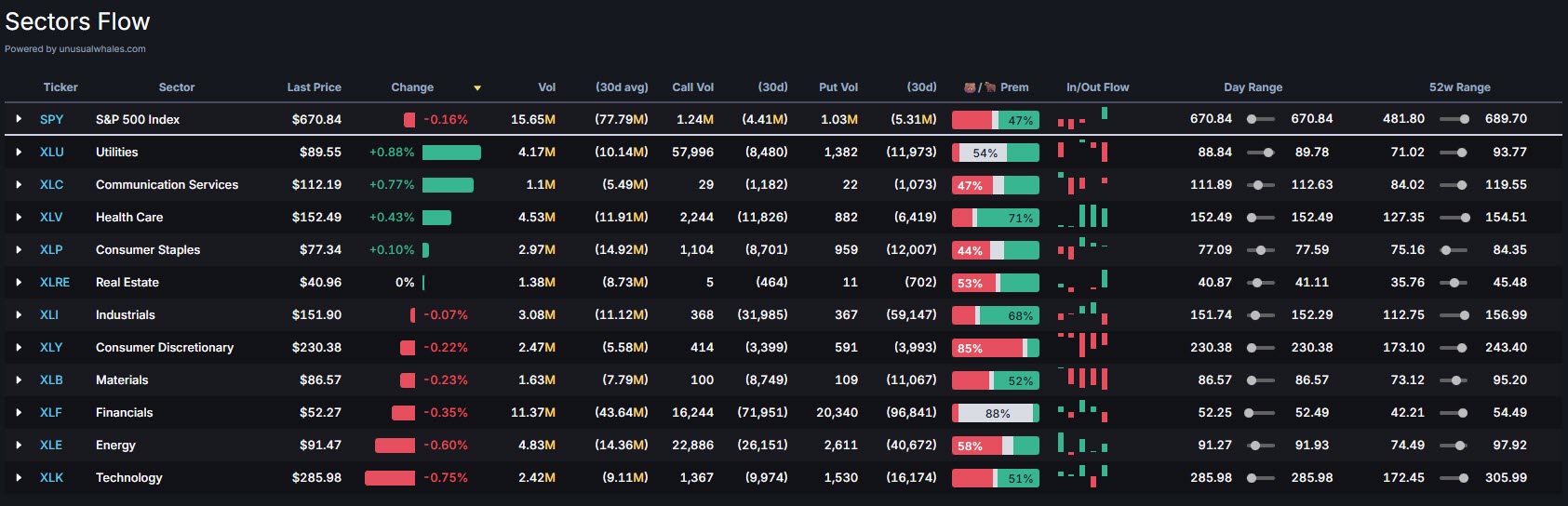

This morning - stocks are showing a slight rotation into defensive names here. Staples Sector (XLP) and Utilities Sector (XLU) showing life.

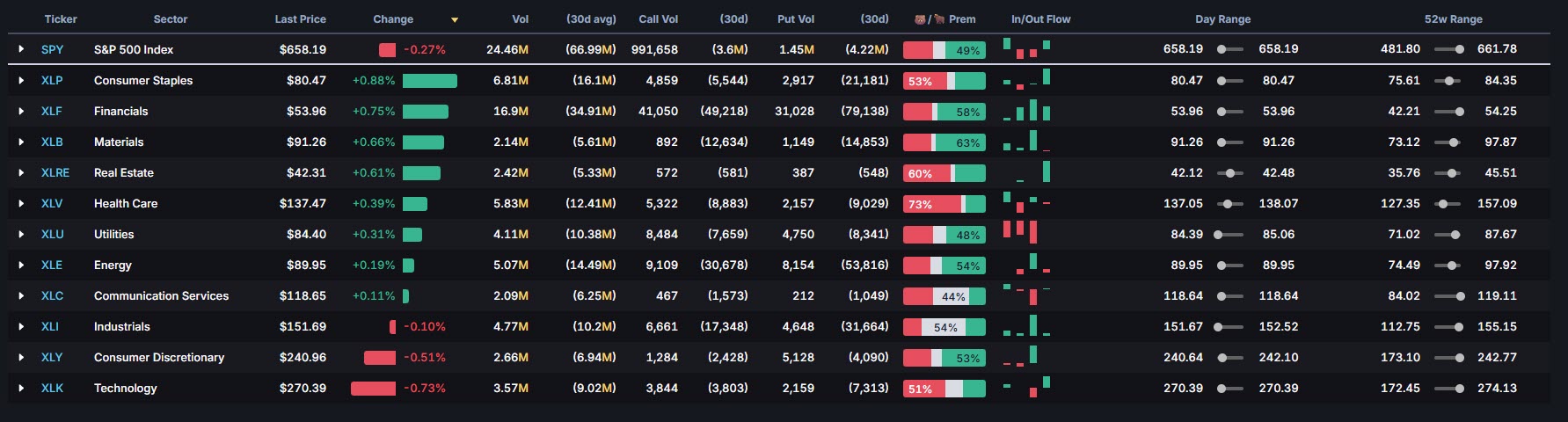

Looks like we are getting fresh rotation back into "Everything Else" with the Staples Sector (XLP) leading the way.

