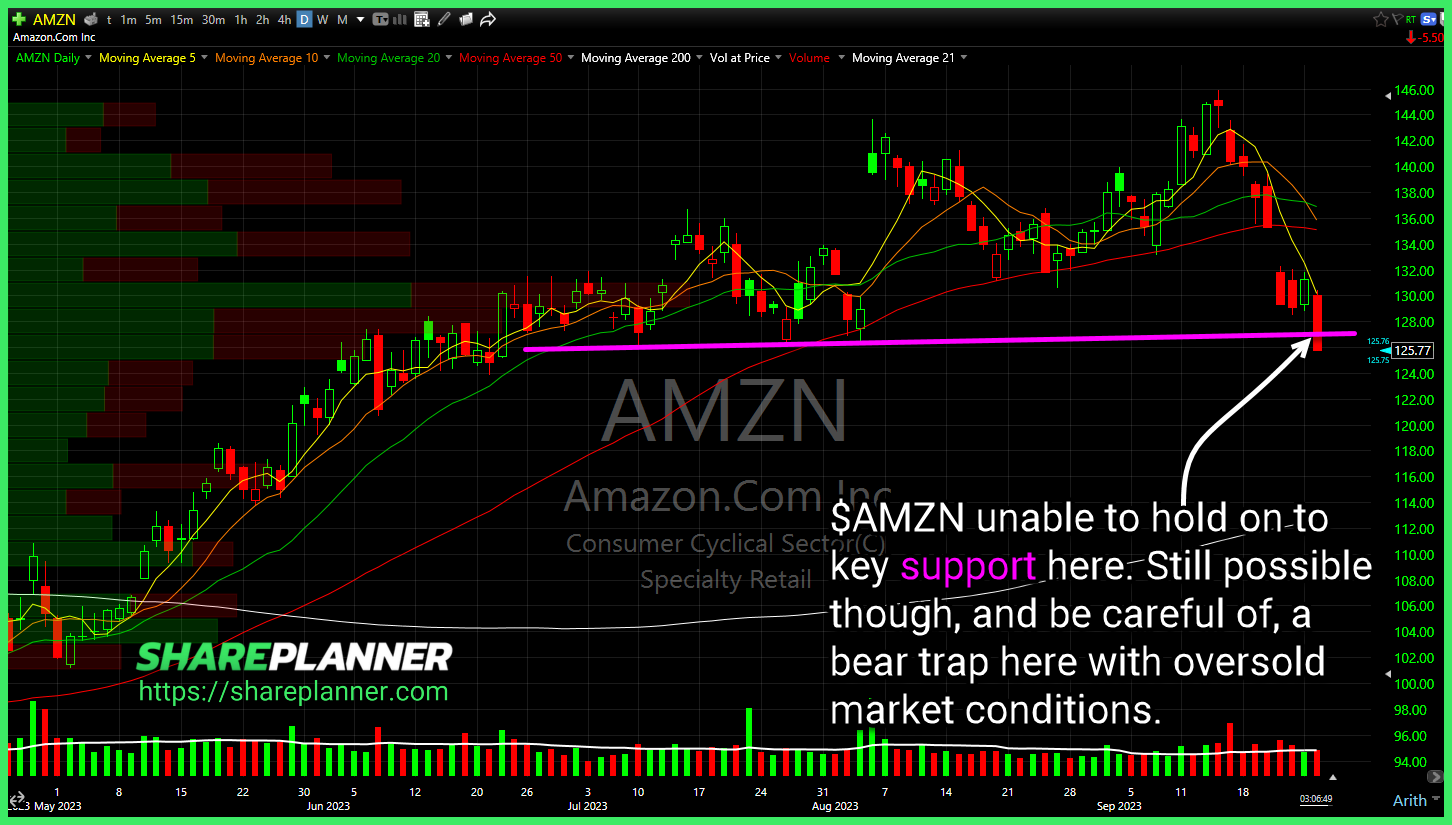

Amazon (AMZN) unable to hold on to key support here. Still possible though, and be careful of, a bear trap here with oversold market conditions. Ideal conditions for Uranium ETF (URA) entry would be on a pullback to the rising trend-line once a bounce materializes. Buying here at overextended levels, creates a high risk scenario

Big break this week for Amazon (AMZN) weekly chart. Needs to hold this level into the close tomorrow. Netflix (NFLX) support levels to watch. Very little reason for me to want to play this bounce so far. No basing taking place, and support has yet to hold. Carvana (CVNA) inverse head and shoulders going back

Apple (AAPL) in one week has wiped out over 6 weeks in gains, and could be headed for a much bigger pullback to long-term support. Heavy resistance seeing a break today. Strong volume of late as well for The Mosaic Company (MOS) Amazon (AMZN) coming up on major long-term resistance. Volatility Index (VIX) continuing the

AMZN earnings was a huge beat! Here's my technical analysis breakdown for what to expect from the stock going forward. AAPL earning wasn't well received by Wall Street and the stock sold off!

