Be sure to sign up for a Free 7-Day Trial to the SharePlanner Splash Zone and receive access to my Real-Time Trades via text and email alerts as well as my my very active trading room where traders are posting and providing all their trades as well. You can sign up by clicking here. Here’s tonight’s Watch-List: Short

I thought it has been long overdue to provide an all-short watch-list. Today’s action and tonight’s subsequent weakness in the futures suggests that this watch-list just might come in handy. I even added an extra setup there for you. Here are the trade setups: Short Fulton Financial (FULT)

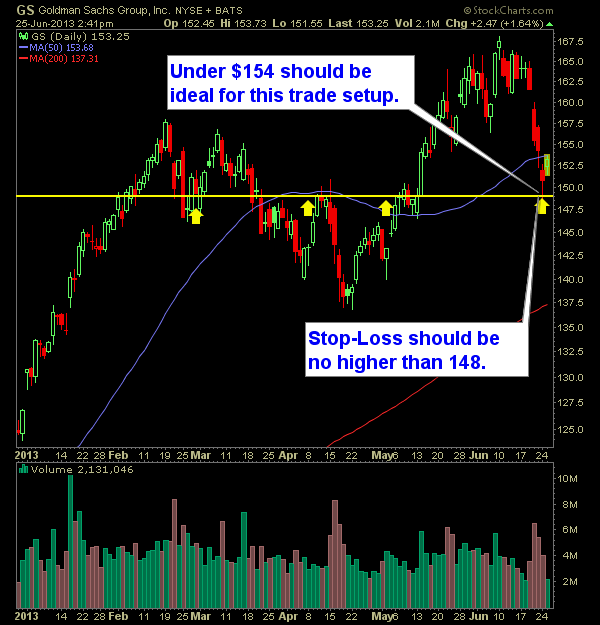

Wow - who knew Lloyd Blankfein's head was so big - apparently it is to compensate for the enormous ego he has....With Goldman Sach's (GS) incredible track record of always being a bunch of frauds on the right side of the trade, I'm sure they dumped all their long long positions yesterday, just in time

Two Bounce Plays that Setup Nicely Activity on the street has turned completely bearish, and everyone is still talking about last week's news. But what happens when that becomes a distant memory, with no new news to sustain it. I could be wrong, but I don't believe the Fed is going to say anything near-term

The market has been about as boring as watching grass grow in a desert. However, this range bound market heading into the final hour of this week, looks like it could make a run to finish green for the 6th consecutive day – but it’s only pure speculation at this point. But the chart is

I’ve been somewhat hesitant to pull the trigger on anything, particularly long, once I saw the S&P give up those early morning gains like it was nothing. But not only that, but the fact that since doing so, we just continue to drift lower with small bounces in between. In fact, I used the latest

Only one new trade for me today, and it happens to be in the stock being featured in today’s Lazy Trade Long.. Nonetheless, the market looks like it is in a state of perpetual selling, which isn’t at all that uncommon when we gap up, and follow it with an immediate sell-off. We are also

LONG: China Ming Yang Wind Power (MY)