bank of America (BAC): Long at $23.99, closed at $24.23 for a 1% profit.

- IBB: Long at $313.18, closed at $324.25 for a 3.5% profit.

- SPXU: Long at $14.82, closed at $14.58 for a 1.6% loss.

- Alibaba Group (BABA): Long at $143.65, closed at $150.40 for a 4.7% profit.

- American Airlines (AAL): Long at $49.26, closed at $51.84 for a 5.2% profit

- Intel (INTC) Short at $35.21, covered at $34.46 for a 2.1% profit.

- Nvdia (NVDA): Long at $155.57, closed at $157.53 for a 1.3% profit.

- IBB: Long at $298.24, closed at $303.74 for a 1.8% profit.

- SPXU: Long at $15.68, closed at $15.25 for a 2.7% loss.

- Whirlpool (WHR): Long at $190.46, closed at $195.19 for a 2.5% profit.

- Ferrari (RACE): Long at $84.60, closed at $89.93 for a 6.3% profit.

- Amazon (AMZN): Long at $964.70, closed at $1001.23 for a 3.8% profit.

- American Airlines (AAL): Long at $49.18, closed at $50.62 for a 2.9% profit

- Alibaba Group (BABA): Long at $124.95, closed at $137.51 for a 10.1% profit.

- Starbucks (SBUX): Long at $61.78, closed at $63.68 for a 3.1% profit.

- Western Digital (WDC): Long at $91.24, closed at $89.29 for a 2.1% loss.

- Broadcom (AVGO): Long at $236.65, closed at $241.15 for a 2% profit.

- SPXU: Long at 16.60, closed at $16.98 for a 2.3% profit.

- JP Morgan Chase (JPM): Long at $87.84, closed at $85.98 for a 2.1% loss.

- Micron Technology (MU): Long at $29.00, closed at $28.04 for a 3.3% loss.

- Alibaba Group (BABA): Long at $116.25, closed at $124.09 for a 6.7% profit.

- Southwest Airlines (LUV): Long at $58.35, closed at 57.23 for a 1.9% loss.

- Broadcom (AVGO): Long at $223.63, closed at $228.65 for a 2.2% profit.

- Workday (WDAY): Long at 86.00, closed at 90.32 for a 5% profit.

- Univar (UNVR): Long at $30.96, closed at $32.20 for a 4% profit.

- Alibaba Group (BABA): Long at $111.91, closed at $115.48 for a 3.2% profit.

- Redhat (RHT): Long at $85.21, closed at $87.21 foor a 2.4% profit.

- Darling Ingredients (DAR): Long at $15.19, closed at $14.90 for a 1.9% loss.

- Apple (AAPL): Long at $143.82, closed at $147.11 for a 2.3% profit.

- Teradyne (TER): Long at $31.16, closed at $33.03 for a 6.0% profit.

- UPRO: Long at $92.75, closed at $94.78 for a 2.2% profit.

Sign up for Trading Block here.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.