Back to the Dull Market Action

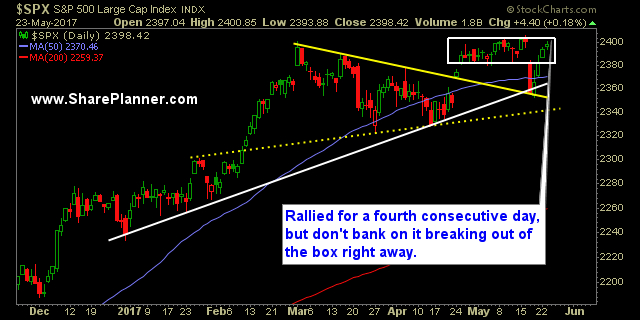

Just as I was expecting, we are back to the market conditions that we saw prior to last Wednesday’s sell-off. The market has bounced hard off of those Wednesday’s lows and within four trading sessions, we are back inside of the box that price action has spent practically the entire month inside of. The bulls have a small window of opportunity – rally this market in the next 1-2 days and out of the box, and establish a new short-term bull trend, or keep price inside the box and eventually set yourself up for another big sell-off to the downside.

The CBOE Market Volatility Index (VIX) continues to get decimated and from the 16’s last Wednesday, it is now back in the 10’s. With all the crazy headlines out there from a sitting president being under investigation for alleged collusion with the Russians, to Terrorist attacks, to possible nuclear war with North Korea, you’d think this market would be more on edge than what it is, but it isn’t. It had a brief moment of weakness last Friday but now all is good in the world (apparently).

But the most resounding indicator is the fact that with the S&P 500 being less than a third of a percent from new all-time highs, only 48% of stocks are trading above their 40-day moving average.

That is absolutely astounding….ASTOUNDING!!!

S&P 500 Chart

Current Stock Trading Portfolio Balance:

- 3 Long Positions

Recent Stock Trade Notables:

- SPXU: Long at 16.60, closed at 16.98 for a 2.3% profit.

- JP Morgan Chase (JPM): Long at 87.84, closed at 85.98 for a 2.1% loss.

- Micron Technology (MU): Long at $29.00, closed at 28.04 for a 3.3% loss.

- Alibaba Group (BABA): Long at $116.25, closed at $124.09 for a 6.7% profit.

- Southwest Airlines (LUV): Long at $58.35, closed at 57.23 for a 1.9% loss.

- Broadcom (AVGO): Long at $223.63, closed at $228.65 for a 2.2% profit.

- Workday (WDAY): Long at 86.00, closed at 90.32 for a 5% profit.

- Univar (UNVR): Long at $30.96, closed at $32.20 for a 4% profit.

- Alibaba Group (BABA): Long at $111.91, closed at $115.48 for a 3.2% profit.

- Redhat (RHT): Long at $85.21, closed at $87.21 foor a 2.4% profit.

- Darling Ingredients (DAR): Long at $15.19, closed at $14.90 for a 1.9% loss.

- Apple (AAPL): Long at $143.82, closed at $147.11 for a 2.3% profit.

- Teradyne (TER): Long at $31.16, closed at $33.03 for a 6.0% profit.

- UPRO: Long at $92.75, closed at $94.78 for a 2.2% profit.

- Murphy Oil (MUR): Long at $28.69, closed at $27.89 for a 2.7% loss.

- Las Vegas Sands (LVS): Long at $57.24, closed at $56.53 for a 1.2% loss.

- UPRO: Long at $91.94, closed at $96.54 for a 5.0% profit.

- Alibaba Group (BABA): Long at $105.736, closed at $108.22 for a 2.4% profit.

- Facebook (FB): Long at $134.27, Closed at $139.23 for a 3.7% profit.

- CDW Corp (CDW): Long at $58.65, closed at $58.91 for a 2.7% loss.

- Redhat (RHT): Long at $82.41, Closed at $83.53 for a 1.4% profit.

- Ambarella (AMBA): Long at $57.15, Closed at $55.52 for a 2.8% loss.

- Alibaba Group (BABA): Long at $104.73, closed at $106.05 for a 1.3% profit.

- Broadcom (AVGO): Long at $218.63, Closed at $222.71 for a 1.9% profit.

- American Airlines (AAL): Short at $44.76, Closed at $44.03 for a 1.6% profit.

- UPRO (Day-Tade): Long at $95.35, closed at $96.50 for a 1.2% profit.

- OZRK: Long at $56.12, closed at $54.69 for a 2.5% loss.

- FNSR: Long at $34.25, closed at $34.70 for a 1.3% profit.

- UPRO (Day-Tade): Long at $96.92, closed at $98.03 for a 1.2% profit.

- JP Morgan Chase (JPM): Long at $87.21, closed at $89.67 for a 2.8% profit.

- Chevron (CVX): Short at $110.03, covered at $111.85 for a 1.6% loss.

- Flex Technologies (FLEX): Long at $15.62, closed at $16.57 for a 6.1% profit.

- Baidu (BIDU): Long at $174.70, closed at $187.00 for a 7.0% profit.

- Ollie’s Bargain Outlet: Long at 33.20, closed at $32.50 for a 2.1% loss.

- Corning (GLW): Long at $26.98, closed at $27.45 for a 1.7% profit.

- Illinois Tool Works (ITW): Long at $127.74, closed at $129.86 for a 1.7% profit.

- Marriott Int’l (MAR): Long at $86.16, closed at $87.51 for a 1.6% profit.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.