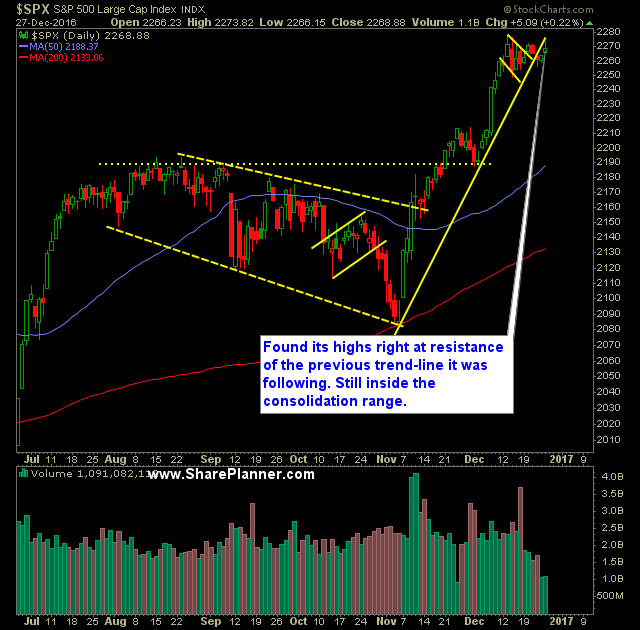

Technical Analysis:

- Yesterday marked the twelfth consecutive day in which S&P 500 (SPX) was stuck in a sideways trading range of 29 points.

- Today is the beginning of the 5-day trading even traditionally known as the Santa Rally, which encompasses the last three trading sessions of the year and first two trading sessions of the new year.

- Last year’s Santa Rally was a disaster for the market. It was down three out of five days and literally jump-started a sizable market sell-off. So don’t take these Santa Rally’s for granted.

- CBOE Market Volatility Index (VIX) rose for a third straight day and off of key support dating back to the August lows of this year.

- Slight uptick in volume yesterday on SPDRs S&P 500 (SPY), considering that Monday had the lowest volume day of the year, that isn’t necessarily an achievement to brag about. And yes, it was still well below recent averages, and will continue to be so through the rest of this week.

- SPX recaptured the 5-day and 10-day moving averages.

- Once again, the Dow Jones Industrial Average (DJIA) was shown the hand and kept from achieving 20,000. Every time this happens, it makes me laugh, as the pundits on TV and the blogosphere keep making such a big deal about a meaningless level that really doesn’t represent anything but a big round number.

- Light Sweet Crude Oil Futures (/CL) still marching higher in an attempt to rally into the year-end and for a fourth consecutive day. It has a solid trend-line in place off of the November lows.

- There is very little news left to be reported before year end. Expect continued light trading and limited price action.

- Nasdaq (COMPQX) remains strong as it continues to form new all-time highs. Yesterday it attempted to breakout of the short-term consolidation range.

- For now the market remains very bullish and shows little to no indication it desires to pullback in the near term. Trying to front-run a market top at this juncture is a very futile exercise and should be avoided. Wait for the market to show signs of cracking via price action before getting net short on this market.

- So far the market is basically ignoring the rate increase entirely. There has be no impact so far. Last year, the selling picked up considerably right at the end of the year when the traditional Santa Claus rally typically kicks off.

My Trades:

- I added one new long position to the portfolio yesterday.

- I did not close out any positions in the portfolio yesterday.

- I will look to add 1-2 new swing-trades to the portfolio today.

- I am currently 50% Long / 10% Short / 40% Cash

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How does war impact the stock market and what are the potential risks and hazards that impact traders attempting to remain profitable in their swing trading? In this podcast episode, Ryan Mallory covers everything managing the volatility that comes with the headline risk, dealing with heightened levels of emotions, securing open profits, and market exposure to uncertainty in the stock market.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.