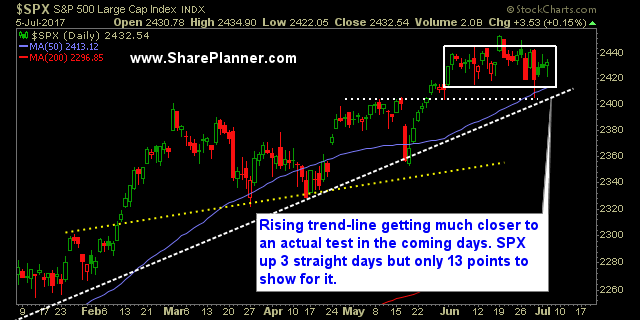

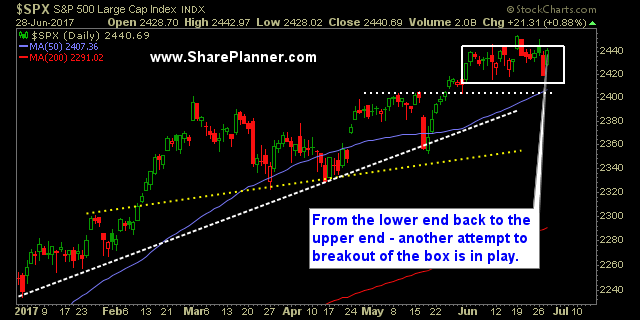

It was just last Thursday when the S&P 500 was on the cusp of a breakdown. Since then, it has been up, up, up. But only 13 points to show for the 3-day rally in the stock market. And each rally has been of mixed signals, with the Nasdaq down the first two days of

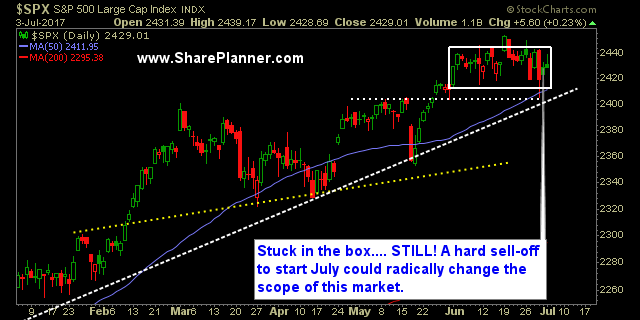

I suspect that the holiday volume will persist into the week. Anytime you have a week where there are only 3.5 trading sessions in total, you can expect that much of Wall Street will take the week off and enjoy an extended vacation.

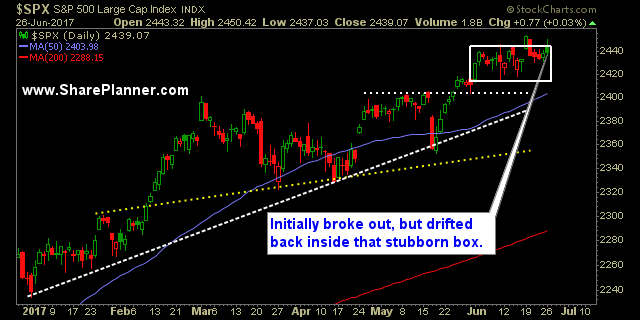

Futures are surprisingly making a move in the premarket Whether it holds will be a whole other question. Gap highers tend to be shakey business of late. Even Friday, where the market was solid all day long, chose to sell off in the final 10 minutes of trading and wipe out about 80% of the

