Technical Analysis:

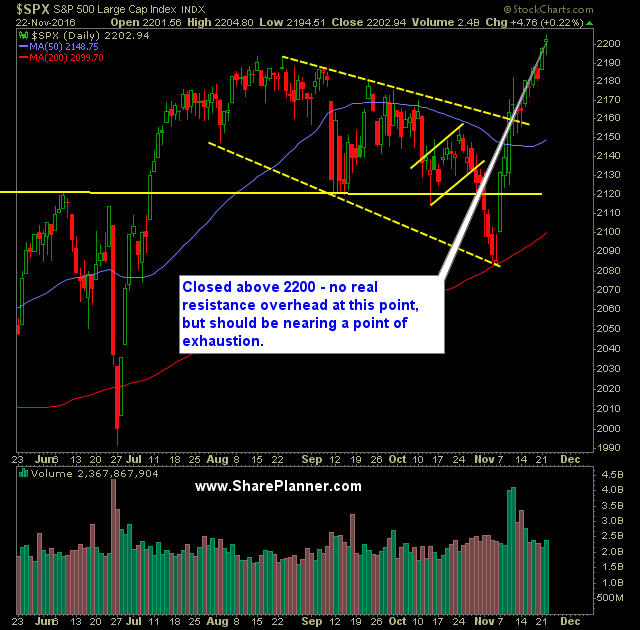

- Two major milestones achieved yesterday, with the Dow Jones Industrial Average (DJIA) reaching 19,000 and S&P 500 (SPX) passing 2,200 for the first time.

- The market has continued along the lines of Thanksgiving being a reliable ‘bullish’ week for the market. The Wednesday before Thanksgiving has a history of being reliably and consistently bullish as well.

- Since the Monday before the election, the market has risen 120 points and nearly unabated along the way.

- CBOE Market Volatility Index (VIX) dropped for a fourth straight day, with only a -0.08% drop.

- I do think that a more risk adverse tone will need to be struck following the Thanksgiving Week, when investors return from the holiday and begin focusing on the near certain rate hike that will take place in December.

- Tomorrow the market is closed, and only open until 1pm on Friday. Expect today’s and Friday’s volume to be extremely light.

- Volume on SPDRs S&P 500 (SPY) fell for a second consecutive day and came in well below average readings. I expect the same to be the case for today.

- Expect Eli Lilly (LLY) to be a drag on the market today as they failed a late-stage trial for an Alzheimer drug. Biotech along with the Healthcare sector as a whole will be greatly hampered.

- Oil (/CL) showing some hesitation at its recent rally highs and looking to fill the gap on United States Oil Fund (USO) that was created on Monday.

My Trades:

- Sold AMZN yesterday at $783.00 (bought at $738.00) for a 6.1% profit.

- Did not add any new swing-trades to the portfolio yesterday.

- I may add a new swing-trade to the portfolio, but am also content in riding the portfolio as it currently is. Very strong and profitable.

- I am currently 40% Long / 60% Cash

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I explain whether it is a good idea or not to rapidly increase the size of your portfolio if you come across a sum of cash. A lot of traders will do this without ever recognizing the emotional toll it can have on you as a swing trader and the awful mistakes you can make in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.