Recursion Pharmaceuticals (RXRX) Perfect example of why you shouldn't FOMO into a trade at the open. Traders down more than 15% since the open. Risk/Reward can't be managed. Kinder Morgan (KMI) breaking out of a short-term ascending triangle but worth being mindful of declining resistance overhead and nearing $18. Ascending triangle in Amazon

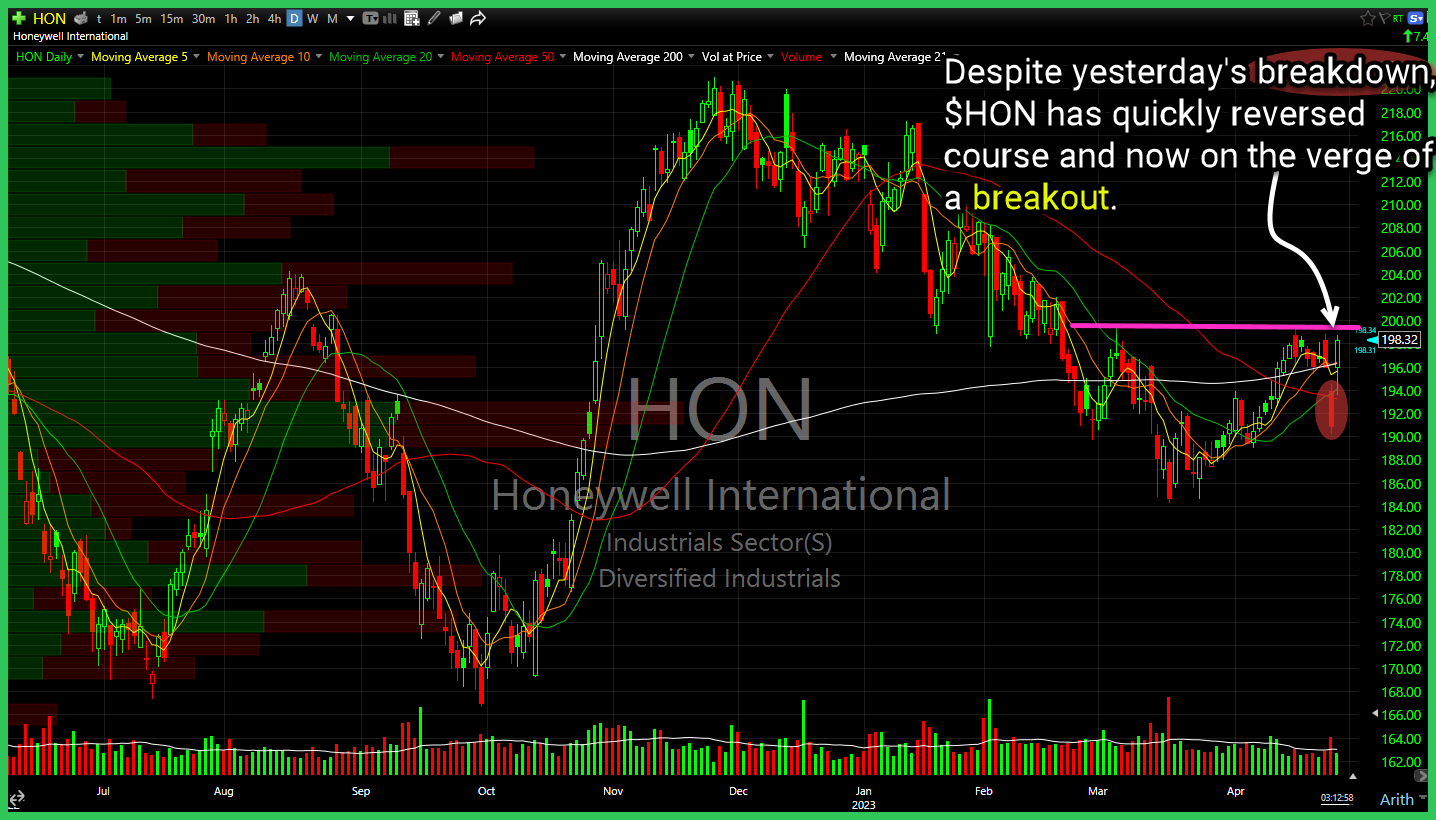

Despite yesterday's breakdown, Honeywell (HON) has quickly reversed course and now on the verge of a breakout. Quite the clown market we are in. Caterpillar (CAT) intraday breakdown of support has now seen a sharp intraday rebound. Watch declining resistance above. Communications Sector (XLC) ripping higher on Meta Platforms (META) earnings, but closing

