I thought I’d shake things up a bit, and redesign the daily trading plan. Honestly, I became a bit bored by how I was doing it before. And if I’m getting bored with it, you probably are to. So lets fix that with what I’ve put together to replace it: The Swing Trading Strategy Report.

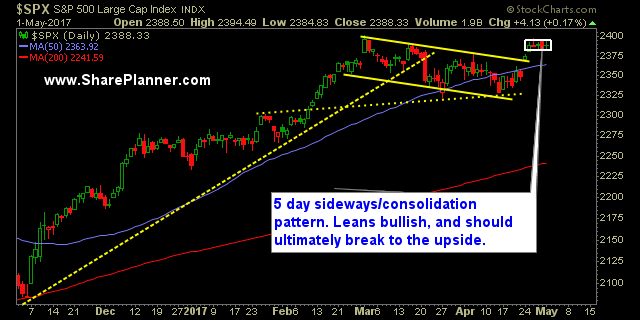

Yesterday’s rally didn’t quite seem there was a great deal of conviction behind it. Perhaps with the Fed set to release its FOMC Statement today, we’ll get the market to provide us with a decent size move. Over the past four trading sessions, the market has been rather quiet.

3 days of selling of less than one point per day That is what SPX has averaged over the course of the last three days when it finished lower each day - less than one measily point. For the bears that has to be infuriating. I don't blame them - I would be too, if

I'm not a big fan of streaks when it comes to stocks I mean it is nice while it lasts, but like any financial instrument that is rallying, eventually there needs to be a pullback and on Friday you got one with a whopping 0.04% pullback on the Nasdaq. How amazing, right? That is the

Breakout of Consolidation a Must SPX had that opportunity on Friday to really close out the month strong and breakout of that consolidation pattern that is more evident on the intraday charts than it is on the daily chart. Instead the market gave traders a gap and crap the entire day. Very little bounce and

Nasdaq Rally + Euphoria Knows No Bounds Nasdaq is blowing the roof off this joint and I wish that when you clicked on this post to read, that I could have had Prince singing his infamous "1999" song. It would have been a nice touch and really brought the point home that I'm trying to

Take a look at these bearish trade setups Maybe the market will finally correct. Who knows!?! The resiliency of the market is a thing to behold. Honestly though, it just takes $10 trillion of endless QE worldwide and you can prop anything up. Nonetheless, the charts look bearish, the S&P 500 acts like it wants

Here is wher you can find yourself a bullish trade setup The market has traded lower for most of the day, but after a hard sell-off early on, it is attempting to stage its own recovery. If that happens, you have a whole list of bullish trade setups below that you can trade off of.