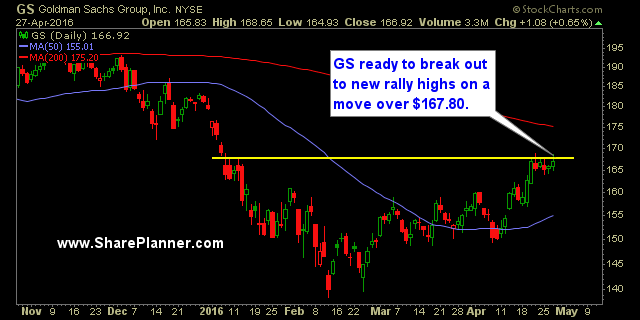

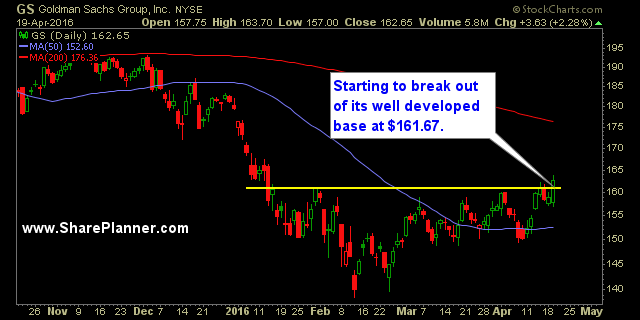

Goldman Sachs (GS) is approaching resistance at the $161-162 area. If it can break through that and the 200-day moving average I would put a price target of $170-175 on the stock. It may not reach the 200-day moving average today as it is outside of its R3 pivot level already, but if it

The stock market is crazy and volatile. But you can still profit from it while minimizing your risk! Join the SharePlanner Splash Zone and start trading with me to see for yourself what a membership can do for your portfolio. Sign up for a Free 7-Day Trial – with your membership, you will get each and every

Learn to consistently profit in your trading by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I trade in each day. Click Here to

Learn to consistently profit in your trading by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I trade in each day. Click Here to

Learn to consistently profit in your own portfolio by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I trade in each day. Click Here

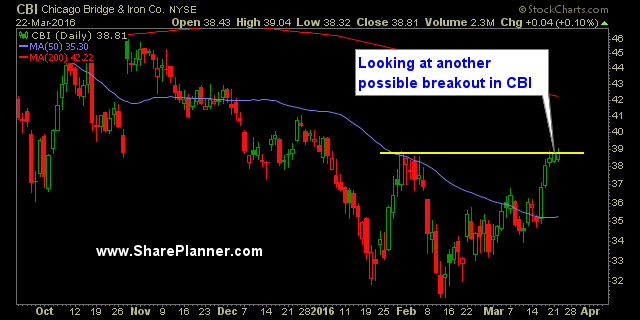

The big banks appear to be setting up for a bigger move here. I am already long in JP Morgan (JPM), but all four of these charts are posting solid reward/risk ratios with the potential to break higher any day now. Take a look at each chart, you’ll see that over the past two

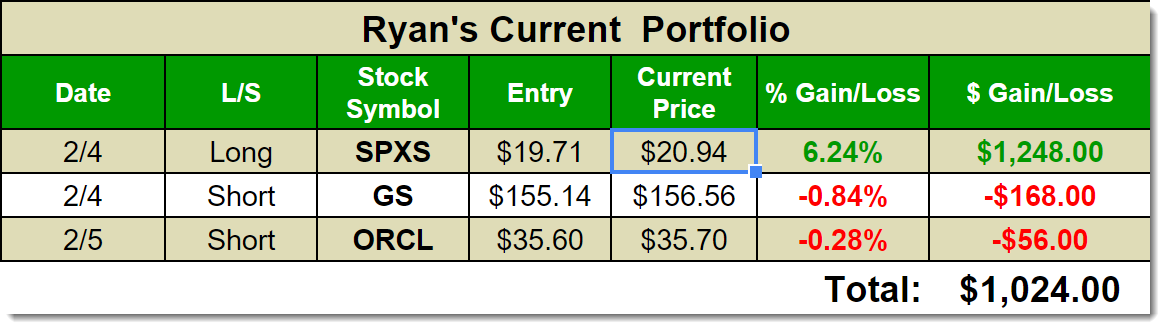

It was a horrid week for the markets but a good one for members of the SharePlanner Splash Zone. Check out how the current portfolio for members is shaping up. While the S&P 500 was down over -3% for the week, my trades were profitable. I’ll be the first to say, that I was a

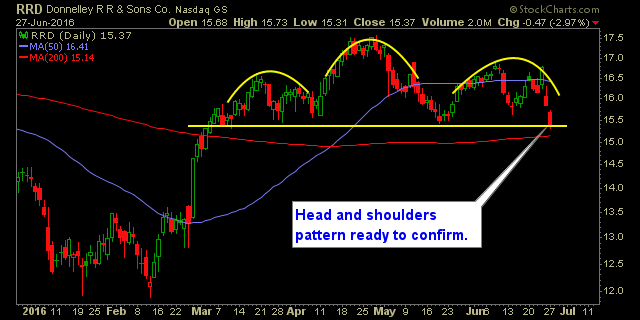

Despite a strong bounce in the financials yesterday and relative strength that it has exhibited today, it still appears as if the banking stocks are setting up for more to the downside. Take a look at these four banking stocks, and the last one will really blow your mind. Goldman Sachs (GS) JPMorgan (

2/4: Heavy resistance on $GS on the declining 20-day moving average. Also resistance in the form of the 5 and 10-day moving averages as well. Established lower highs and lower lows and on the weekly chart you have a major head and shoulders pattern that has confirmed and following two weeks of consolidation is showing

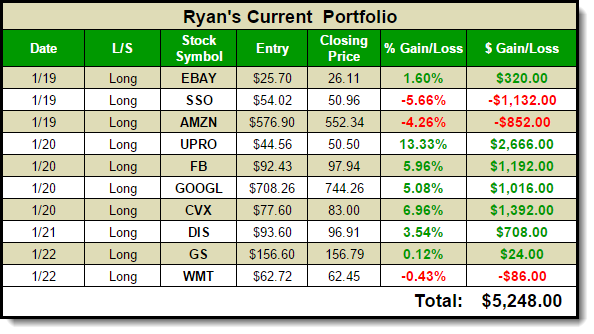

The kind of trading week you saw last week is pretty much as wild as it gets in the stock market. Sell-offs that take you to the brink of a market crash followed by a market rally that gives you the impression that, at the very least, a market bottom could be in place. The