If you glance at the indices, you wouldn’t realize the market is actually fairing poorly today. Breadth is actually negative VIX is trading 3.5% higher The percentage of stocks trading above their 40-day moving average is declining. Technology is trading lower Small Caps are in the red

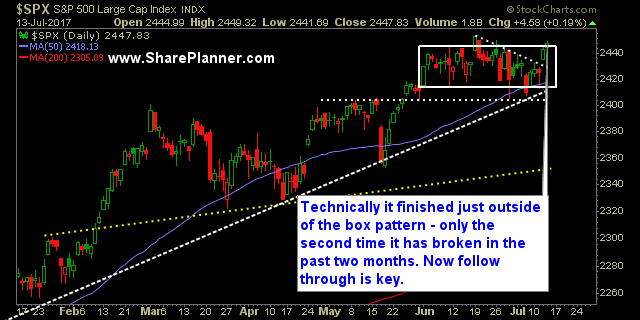

Out of the Darvas Box - just barely though Okay, so we have been here before. This almost-two month long box that the S&P 500 has been trading in has been broken for only the second time, yesterday. The last time it broke was on June 19th, and the following day resulted in a huge

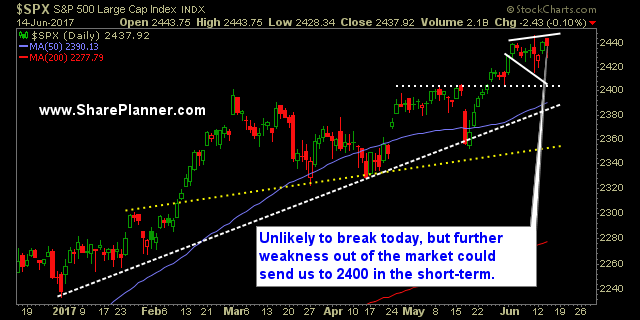

‘Hawkish Rate-Hike’ Gets the market in a tizzy But lets not kid ourselves, all this talk about a ‘hawkish rate hike’, whatever that means, probably gives the bulls another opportunity to by the dip. If the bears can pull it together today, it could be a very nice for their short positions. But it is

Today’s stock picks If you haven’t done so yet, you need to check out my swing-trading past performance for the Splash Zone for the month of May and every month before then. Long Goldman Sachs (GS)

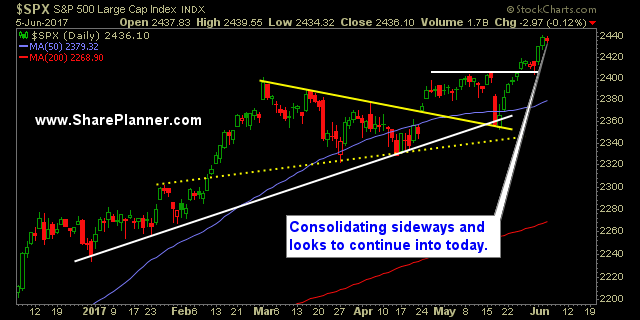

Barely a sell-off yesterday, market cooling off now When you can get a 3 point sell-off these days on the S&P 500, you might want to consider it a generational buying opportunity as stocks rarely do anything but go up these days.

Whether you like Donald Trump or not, when it comes to trading or investing in the stock market, it simply doesn’t matter. Political views you harbor will never provide you with any kind of return on your trades. So when it comes to profiting in the stock market, get past your hate, or your love

Here’s one of the more intriguing trade setups that is out there in Goldman Sachs (GS). I just made this trade in the SharePlanner Splash Zone. The consolidation was extremely tight over the past few days and now it is coming out of it quite nicely the potential for the $180’s in the coming

Watch these big banks! Namely: JP Morgan (JPM), Citigroup (C), Bank of America (BAC) and the notorious Goldman Sachs (GS). All of them are breaking out as I am typing this and they look like they could be solid runners for the entire week. Rarely do you find them or any

Join the SharePlanner Splash Zone and start trading with me to see for yourself what a membership can do for your portfolio. Sign up for a Free 7-Day Trial – with your subscription, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my

Goldman Sachs (GS) is approaching resistance at the $161-162 area. If it can break through that and the 200-day moving average I would put a price target of $170-175 on the stock. It may not reach the 200-day moving average today as it is outside of its R3 pivot level already, but if it