Episode Overview Ryan goes over one listener's swing trading journey, analyzes the trading strategy being employed, and answers questions on everything from short squeezes and short floats to insider and institutional buying and sector rotations. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan kicks off the episode by explaining why he

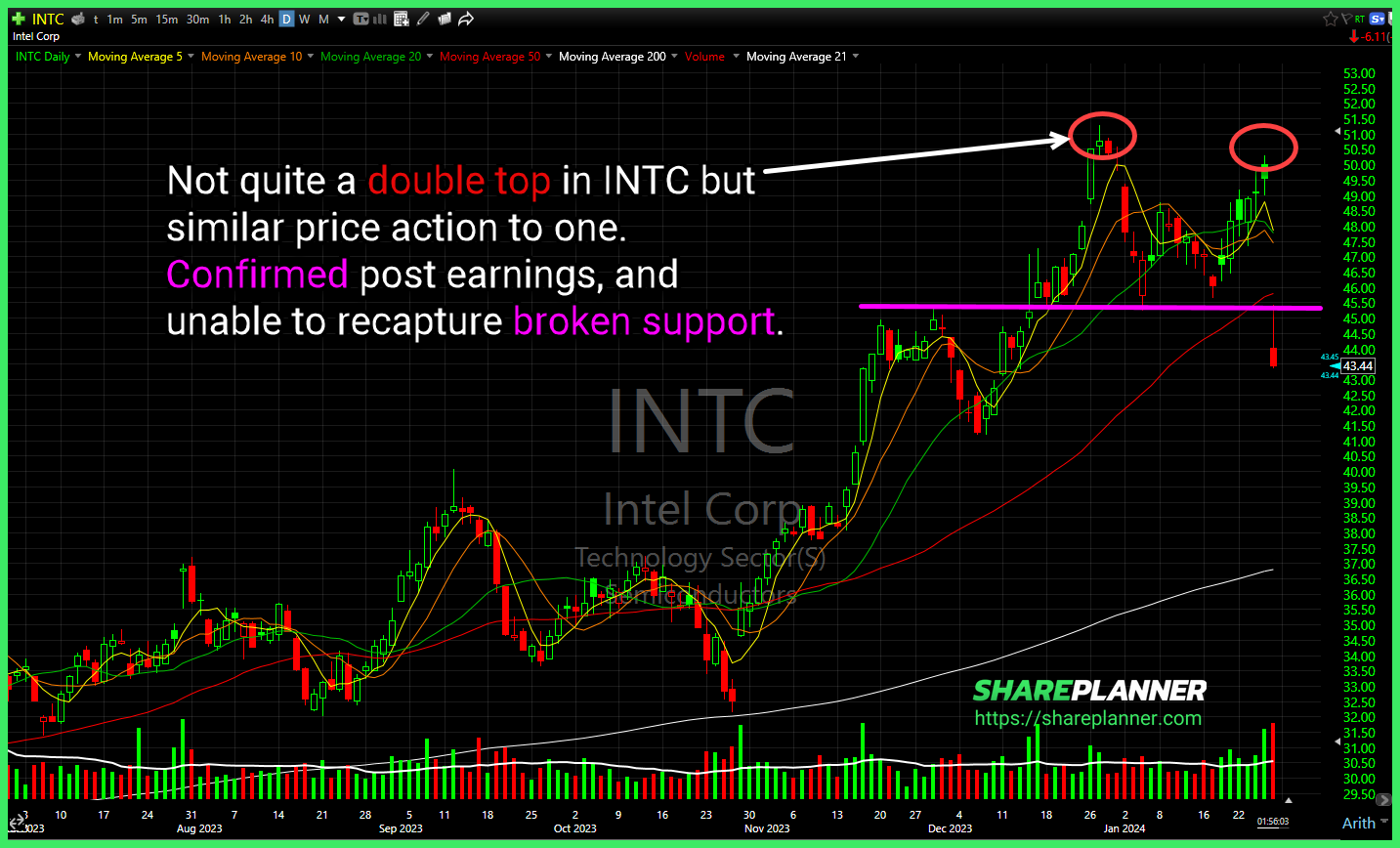

Not quite a double top in Intel (INTC) but similar price action to one. Confirmed post earnings, and unable to recapture broken support. A lot of consolidation of late in staples Staples Sector (XLP) - and possible that yesterday and today's strength could lead to an upside breakout. Good consolidation in ZipRecruiter (ZIP)

Episode Overview This episode focuses on Ryan's sector analysis and what he's looking for when determining which sectors to trade from. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan kicks off the episode by setting the tone on managing complexity in trading, particularly around sector analysis. [1:13] Listener Question: Otis from

Episode Overview Step-step directions on how I use the Top Down Trading Strategy in my swing trading. This trading strategy guides my decisions and how I analyze stocks and choose which stocks to trade. In this strategy I connect the overall stock market direction with sector strength and industrial technical analysis to help find the

Episode Overview What's the differences, advantages and disadvantages of swing trading vs day trading vs position trading, and what does it mean to be either of them? Also in this episode, Ryan explores one trader's questions about trading index funds only and provides the bigger questions that this person should be asking himself. 🎧 Listen

Watch this resistance on $SHOP that is being tested.

And with that $SNAP officially loses its long-term support level.

Episode Overview For working traders or those with a heavy family load, it can be difficult combing through hundreds if not thousands of stocks looking for that one quality swing trade setup. In this episode I talk about how one can trim down the stocks that they have to follow as well as trading off