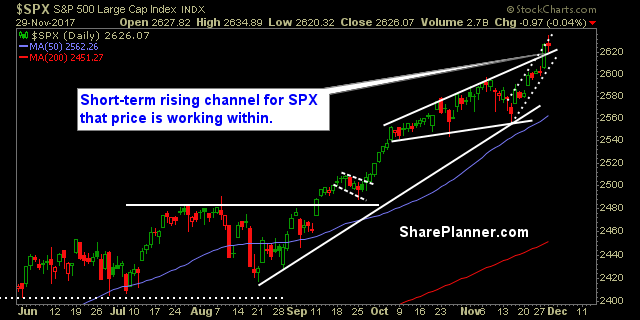

Stock Market is on shaky ground here. Direction is Uncertain. So lets take a deeper look at the sectors themselves. Which ones are most favorable and the ones that are not.

Market’s have rebounded well since the sell-off that led to a test of SPX 200-day moving average. Following today’s CPI report in the pre-market, and the subsequent sell-off, I was ready for the market to begin its selling yet again, so I raised my stops to protect all profits.

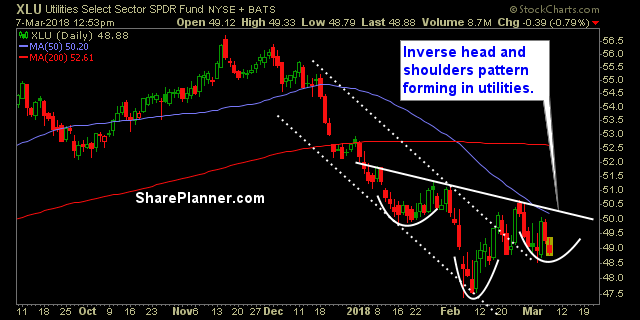

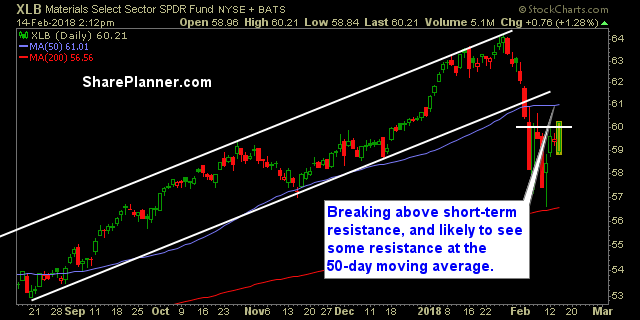

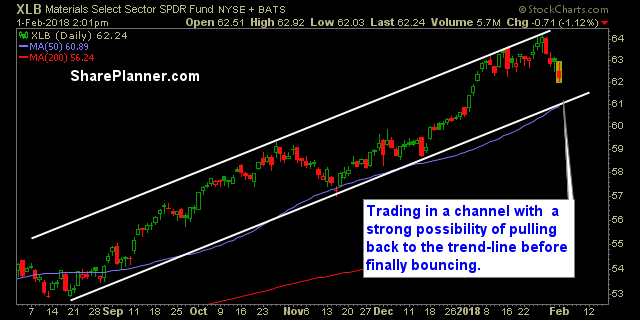

Beyond the technical analysis of the overall market, it is critically important to keep tabs on each sector, to know where the strength lies. For instance, had you invested in utilities over the past two months, you would be down royally, on your trade, while the rest of the market rallied. The same could be

My Swing Trading Approach I added two trades to the portfolio yesterday, was whipped out of a another for a small profit. I will look to keep the portfolio the same, with little changes to it, beyond increasing my stops. If a great opportunity comes my way, I may pull the trigger on it. Indicators

Plenty of takeaways during the month of November for my swing-trading. For one, it was another successful month, but there were a few stretches in there, that I’d like to soon forget. Most notably was the way in which it ended.

My Swing Trading Approach I will look for opportunities in tech stocks today, if the early gap higher shows that it wants to hold. If not, I will look to play the market with a much more cautious approach. Indicators

My Swing Trading Approach First and foremost – manage the existing positions in the portfolio. If the opportunity arises to add more long exposure in the portfolio, I will do so, but there is a looming tax vote that could create some turmoil for the market if it doesn’t go according to plan. Indicators

My Swing Trading Approach I’m concerned by this market, and I’m taking a much more cautious tone to my swing-trading. Not against adding new positions, but won’t do so unless the market makes a compelling reason for doing so. Indicators

My Swing Trading Approach All this market knows is to continue to rally, regardless if stocks as a whole want to follow. I’ll still continue trading long as the market wills for that to be a viable trade, but I am also watching closely whether this market intends to pullback at some point in the

My Swing Trading Approach There’s not a lot of movement out of stocks this week. In fact it has been quite a dull week for traders. If I can find some momentum to this market today, I’ll look to add a new long position. Otherwise, I will likely stay put. Indicators