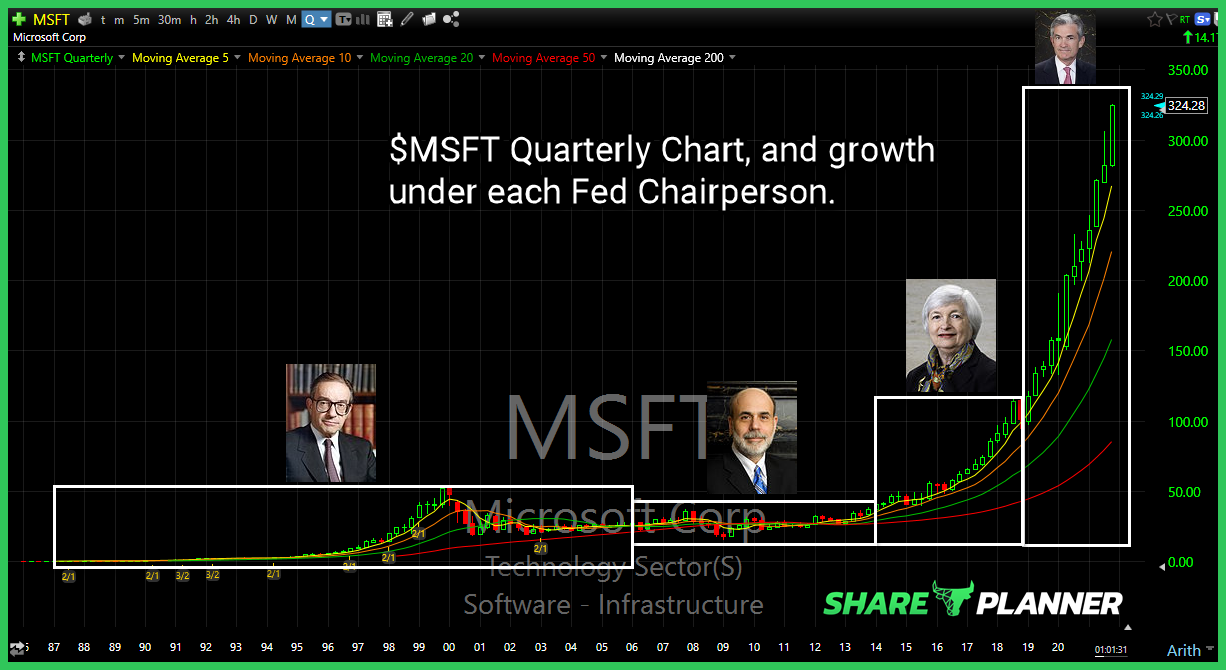

$MSFT and the Federal Reserve through the years. Amazing how Jay Powell, has used Fed policy to pump these tech behemoths.

As a new feature to SharePlanner, I'm going to roll out, the SharePlanner Notebook, where I essentially "clear out my notebook" of the charts I went through today, and provide you with some or all of the ones that I found interesting. Some of them, may have been requests from members of the SharePlanner Trading

As a new feature to SharePlanner, I'm going to roll out, the SharePlanner Notebook, where I essentially "clear out my notebook" of the charts I went through today, and provide you with some or all of the ones that I found interesting. Some of them, may have been requests from members of the SharePlanner Trading

As a new feature to SharePlanner, I'm going to roll out, the SharePlanner Notebook, where I essentially "clear out my notebook" of the charts I went through today, and provide you with some or all of the ones that I found interesting. Some of them, may have been requests from members of the SharePlanner Trading

Conditions are looking bad beneath the surface. This market is rallying right now, mainly because of five stocks. Six if you want to throw Netflix (NFLX) in there too. These stocks have a huge sway on the overall market: Amazon (AMZN), Facebook (FB), Alphabet (GOOGL), Apple (AAPL) and Microsoft (MSFT).

Tech continues to be unstoppable – rising for a sixth straight day. You’d probably expect that there’d be more tech stocks on the list, but I’ve had to take so much of them off the list because they have gone straight parabolic over the past week. Many of which have seen gains of over 20%.

Bulls are using the force on this May the Fourth to push the markets into positive territory. However the breadth is absolutely putrid, and once again we are seeing a flight into technology, primarily in the big tech giants, as Apple (AAPL), Netflix (NFLX), Facebook (FB), Amazon (AMZN), and Microsoft (MSFT) are ripping the faces

Swing Trading Strategy: Finally a follow through (kind of)… All day long the market looked really solid following its early morning sell-off from the highs of the day. A very strong rebound though and you had what looked to be another triple digit gain for SPX, and then the politicians started talking and down

Swing Trade Approach: Took off half my position in Baidu (BIDU) at $140.29 for a +9% profit, and will let the rest ride. Also closed out all together my positions in Lowe’s (LOW) and Take Two Interactive (TTWO) for +2% and +3% in profits respectively. The profits are piling up and the rally in the market is quite amazing as the bulls

First off, a big salute to the veterans who read this blog and are either serving this country or have served in the past. There was a lot of commotion outside my office window this morning and then heard all of this great patriotic music and so I looked and outside a parade was starting.