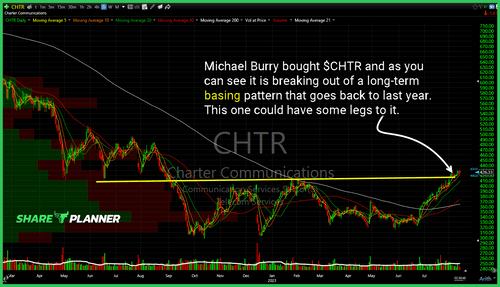

Michael Burry bought $CHTR and as you can see it is breaking out of a long-term basing pattern that goes back to last year. This one could have some legs to it. $VIX still can't break above resistance. Volatility shorts continue crushing the index with every bounce. Strong bounce so far today for $SMH, but

ARK Next Generation Internet ETF (ARKW) continues to see heavy rejection at the declining resistance level going back to last May. A lot of people chasing Amazon (AMZN) despite the fact it is trading on the underside of multi-year declining resistance. Better to wait for that resistance to clear first. Semiconductor ETF (SMH)

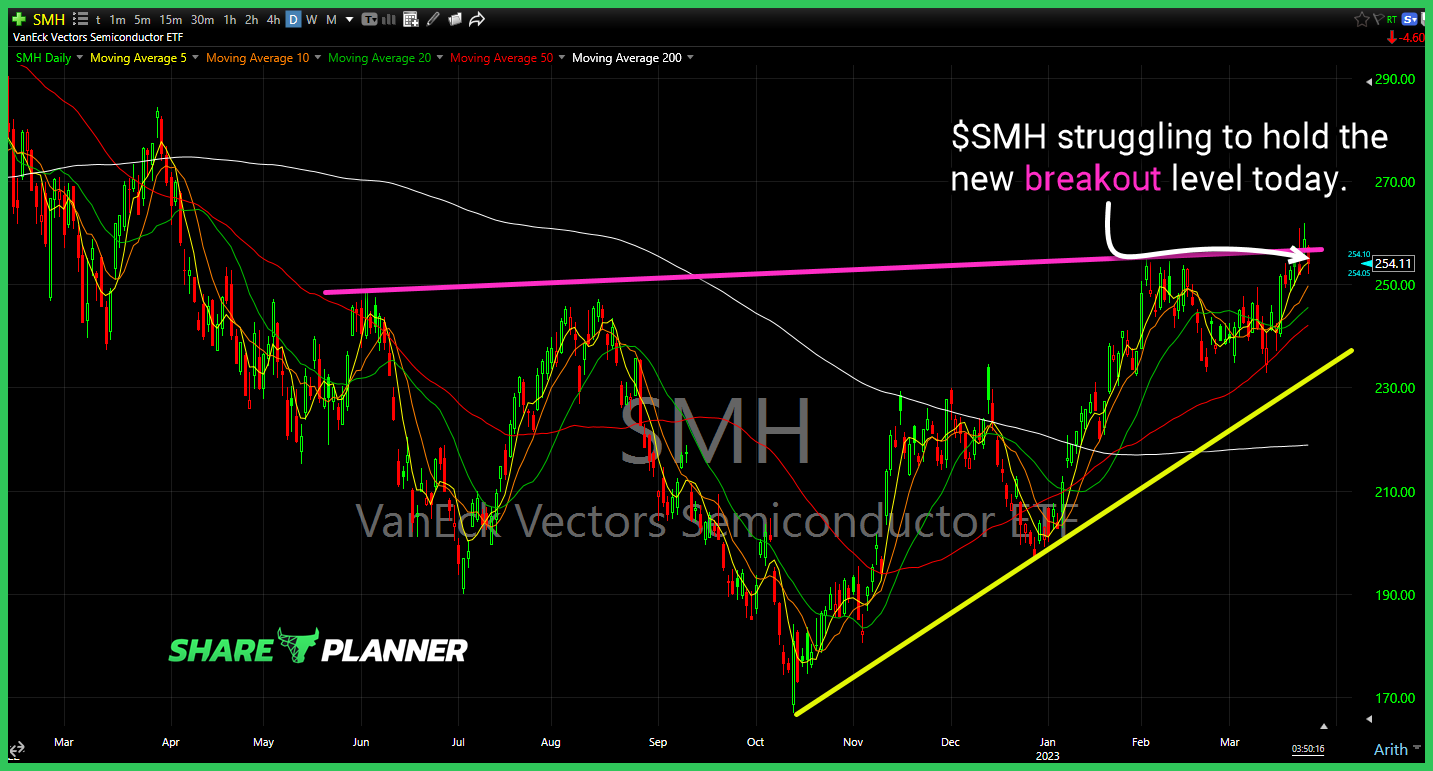

Semiconductors ETF (SMH) struggling to hold the new breakout level today. Nice basing pattern in Intel (INTC) worth watching in the week ahead. Could see a breakout AMC Entertainment (AMC) up 4 of the last 5 days, but despite that, a bear flag has been forming. Robinhood Markets (HOOD) nearing a test of its rising

Watch how Nike (NKE) responds to a potential test of its rising trend-line in the coming days. SPX with a 103 point sell-off, those chasing the initial bullish reaction got fleeced today! Somewhat muted SPY response so far following FOMC Statement. Semiconductors ETF (SMH) testing resistance going back to May of last year.

