Cannabis and US Cannabis ETF (MSOS) specifically rolling over. I expect a retest of the $6's. Arm (ARM) continues to trend lower following its IPO which is what is to be expected with pretty much any IPO. Best to wait at least 6 months before buying for the long-term. Microsoft (MSFT) pulling back

Electronic Arts (EA) breaking below key support and, so far, failing to bounce. Worth staying away from, for now while it searches out a new bottom. Microsoft (MSFT) possibly putting in a significant topping pattern and breaking below key support here. CBOE Market Volatility Index (VIX) break in the declining trend-line, and a

United States Oil Fund (USO) spiking and pushing through major resistance today. Tupperware Brands (TUP) traders chasing the pipe dream into heavy resistance. May be the top on this one. Highlighted the dangers of these in my podcast this weekend. Keep a close eye on this support level for Microsoft (MSFT). If it

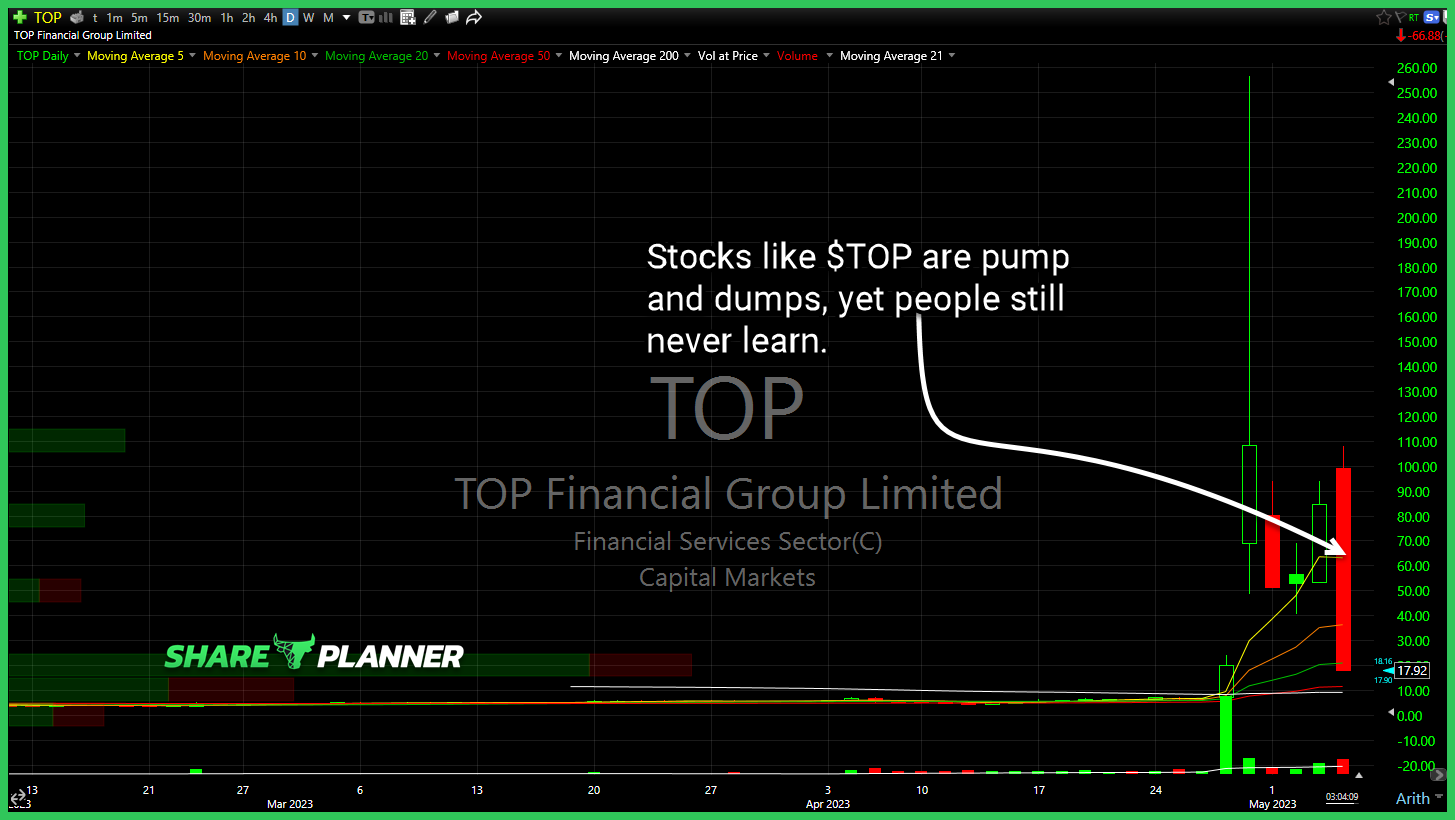

Stocks like TOP Financial Group (TOP) are pump and dumps, yet people still never learn. They still have to chase and then blame the boogeyman when it doesn't work out. Bearish Big move out of Advanced Micro Devices (AMD) on Microsoft (MSFT) news, but still within the short-term declining channel. Considering there hasn't been a

