My Swing Trading Approach I bought Square (SQ) on the dip yesterday in the SharePlanner Trading Block and currently sitting on +5.7% in profits. I will consider adding one additional long position today. Indicators Volatility Index (VIX) – A small upward move of 0.5% yesterday. Again the 20-day moving average was tested, and price was

My Swing Trading Approach One additional long position was added to my portfolio yesterday, while taking a 0.7% loss on Eastman Chemicals (EMN). I am open to adding another position today, but I need to see a little more out of my existing positions first. Indicators Volatility Index (VIX) – Broke through the 20-day moving average

My Swing Trading Approach I added one additional lon position yesterday and will likely hold off here before adding anything else to the portfolio. Indicators Volatility Index (VIX) – A push into the close, kept the VIX near its highs of the day. Potential for another test of the 20-day moving average today, which has resulted

My Swing Trading Approach I booked profits in Alibaba (BABA) yesterday at $183.29 for a +7.8% profit, along with Advanced Micro Devices (AMD) at $24.98 for a +3.7% profit. I added one additional position yesterday, but overall reduced my overall long exposure. Indicators Volatility Index (VIX) – A much bigger pop than what we

My Swing Trading Approach I did not sell any of my positions ahead of the bell on Friday, and I added one more long as well. I may add one additional trade to the portfolio today. I do plan to further tighten my stops on existing trades as well. Indicators Volatility Index (VIX) – VIX is

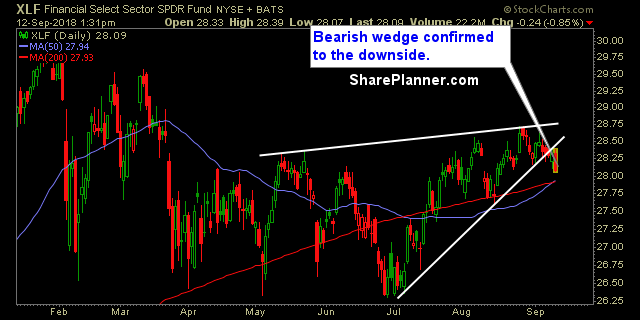

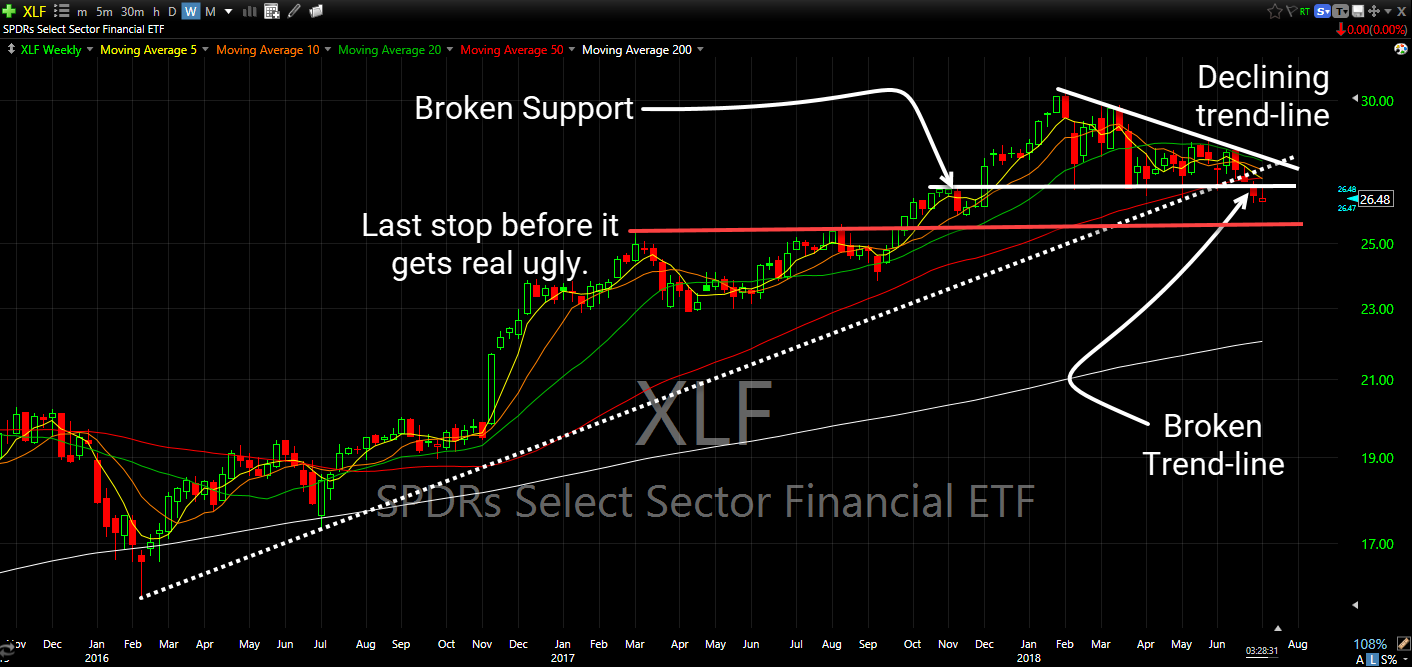

Sectors as a whole remain bullish, despite recent market pullback. The two sectors that I like the least are the financials and the materials. Both of them look problematic, and the financials are showing more weakness today, despite already being oversold.

My Swing Trading Approach I will be looking to add additional tech exposure today as well as raise the stops on my existing, profitable positions. Market has to hold up in the early going though, for me to commit additional funds. Indicators

My Swing Trading Approach Plenty of long positions already in the portfolio. I will look to add 1-2 new long positions today on improved bullishness over last week. Careful not to add additional shares of anything if the market is not willing to commit to a direction. Indicators

My Swing Trading Approach I continue to follow the sectors that are setting up the best right now. Earnings this week, so caution as it pertains to specific industries (banks) that are reporting soon has to be respected. I will continue to add more positions as long as the market plays nice. Indicators

The one sector that I have had little to no interest in buying over the large part of this year has been financials. Sure, from time to time I have dabbled in them – some successful, some not so. However, they have been one of the least traded sectors for me and that doesn’t look