ARK Next Generation Internet ETF (ARKW) continues to see heavy rejection at the declining resistance level going back to last May. A lot of people chasing Amazon (AMZN) despite the fact it is trading on the underside of multi-year declining resistance. Better to wait for that resistance to clear first. Semiconductor ETF (SMH)

Watching for Super Micro Computer (SMCI)to pullback to the rising trend-line for a potential bounce play. Rumors of an AMC Entertainment (AMC) buyout by Amazon (AMZN) shooting stock price up, and potential creating a breakout scenario. However, in doing so it will keep a lot of long-term bagholders ($10+) from ever colonizing the moon. Lands

Bed Bath & Beyond (BBBY) down 67% since the highs of Monday. Significant week for CBOE Market Volatility Index (VIX) as it was finally about to breakout of the downtrend. US 10 year treasury yield (TNX) breaking out of its declining trend-line from October highs. Alibaba Group (BABA) breaking that rising trend-line. Apple

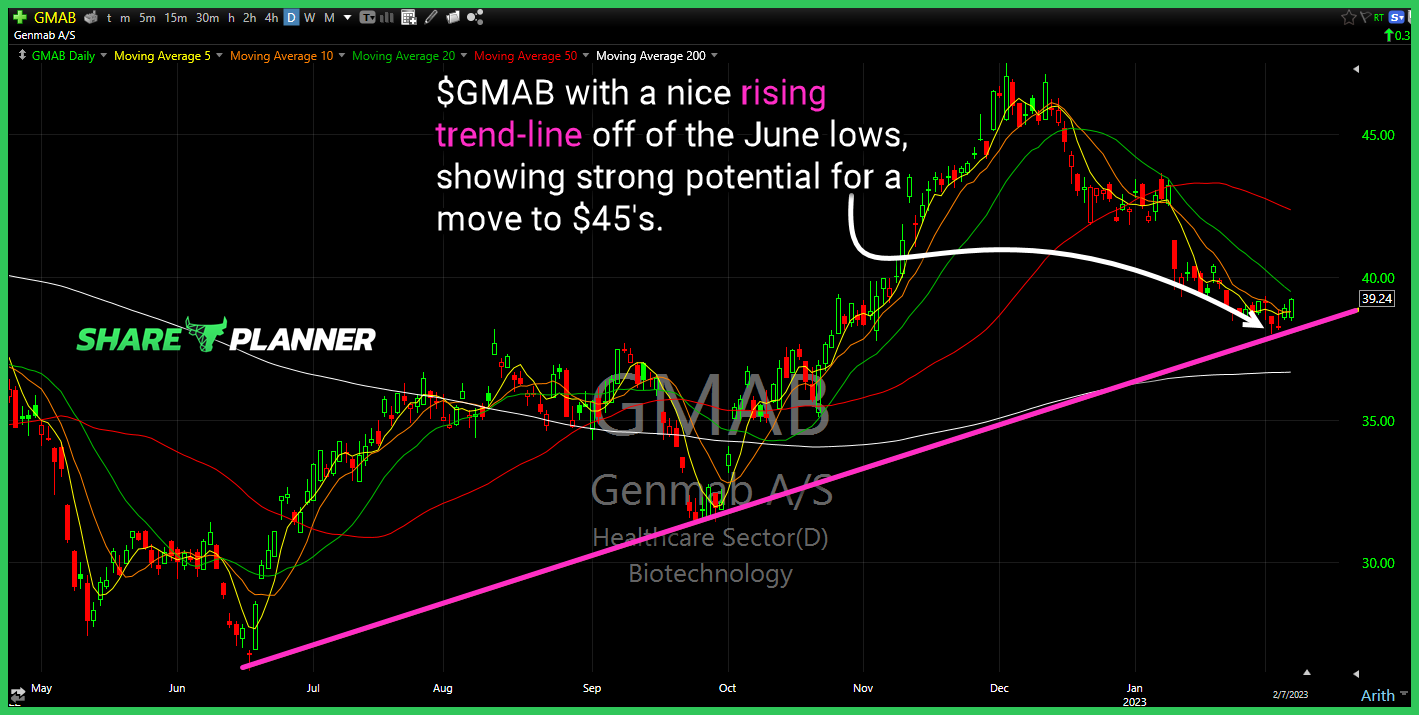

Genmab (GMAB) with a nice rising trend-line off of the June lows, showing strong potential for a move to $45's. US 10 year yield (TNX) testing declining resistance Amazon (AMZN) pulling back to the short-term rising trend-line, and attempting to bounce. Royal Caribbean (RCL) rally has been incredible of late, but may be facing resistance