$DXY nearing a breakout above the ’23 highs.

Careful with Luminar Technologies (LAZR) despite the monster rally today that places price right at declining resistance. Adobe (ADBE) on watch for whether it attempts to bounce off of support. Semiconductors ETF (SMH) looking like it may try pulling back to its rising trend-line. AMC Entertainment (AMC) headed towards a test of major resistance. A

CBOE Market Volatility Index (VIX) Inverse head and shoulders basing pattern forming that is worth watching for a potential breakout next week. Applied Materials (AMAT) attempting to break out of the bull flag and re-confirm the inverse head and shoulders pattern. Semiconductor ETF (SMH) testing support that if broken would confirm a short-term

Rising channel in place to trade from on $GMED. A break below would be bearish.

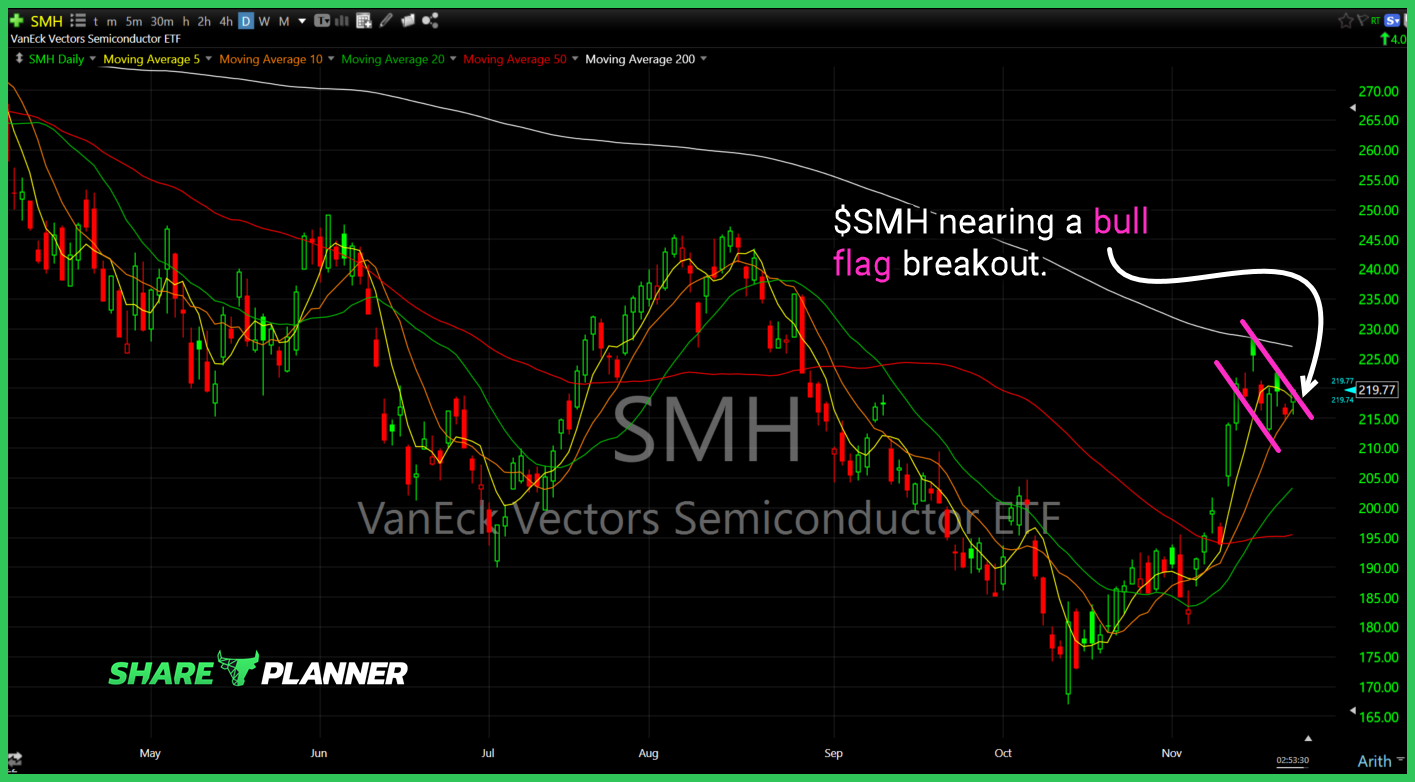

$SMH nearing a bull flag breakout.

$TTD testing the declining trend-line off the August highs. Watch for a potential rejection.