Recently I have tried to provide readers on the weekend with the most interesting article from the past week. The article below comes from MarketFolly.com. It details the most popular stocks among hedge fund's top-ten holdings. Perhaps you may be able to find a trading idea or two as a result. Given our focus on

Things are pretty quiet this morning, after yesterday’s solid market rebound. Futures are flat heading into the open with the Dow down 4 points, while the Nasdaq is down 3 points and the S&P is only down a half point.We have a number of reports today with Retail Sales at 8:30am ET, which will

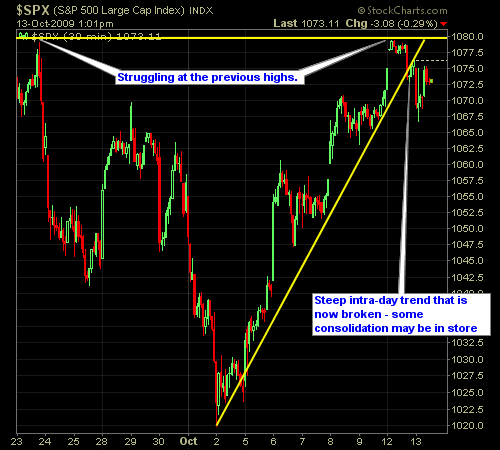

Some weakness so far today on the mixed JNJ earnings report. But it’s doubtful that the bulls are all that worried as the selling is minor (so far at least) and there isn’t a killer amount of volume rattling the markets. If the market is going to pullback in the near-term, it is likely

Good Morning to you! It is a very early start for me this morning, after staying up late into the night watching my Miami Dolphins man-handle the New York Jets. What a game that was! But getting up this morning was horrendous. One thing can be said and that is Monday Night Football and the

It’s earnings season and you never know what you are going to. INTC saved the market today with well-received second quarter earnings report. As a result the NASDAQ rallied 3.5% and the S&P took 3%. There was a nasty gap up, which I believe will eventually be filled. In fact, had that gap up

March 4, 2008 Déjà Vu….Like yesterday, a flurry of late afternoon buying brought the markets off their lows, and we managed to close the day with a small loss in the S&P and a negligible gain in the NASDAQ. Stocks were weak throughout the morning Tuesday as a result of comments from Fed Chairman Bernanke and

January 15, 2008 Almost as if a perfect storm came to fruition. The day started out with Citigroup’s earnings report, and the problems found with it was that they actually didn’t write-off enough mortagages as was previously believed to be reported, leaving many to believe that these problems will continue to persist into the next

The Market opened up strongly today but quickly gave back those gains as the bears worked to close the gap on an intra-day basis (gaps are created from the market opening higher then the high of the previous day, and vice versa for when the market opens lower; these gaps typically are closed – meaning