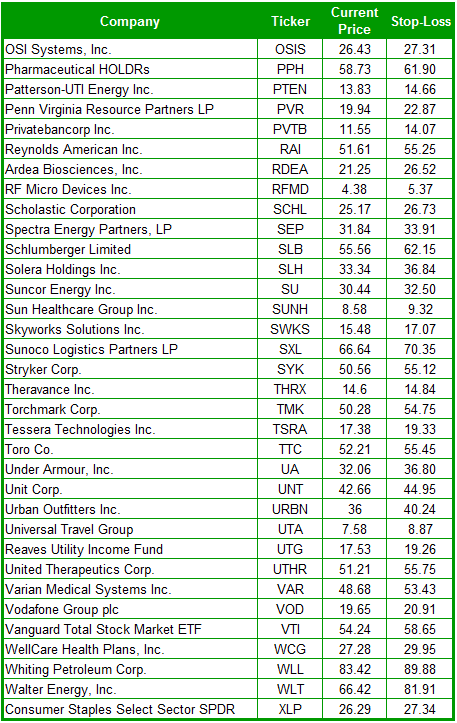

Last week I had so many short setups in my stop-loss I had to divide it up into three posts. This week, I’ve narrowed it down to only ONE post. I’ve weeded out some of those that, with the recent market rally, don’t quite have the bearish case that they once did. But as

Same as Part 1 and Part 2…Rationales for why I have each of these stocks on the list, and even though I don’t explain my rationale for each one (I’d be forever typing out this post if I did), I can break them down into three categories; 1) Price and volume pattern is intriguing 2)

Alright folks here is part two – with part three coming shortly thereafter. I’ll say it again…there are lots of different rationales for why I have each of these stocks on the list, and even though I don’t explain my rationale for each one (I’d be forever typing out this post if I did), I

Since the last time I posted my watch-list it has nearly doubled in size. So much so, that I am breaking my short watch-list into three separate posts to be done throughout the trading day, today. As I always do, I updated the stop-loss for those that are carry-overs from last week, and provided

As I try to do every week, below you will find my current watch-list for short setups. I keep a Long Setup Watch List (which I will be posting tomorrow night) and a Short Setup Watch List, which you will find below, at all times to provide me with the flexibility to “flip-the-switch” should the

Below is my current list of stocks that I am using to short from. The stocks below are either those that I have found to have ideal setups, close to becoming ideal setups, or stocks (like Goldman Sachs – GS) that have a level of intrigue that warrants inclusion on my list. Nonetheless, you have

After yesterday, thoughts on the street was that perhaps we would get a sympathy bounce out of the market, but the way futures are looking, it doesn’t appear to be so. Different from my usual morning trade-setups, I thought I’d publish my running watch list of stocks with their ideal stop-loss. Some of these

Futures have a bullish tone heading into the open as Goldman Sachs (GS) and IBM managed to report a solid earnings report. Also later today, you have Coca-Cola (KO), Apple (AAPL) and Yahoo (YHOO) that are reporting. At 7:45am ET you have the weekly ICSC Goldman Store Sales, followed by the Redbook

Today’s watch-list is coming to you a little bit earlier than usual, as I am finding it quite difficult to sleep right about now, so I figured I would take advantage of this extra time and knock out the trade-setups for today. Prior to the open things should be relatively quiet as we have the

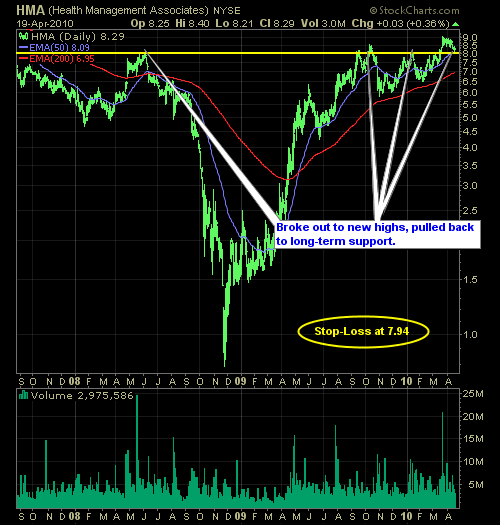

This bull market has not been kind to me this past week, and that’s okay. I’m trading my system that I know works, has worked in the past, and have no reason to think it won’t continue to work in the future. I added another short position today, after getting stopped out of SDS. The new