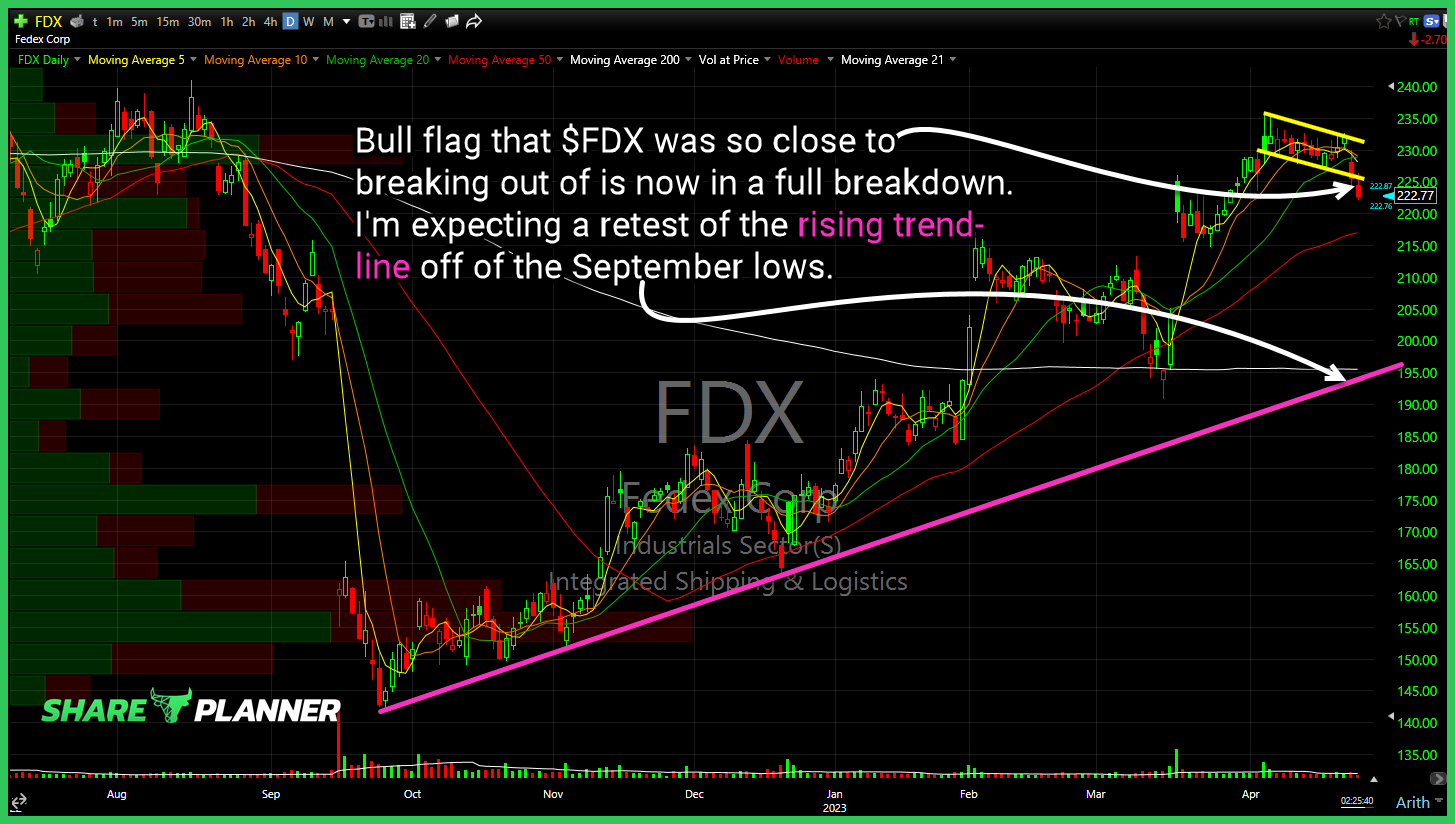

Bull flag that Fedex (FDX) was so close to breaking out of is now in a full breakdown. I'm expecting a retest of the rising trend-line off of the September lows. Snowflake (SNOW) testing the triangle resistance after testing its support yesterday. Massive head and shoulders pattern formed on the US Dollar (DXY)

