It was a horrid week for the markets but a good one for members of the SharePlanner Splash Zone.

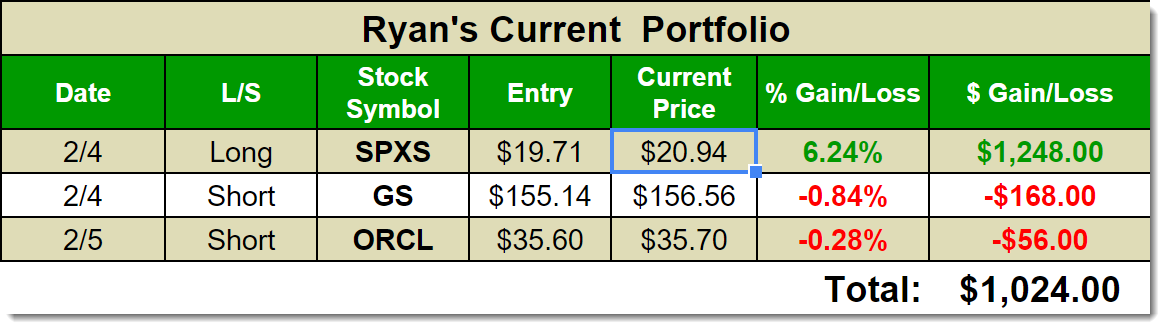

Check out how the current portfolio for members is shaping up. While the S&P 500 was down over -3% for the week, my trades were profitable.

I’ll be the first to say, that I was a bit irritated by the Goldman Sachs (GS) upgrade on Friday that pretty much stifled any opportunity to see a heavy drop in the financials, much less in GS. UBS upgraded a stock in an industry that is facing so much headwinds, that the notion of upgrading a bank of any kind at present moment is mind blowing until the energy crisis blows over and the bank’s debt exposure finally understood.

Nonetheless, Friday was still nicely profitable for me. I added Oracle (ORCL) after much of the market’s drop had already happened, not expecting a major move then, but preparing for a larger move to the downside in coming week.

So over all, I am pumped for the coming week, and nimble enough to where if the market doesn’t go in the direction of my trades, I can quickly adapt to the current sentiment.

If you’d like to receive the trades that I make on a daily basis, then you need to sign up for the SharePlanner Splash Zone. With your membership, you get a Free 7-Day Trial along with access to my chat-room that I post all my trades in, as well as real-time email and text alerts (international too). Not to mention that if you can’t be at your desk all day for trading, I provide multiple auto-trading options that can do the work for you.

With The Splash Zone, you will get my low risk and high probability trade setups that no other trading service can offer.

Start Your Free 7-Day Trial Today!

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Trading what you see and not what you think is one of Ryan's popular trading expressions that he has lived by in his 30 years of trading experience. In this podcast episode Ryan explains why it is so important to not think your way through the market but to be a trader who sees what to trade and reacts accordingly. If you are struggling as a trader, it may very well be that you aren't seeing but thinking your way through your swing trades.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.