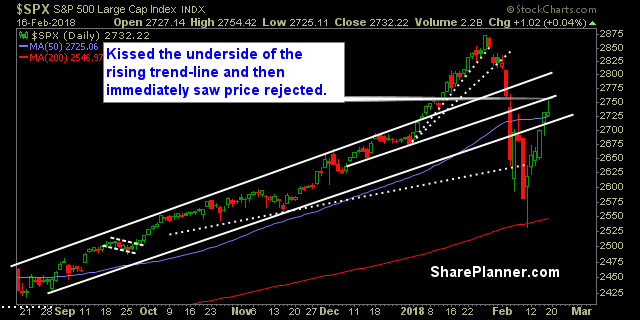

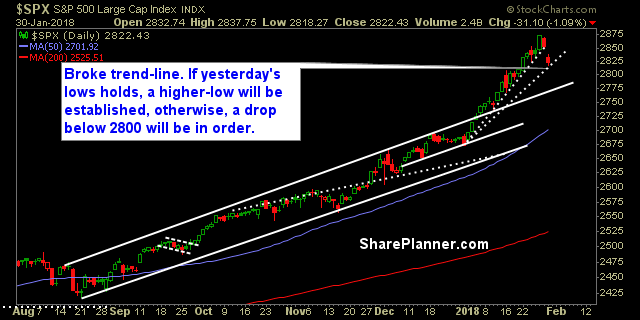

My Swing Trading Approach There is a solid possibility that I put a couple of short positions to work today. Plenty of trade setups to the downside are out there, and bears may be hitting the end of this dead cat bounce. If not, then I will look to continue playing the long side.

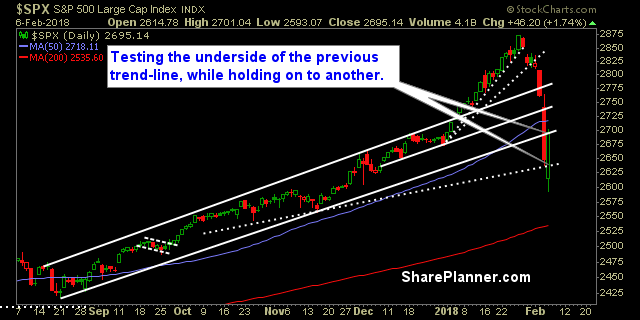

My Swing Trading Approach Right now, I have plenty of trades to work with in the portfolio. I may still add more to the portfolio, but I want to see how this morning’s weakness plays out. If necessary, I will begin booking gains, and even consider a short position if this market decides to roll

My Swing Trading Approach I am looking to add 1-2 new long setups to the portfolio today, if the market rally can continue, targeting large cap, quality stocks that are bouncing off of key support. Indicators

My Swing Trading Approach I’m not looking to add new positions to the portfolio unless this market can show itself capable of sustaining a bounce. Indicators

My Swing Trading Approach Wait and see if the market wants to continue with the bounce off of the morning lows. If not, it will be a time to sit on my hands and watch. Indicators

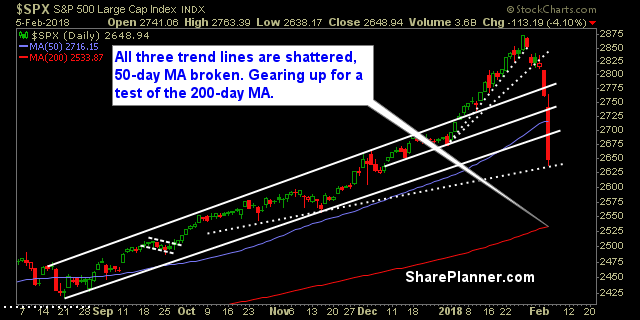

My Swing Trading Approach There will be a substantial bounce to play at some point in the future. I will sit on the sidelines until that time is unveiled. Indicators

My Swing Trading Approach I expect us to see a rally come forth at some point this week that will be hard and fast. However, while playing it is okay, committing too much capital to it is a bad thing. Be careful as it may not take place exactly when you expect. Stay nimble and

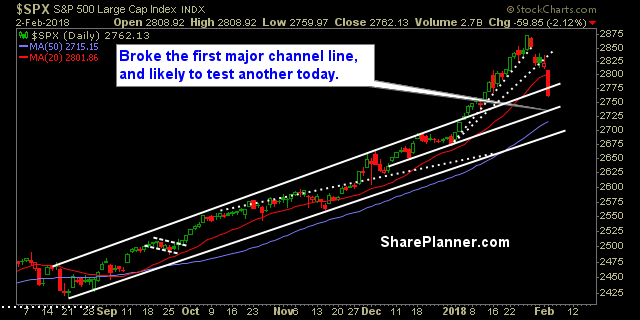

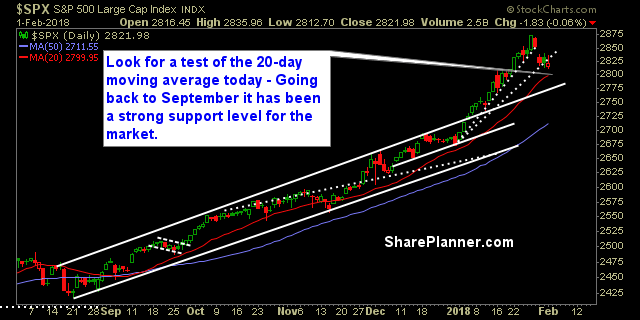

My Swing Trading Approach I will be watching to see how the 20-day moving average is holding up today. If it does hold, it will likely be a good opportunity to buy the dip. Otherwise, if it slices right through it, I will stand by. Ideal shorting opportunities going forward should come from a failed

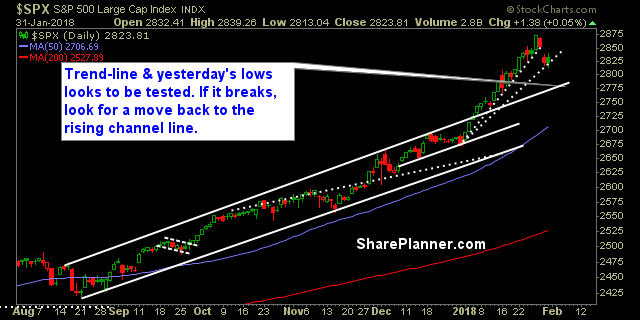

My Swing Trading Approach I didn’t buy any stocks yesterday. I stayed put, and may do the same thing again today. If the bulls can turn things around, I’ll consider adding some long exposure, but not ready to start aggressively short this market. I’ll see how the day unfolds. Indicators

My Swing Trading Approach If the market is interested is reversing the selling of the past two days and rallying, I will be interested in adding 1-2 new positions to the portfolio. Beyond that, I will continue raising my stops on existing positions. Indicators