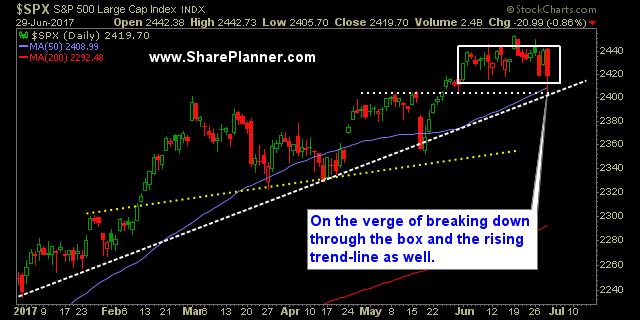

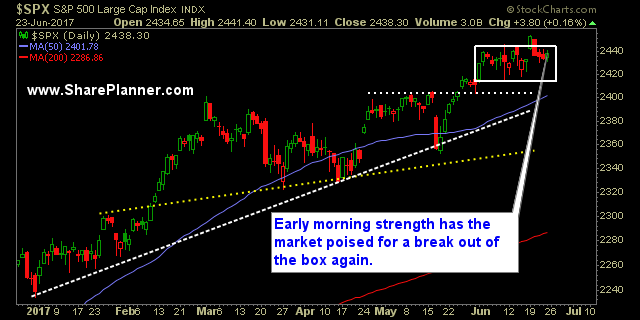

Stock market is on shaky ground That doesn't mean the market is simply going straight down from here - if it were only that easy. That's because, despite the sudden bearishness that has been prevalent throughout this week, there is still that pesky dip buying mentality of the stock market that won't let the 8

Nasdaq selling off again, SPX flat The technology purge looks to resume again this morning, while most of the overnight gains have been lost by the large caps. This market is becoming a bit less predictable in the latter half of this month. yesterday's bounce looked reminiscent of the bounce following the May 17th sell-off,

Buy Machines Continue to Bounce following One Day Sell-offs If the premarket is any sign of what looms for the market today, it will be yet another hard bounce following a one-day sell-off.

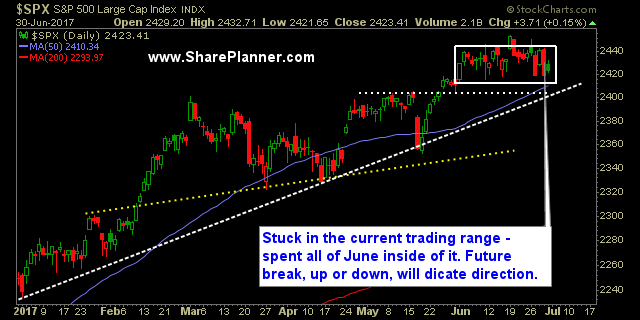

Stocks and Indices continue to trend sideways Outside the first trading day of the month, the market has absolutely gone nowhere. Stock trends in general have been totally sideways or in more technical terms, “consolidating”.

Prepare for the funds to start window dressing their quarterly and 6 month reports This is one of those points in the year, where the funds become very concerned by their performance. So much so, that they’ll start what is commonly known as ‘window-dressing’ their portfolios with all the right stocks so that they can

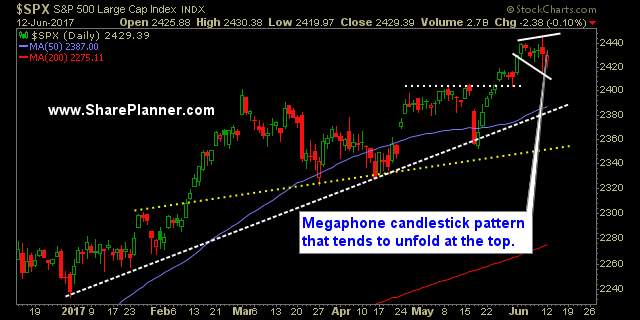

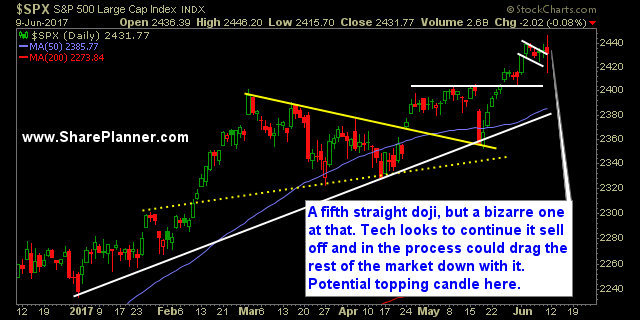

Short-term bearish megaphone pattern showing itself. Much of it comes from the fact that Friday’s crazy doji pattern has created this megaphone pattern, but nothing happened today to change the look of it either.

Inflection point: Let tech bust here or buy the dip once again. That is the choice the market has because what we saw on Friday with everything tech related being sold in a frenzy, made it seem like that suddenly, no one wanted to be in anything Nasdaq or tech related. Heck, did you