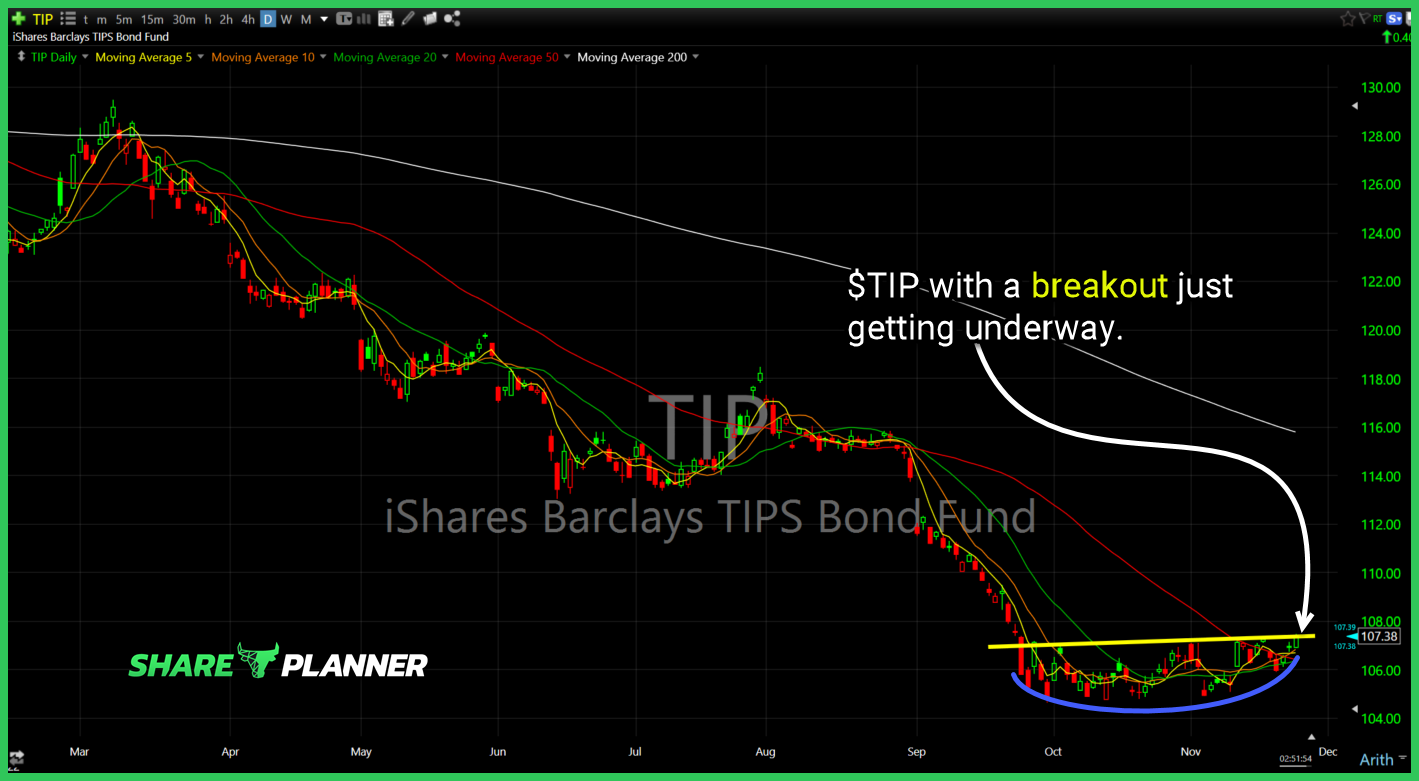

TIPS Bond Fund (TIP) with a breakout just getting underway. US Natural Gas ETF (UNG) breakout and pullback to the support level. Watch for whether that level an hold into the close. Ulta Beauty (ULTA) testing all-time highs here. Overbought on the daily chart. Could run into resistance before trying to slow down.

