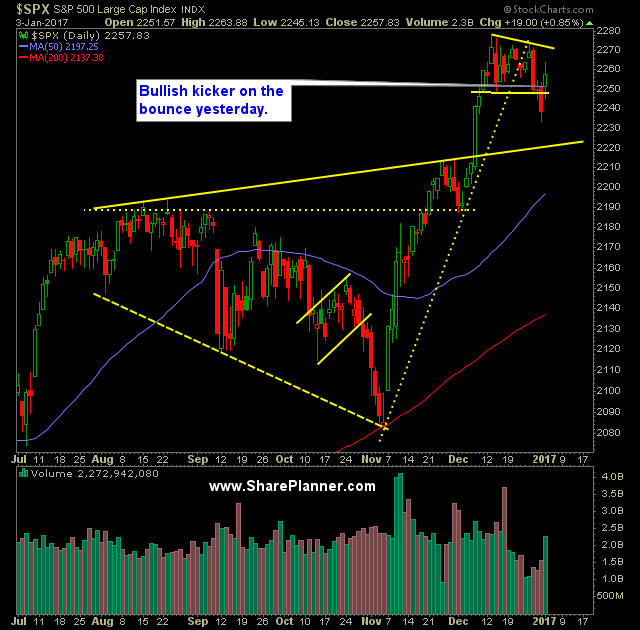

Technical Analysis:

- Volatile trading session to start the year with the initial gap up being all but squandered before the end of day rally restored much of the day’s morning gains.

- This was the first time S&P 500 (SPX) has traded higher during the “Santa Rally”. Today will be the last day of this rally – so far the return has been negative for the market.

- Expect some short-term resistance between 2259 and 2272 on SPX today.

- Clearly the market has lost some of the enthusiasm that it portrayed the couple of months following Donald Trump’s election victory. Careful with continuing to add new trades to the portfolio here.

- Volume has increased on SPDRs S&P 500 (SPY) over the past two trading sessions and returned to average levels. Much more liquidity than what we saw during the days before and after Christmas.

- Bullish kicker on SPX yesterday, where following a selloff, the bulls gap above the previous day’s opening price and closes higher.

- The 5-day and 20-day moving average were recaptured yesterday.

- SPX on the weekly chart is putting together a nice bullish flag.

- The “January Effect” which many believe is a barometer on how the rest of the year will fair, has been right only once in the last three years. Consider the fact that 5 of the last 8 years January has performed opposite of the total returns for its given year.

- CBOE Market Volatility Index (VIX) snapped its six-day winning streak with a sizable -8.5% sell-off down to 12.85.

- Light Sweet Crude Oil Futures (/CL) experienced a massive sell-off yesterday after gapping higher for the year and forming a bearish engulfing candle pattern. Lots of caution is warranted here on the oil trade.

My Trades:

- Increased my exposure on the long side, up to 50% while maintaining my 10% short exposure. The rest is is cash.

- I added two new long positions to the portfolio on Friday.

- I did not close out any positions yesterday.

- I will look to add 1-2 new swing-trades to the portfolio today.

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I explain whether it is a good idea or not to rapidly increase the size of your portfolio if you come across a sum of cash. A lot of traders will do this without ever recognizing the emotional toll it can have on you as a swing trader and the awful mistakes you can make in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.