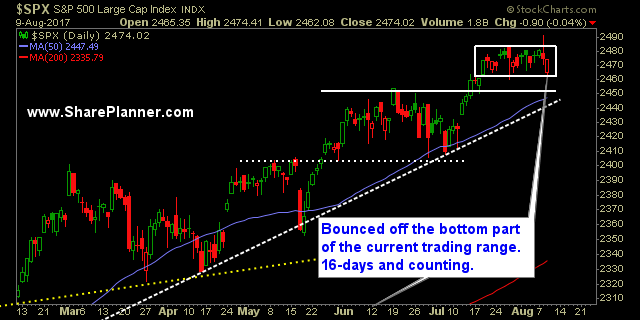

My Swing Trading Approach Watch to see whether this bounce holds today in the AM and trade is accordingly. Could be a dead cat bonce.

My Swing Trading Approach I’ve been aggresive with booking gains and will continue doing so going forward until the market breaks out of the current range that it is trading in.

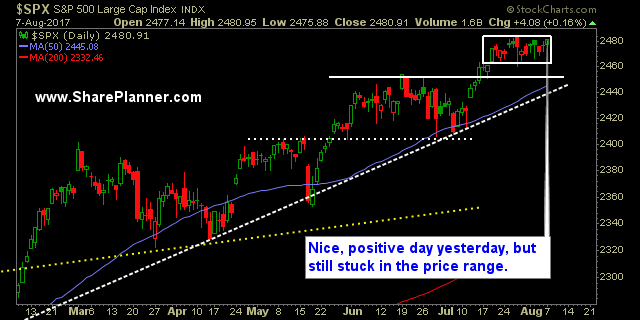

My Swing Trading Approach Get more short if necessary. Right now, I am slightly short on this market. Need to see that the bears want to continue yesterday’s selling first.

My Swing Trading Approach Flexibility is key for me here. I want to flip my portfolio in either direction based on what it does with the current tight trading range.

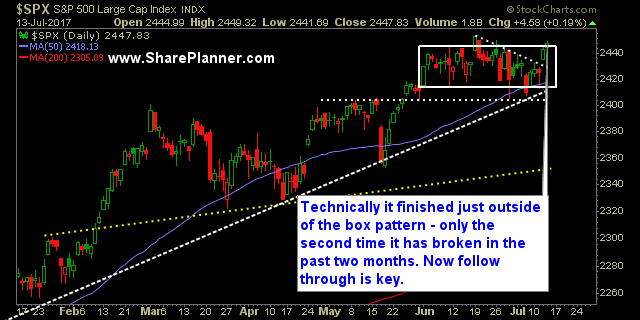

All time highs without a worry in this world. It really is impressive how the market will rebound every time from even the smallest of sell-offs to hit new all-time highs, time and time again. There is a lot of risk out there – tons of it. Despite all the horrible headlines that could readily

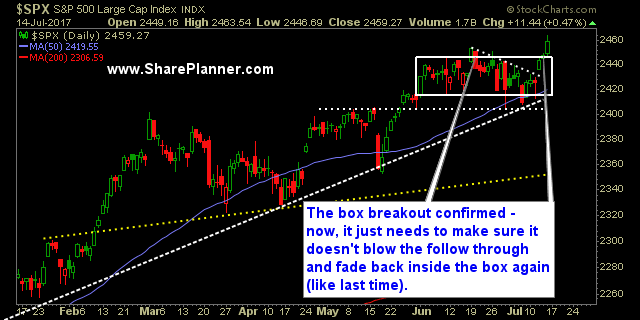

Out of the Darvas Box - just barely though Okay, so we have been here before. This almost-two month long box that the S&P 500 has been trading in has been broken for only the second time, yesterday. The last time it broke was on June 19th, and the following day resulted in a huge

Watch these big banks! Namely: JP Morgan (JPM), Citigroup (C), Bank of America (BAC) and the notorious Goldman Sachs (GS). All of them are breaking out as I am typing this and they look like they could be solid runners for the entire week. Rarely do you find them or any

The big banks appear to be setting up for a bigger move here. I am already long in JP Morgan (JPM), but all four of these charts are posting solid reward/risk ratios with the potential to break higher any day now. Take a look at each chart, you’ll see that over the past two