Do or Die for $GLD. Double top pattern, followed by two years of price level support and a 4 year trend-line that has converged. If they break, I expect $GLD to see $136.

Quite the reversal for $SPY $SPX today.

$GME declining resistance being tested today.

$SMH failing to hold the breakout through resistance today.

$SMH major resistance (broken support) being retested, but unable to break through as of yet.

$BBIG – I repeat myself a lot on this front, but still worth repeating – don’t chase big movers. More times than not, the easy money has been made.

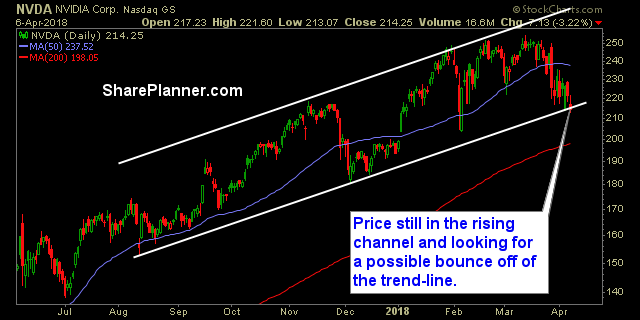

The charts on the Semiconductors simply look BAD! There is nothing redeeming about them here, and there are plenty of more earnings reports to come out on them still, including the big names like Advanced Micro Devices (AMD), Nvidia (NVDA) and Intel (INTC).

Plenty of takeaways during the month of November for my swing-trading. For one, it was another successful month, but there were a few stretches in there, that I’d like to soon forget. Most notably was the way in which it ended.

Despite the tear the market has been on this week, the early morning hours is showing futures with a little bit of hesitation. I added three additional short positions to the portfolio with the expectation that this market cannot go much higher as it is up against critical levels of resistance. So if the market doesn’t