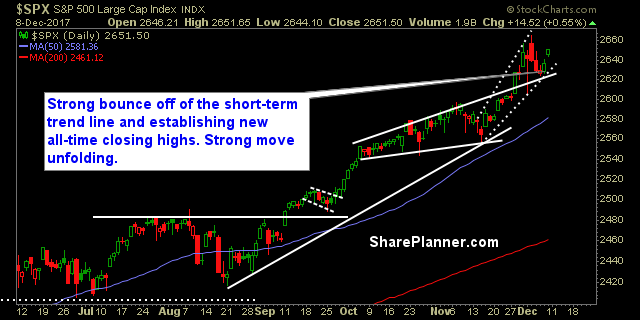

Each of the indices are telling a different story, and they can shift quite regularly. But after the surprising, not-so-surprising bounce off the lows of the day, to rip the hearts right out of the bears, the markets are showing themselves to be willing to push higher – particularly the Nasdaq and S&P 500.

My Swing Trading Approach I am concerned with whether Tech will fall apart again and drag the rest of the market down with it. If that is the case, I will look at a more cautious approach to the market today. Indicators

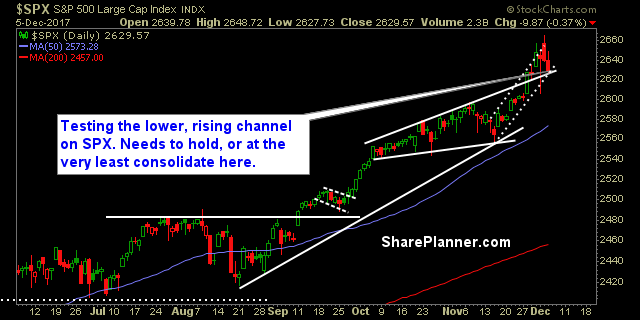

My Swing Trading Approach I am watching the follow through today, to see if this bounce has any legs. I’ll add additional positions, should the right opportunity arise. Indicators

My Swing Trading Approach Not trusting the market here, unless it can show me it wants to play nice. I’ll add more positions to the long side, but the market needs to show it wants to bounce. Indicators

