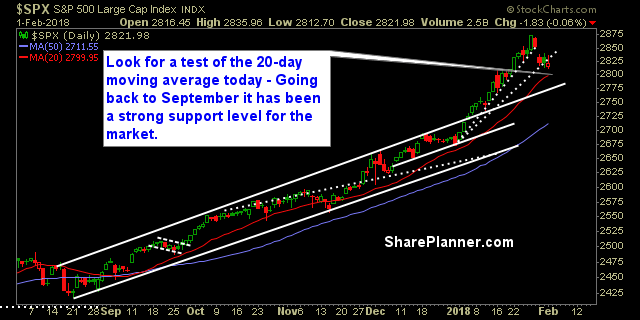

My Swing Trading Approach I will be watching to see how the 20-day moving average is holding up today. If it does hold, it will likely be a good opportunity to buy the dip. Otherwise, if it slices right through it, I will stand by. Ideal shorting opportunities going forward should come from a failed

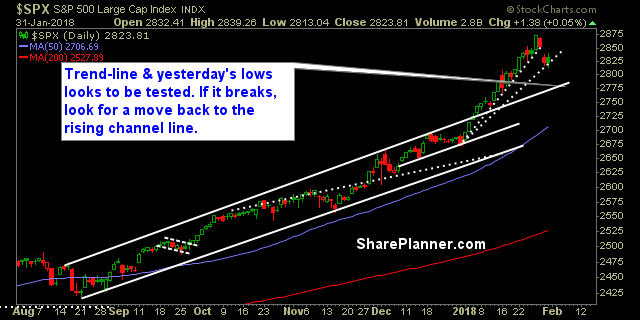

My Swing Trading Approach I didn’t buy any stocks yesterday. I stayed put, and may do the same thing again today. If the bulls can turn things around, I’ll consider adding some long exposure, but not ready to start aggressively short this market. I’ll see how the day unfolds. Indicators

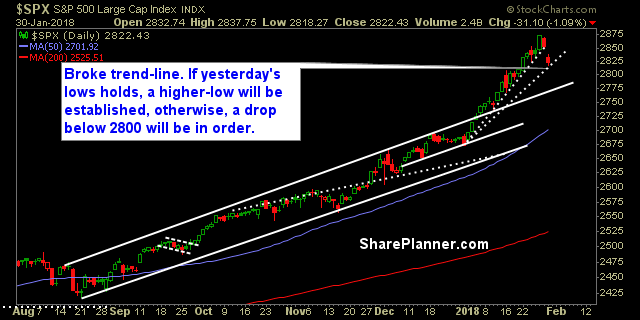

My Swing Trading Approach If the market is interested is reversing the selling of the past two days and rallying, I will be interested in adding 1-2 new positions to the portfolio. Beyond that, I will continue raising my stops on existing positions. Indicators

My Swing Trading Approach Tighten my stops, and sit tight. The key here isn’t to fight the market but to wait for favorable market conditions for trading. Indicators

My Swing Trading Approach I will be looking to manage my existing positions first, and may let my portfolio ride out here, rather than adding new positions today. Indicators

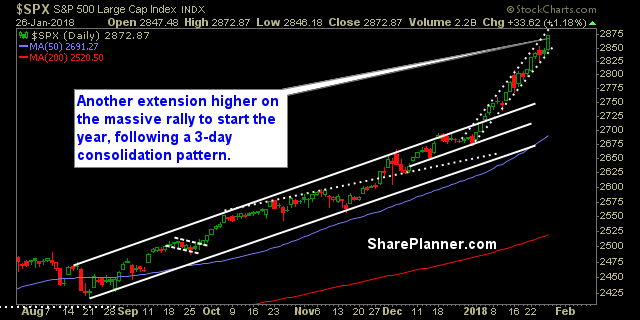

My Swing Trading Approach Added two new positions to the portfolio on Friday, looking to add 1-2 more today. The market, simply isn’t breaking, and the trend can’t be wrestled with. Indicators

My Swing Trading Approach I am open to adding one to two new positions to the market today, but price action in the overall market needs to be favorable. Indicators

My Swing Trading Approach Should this rally continue into today, 1-2 new positions is likely for the portfolio. I will also continue raising my stops on my profitable positions. Indicators

My Swing Trading Approach A number of my profitable positions were stopped out yesterday. That’s what the stops are there to do – protect profits! So, if this market can sustain the early morning strength being seen so far, I will look to add 1-2 new positions to the portfolio today. Indicators

My Swing Trading Approach I’m not against adding new positions to the portfolio, but right now, the risk is not in the bulls favor. A near-term pullback at some point is likely, which will create better entry prices. Keep moving up those stops! Indicators