Swing Trade Approach:

Took some small gains off the table of trades Amgen (AMGN) and Starbucks (SBUX) that simply wasn’t providing enough return for the risk I was taking. Got knocked out of my Micron (MU) short trade at the open, following that damn upgrade they received this morning. Overall, I was fine with the returns of the portfolio. Uber Technologies (UBER) remains a solid star for me, but now you have the escalation in the US/Iran conflict that initially resulted in 50 handles to the downside on SPX, but has since recovered about 80% of those losses as of this writing, and is starting to look like the US won’t counter with any additional actions of their own. However, I am still prepared for tomorrow to be a volatile session, and ready to take positions off the table where I must.

Indicators

- Volatility Index (VIX) – Dropped 0.4% today, but expect this indicator to come alive tomorrow, especially if further escalation takes place here.

- T2108 (% of stocks trading above their 40-day moving average): A 6% drop taking the indicator down to 60%. Huge potential for further downside in this indicator depending on what happens tomorrow.

- Moving averages (SPX): Closed below the 5-day moving average but managed to hold the 10-day MA. Looks like there will be a break below the 10-day tomorrow.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy is likely to be the safest play tomorrow considering the tension in the middle east between the US and Iran. Also there should be pockets of strength in Materials and Defense Contractors. Also, your traditional safe sectors like Utilities and Real Estate could catch a bid. Technology should be weak as will Discretionary.

My Market Sentiment

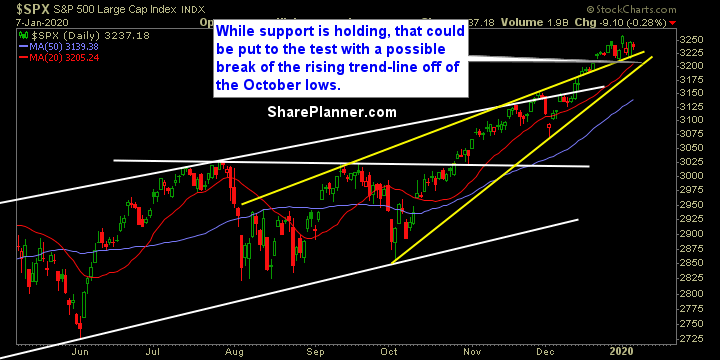

There’s a lot of risk in the headlines tonight. SPX futs were down over 50 points at one point but has since recovered 80% of those losses. However the night is long, and we could still see the market sell-off again. First and foremost watch the rising trend-line off of the October lows. If that breaks, then the 50-day MA could eventually be in play for the bears. Those are the two areas I would watch on Wednesday.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Each year I like to take a moment to reflect on my swing trading from the prior year. The 2025 trading year offered a lot to be happy about, but it also changed my views in a number of ways and gave me some lessons to take from it, as well as some new perspectives to take into 2026 as I navigate the stock market for yet another year. I'm hoping this moment of reflection in this podcast episode will be as beneficial for you as it was for me in making it.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.