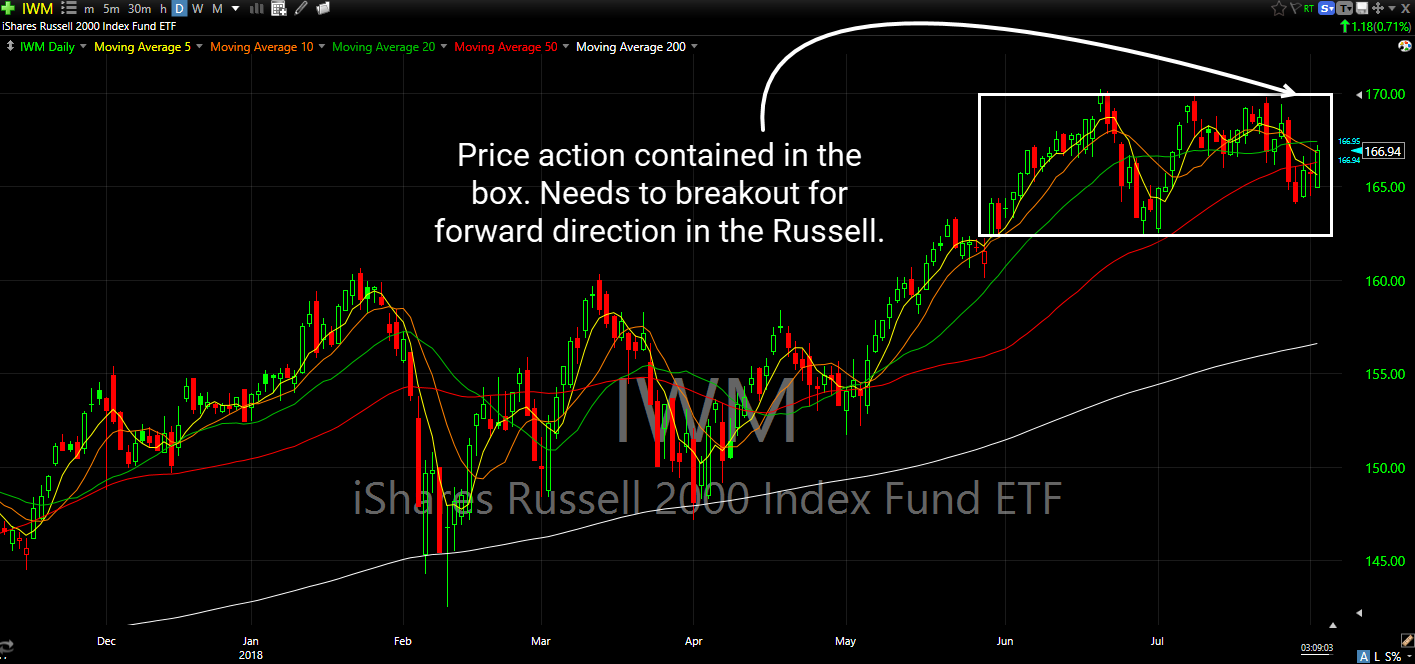

My Swing Trading Approach Light is best right now. I have the flexibility here to get more long or to start adding short positions depending on what the market wants to do today. Indicators

My Swing Trading Approach I have a balanced portfolio at this moment and need to see whether the bulls can bounce this market or not, before adding additional long positions to the portfolio. Indicators

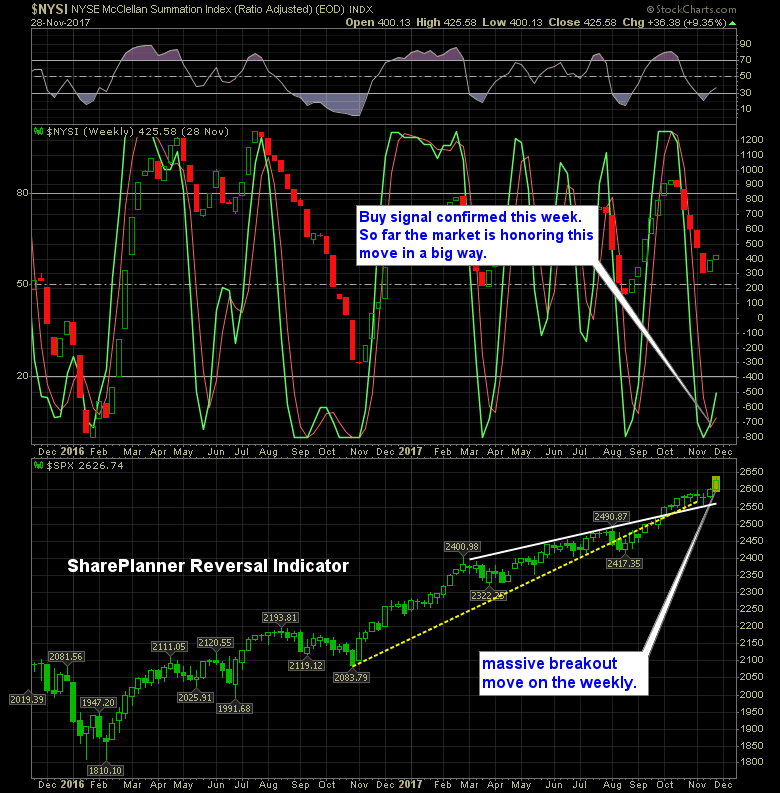

Last week, during the shortened trading week, the SharePlanner Reversal Indicator gave us a buy signal. So far this week, the market is honoring that move. In particular, yesterday, when the market made a 1% move to the upside out of nowhere.

My Swing Trading Approach I will look to add 1-2 new long positions to the portfolio should the market conditions cooperate. I will also consider adding a short position as well to hedge against a potential pullback. Indicators