It's a big week of earnings for the stock market including earnings reports from the major big tech stocks. I provide analysis for the following stocks: Apple (AAPL), Microsoft (MSFT), Google (GOOGL), Meta (META) and Amazon (AMZN).

$DKNG breaking below key support.

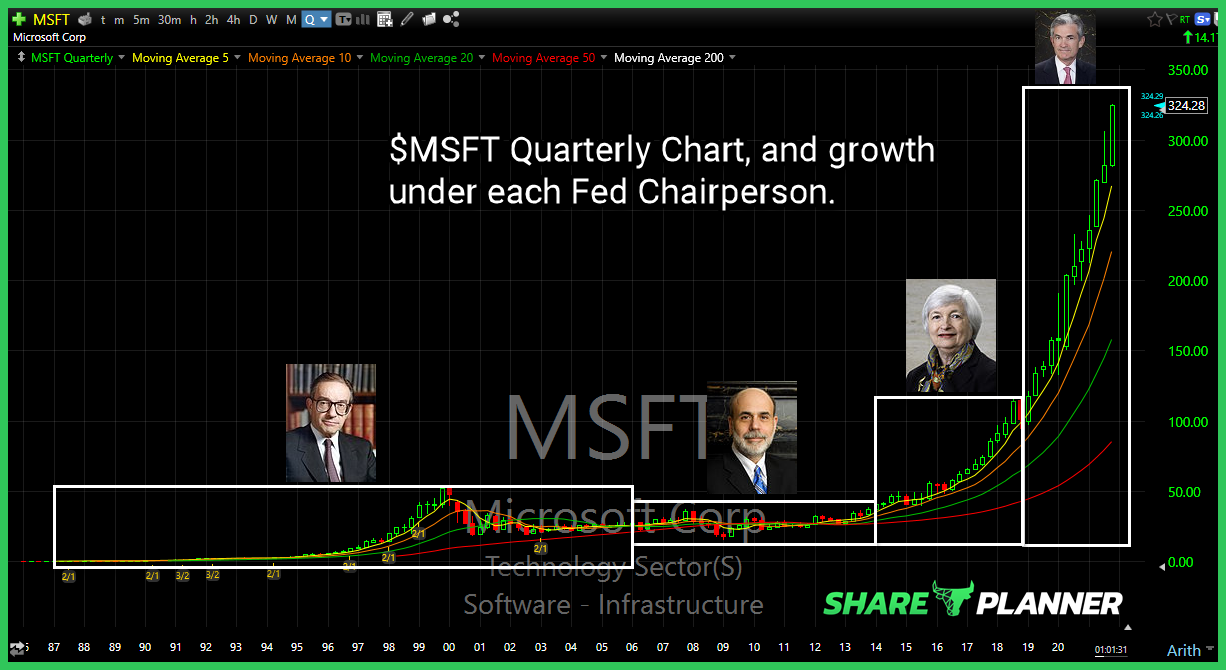

$MSFT and the Federal Reserve through the years. Amazing how Jay Powell, has used Fed policy to pump these tech behemoths.