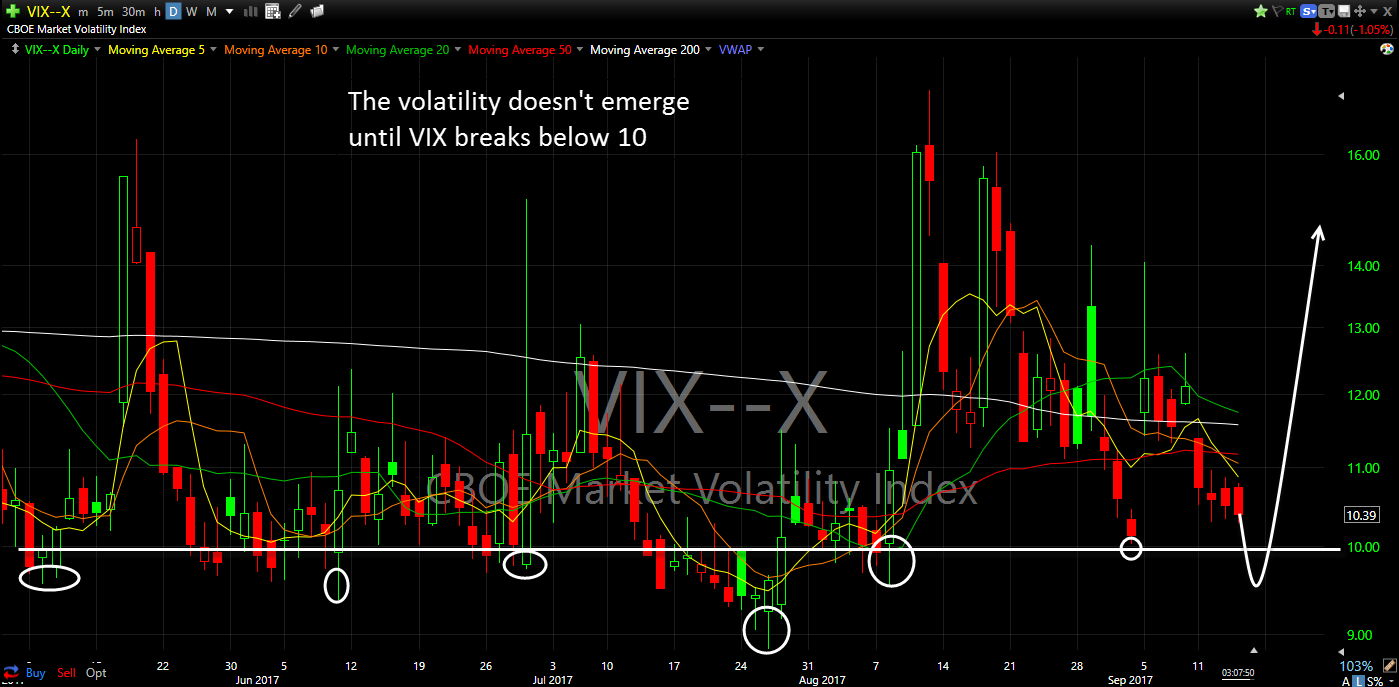

My Swing Trading Approach Will look to increase my stops in current positions as well as lock in profits where needed. Likely to be careful about adding additional long exposure at current VIX levels. Indicators

My Swing Trading Approach Watching for follow through today, to add legitimacy to yesterday’s ATH rally. If that happens, I’ll look to add more long exposure. Indicators

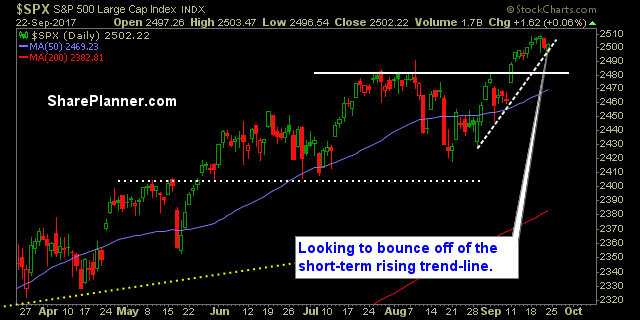

My Swing Trading Approach Yesterday’s intraday bounce off the lows could provide a good launching pad to add a couple of new long positions to the portfolio today – particularly with some of the oversold big-tech stocks. Indicators

My Swing Trading Approach I’m not looking to get 100% long here. While a lot of traders are very comfortable with this market,I realize the risk of a sell-off that takes price down 1-2%. As a result, I want to maintain the flexibility to get net short if need be. Indicators

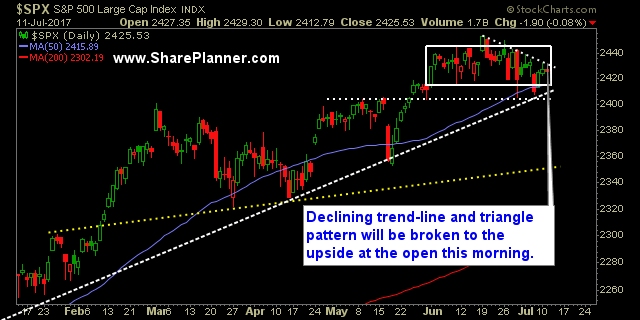

My Swing Trading Approach Keeping a slightly bearish portfolio here as the bulls continue to show the inability to rally this market thorugh key resistance levels. Though I am ready to flip to the long side if necessary. Indicators

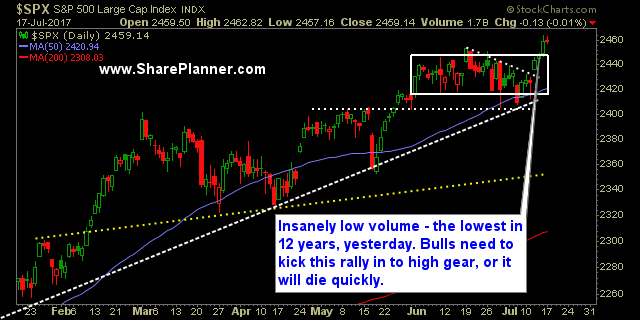

Yesterday’s rally didn’t quite seem there was a great deal of conviction behind it. Perhaps with the Fed set to release its FOMC Statement today, we’ll get the market to provide us with a decent size move. Over the past four trading sessions, the market has been rather quiet.

3 days of selling of less than one point per day That is what SPX has averaged over the course of the last three days when it finished lower each day - less than one measily point. For the bears that has to be infuriating. I don't blame them - I would be too, if

Support holding strong, dip-buyers still flying in at any moment of weakness. Yesterday was a sound day for the bulls from a technical standpoint. For one, the S&P 500, by a large margin, saw a huge uptick in volume from the day before. Which is good, because I kind of thought the market was dying

Stocks ready to bust a move despite yesterday’s freakout That was a fast, hard, sell-off that came out of nowhere yesterday and looked like it was going to really bring down the market in a big way, until the Senate announced that they were going to do their job and actually work and not take