Technical Analysis:

- The S&P 500 (SPX) took a breather yesterday when it decided to sell-off ever so slightly.

- The 5-day, 10-day and 20-day moving averages on SPX are converging and offered an excellent support level for the bulls to bounce off of yesterday. Watch that level of support, again today.

- Light Sweet Crude Oil Futures (/CL) still range bound and could go either direction at this point. However it is trying to string together a 3-day winning streak.

- Volume on SPDRs S&P 500 (SPY) barely fell yesterday, but did so for a third straight day, and the readout was also below recent averages.

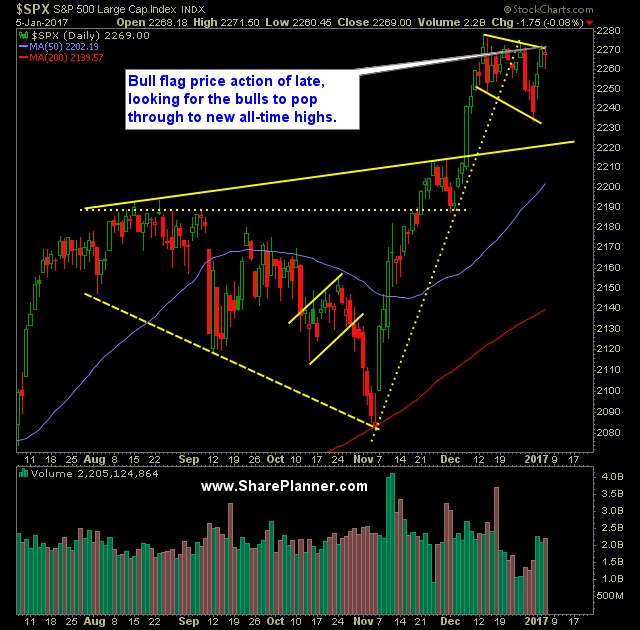

- Bull flag on the SPY/SPX charts that I would expect for the bulls to eventually push through.

- A good rally today will put the Dow Jones Industrial Average (DJIA) past the 20,000 mark and put the meaningless story to bed.

- CBOE Market Volatility Index (VIX) got slammed for a third straight day. Support hovering around the 11.25 area. Potential for a bounce here.

- Nasdaq (QQQ) bucked the trend yesterday of the other indices with a rally of its own. It is poised for new all-time highs yet again.

- The “January Effect” which many believe is a barometer on how the rest of the year will fair, has been right only once in the last three years. Consider the fact that 5 of the last 8 years January has performed opposite of the total returns for its given year.

My Trades:

- No new trades for me yesterday. The market action wasn’t conducive to adding anything else.

- My current market exposure is 50% long and 0% short and the rest is cash.

- I didn’t close out any trades yesterday either. Portfolio remained the same.

- I will look to add 1-2 new swing-trades to the portfolio today as well as a new hedge to the portfolio.

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

What do you do when the best trade setup that you can find is a stock that you already have a position in? Should you trade a stock that you already have a position in and exponentially increase the size of that position? In this podcast episode Ryan explains the circumstances that allows you to increase your position size in an already profitable trade and how to manage the risk in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.