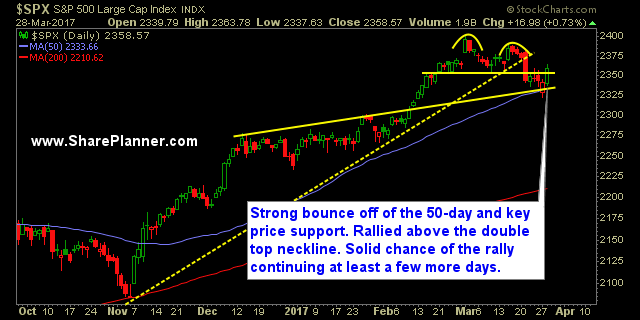

Solid bounce yesterday, but can the markets today follow through? For many years now, when we see the dead cat bounce come about, stocks overall will look to continue the bounce for several days going forward. For the markets today, will that ring true yet again? The futures are slightly down, but that has

My Trading Journal for the DJIA Today: Nasdaq still doesn't look so bad, Russell index does look pretty rough, the S&P 500 is giving up all of Wednesday's market rally, but the DJIA today managed to hold that 10-day moving average with a three day pullback that was quite shallow in nature. If it holds tomorrow,

My Trading Journal for the Stock Market Today: I'm pretty sure we are at that point where, "how many days can the Dow push higher", has become irrelevant. Lets just admit it, we are in the Phantom Zone at this point. We can decline 1% today is probably less likely than us running higher for another

Technical Analysis: The S&P 500 (SPX) took a breather yesterday when it decided to sell-off ever so slightly. The 5-day, 10-day and 20-day moving averages on SPX are converging and offered an excellent support level for the bulls to bounce off of yesterday. Watch that level of support, again today. Light Sweet Crude Oil Futures

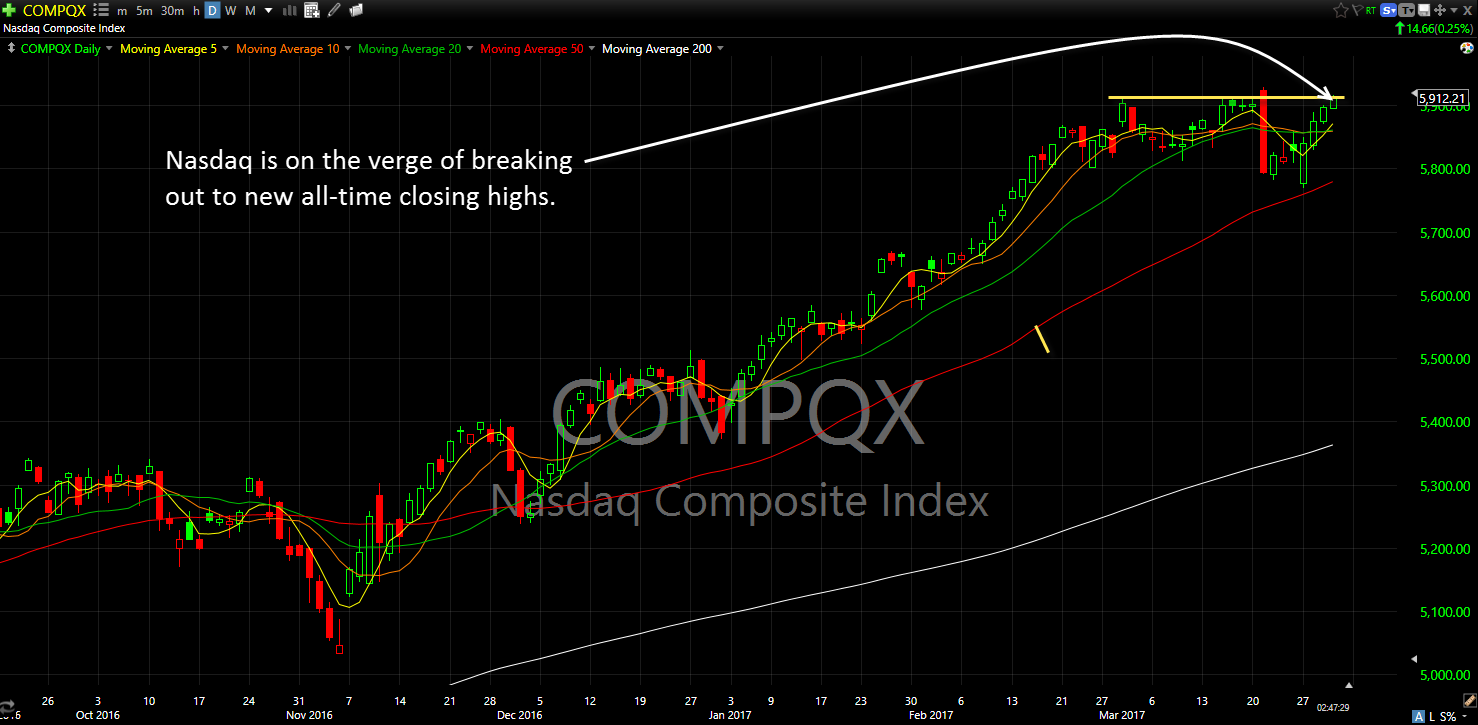

Technical Analysis: A much cleaner trading session for the bulls, as the market opened and rallied higher on the day, leaving little doubt as to who was in control during the session. Biotechs saw a solid push higher yesterday which provided the market with a solid floor to work from. Nasdaq (COMPQX) looked re-energized

Technical Analysis: A sell-off yesterday that was hardly a sell-off for the S&P 500 (SPX). Price fell by 0.66 points or 0.03%. Essentially it was a day of sideways price action. SPX found support right at the 20-day moving average yesterday by forming an indecisive doji candle just above it. Volume fell off some yesterday

Technical Analysis: Yesterday marked the twelfth consecutive day in which S&P 500 (SPX) was stuck in a sideways trading range of 29 points. Today is the beginning of the 5-day trading even traditionally known as the Santa Rally, which encompasses the last three trading sessions of the year and first two trading sessions of the new year.

Technical Analysis: Christmas volume starting to kick in yeserday as the S&P 500 (SPX) barely moved and gave up most of its gains on the day. SPDRs S&P 500 (SPY) volume fell off dramatically yesterday, coming in below average and at the lowest level seen over the last 9 trading sessions. The CBOE Market Volatility Index (

Technical Analysis: The S&P 500 (SPX) keeps marching higher with little resistance to counter its momentum, rising another 14 points towards the goal of 2300. Even more so, the Dow Jones Industrial Average (DJIA) is up 22 of the last 26 days (over 84% win rate) and has made new all-time highs 7 days in a row. Despite