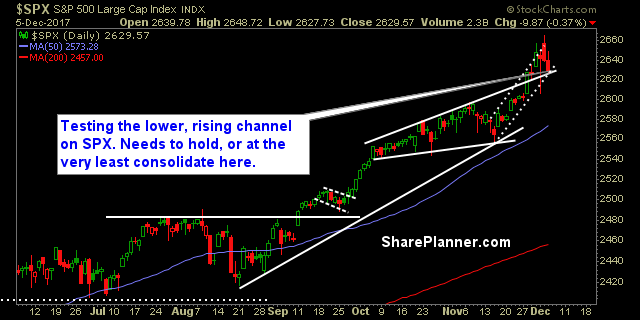

My Swing Trading Approach Not trusting the market here, unless it can show me it wants to play nice. I’ll add more positions to the long side, but the market needs to show it wants to bounce. Indicators

My Swing Trading Approach Light is best right now. I have the flexibility here to get more long or to start adding short positions depending on what the market wants to do today. Indicators

My Swing Trading Approach I have a balanced portfolio at this moment and need to see whether the bulls can bounce this market or not, before adding additional long positions to the portfolio. Indicators

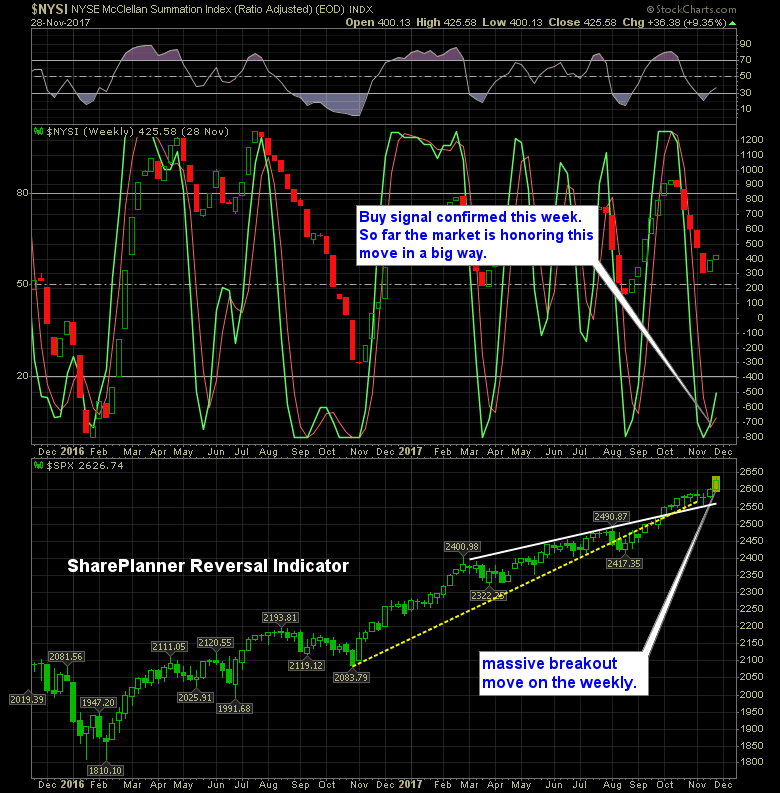

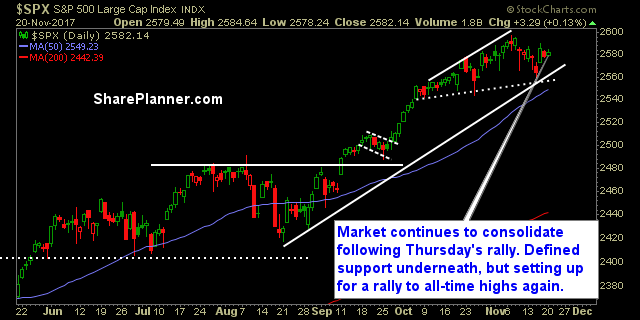

Last week, during the shortened trading week, the SharePlanner Reversal Indicator gave us a buy signal. So far this week, the market is honoring that move. In particular, yesterday, when the market made a 1% move to the upside out of nowhere.

My Swing Trading Approach I will look to add 1-2 new long positions to the portfolio should the market conditions cooperate. I will also consider adding a short position as well to hedge against a potential pullback. Indicators

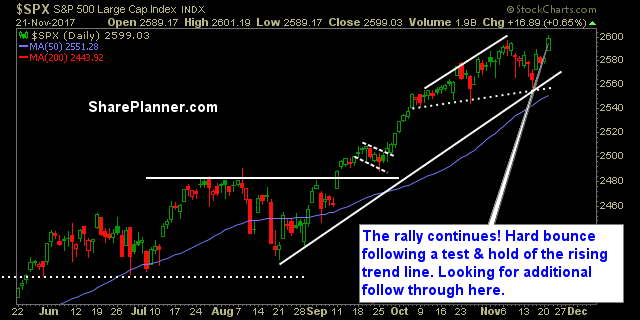

My Swing Trading Approach Raise my stop-losses in existing positions. Protecting profits comes first and foremost. Should the market rally continue into today, I will look to add low-risk plays to the portfolio. Indicators

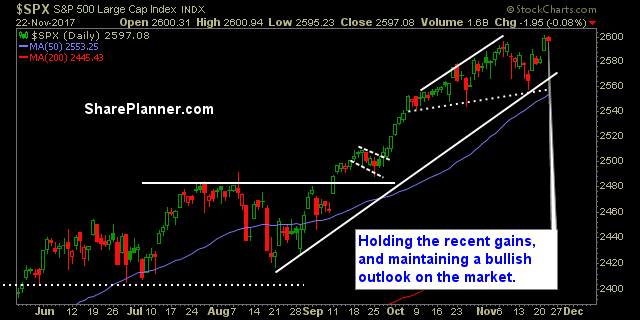

My Swing Trading Approach I may add a new swing-trade to the portfolio today, but likely will stay put on a shortened, light volume trading session. Indicators

My Swing Trading Approach Volume should start to dry up today. Surprising to me that there was above average volume yesterday, considering it was a holiday week. I won’t rule out adding an additional position to the portfolio, but right now, I am content with my current crop of trades. I will certainly increase the

My Swing Trading Approach Looking to increase my stop-loss on my profitable positions today, while adding 1-2 new long positions. Indicators