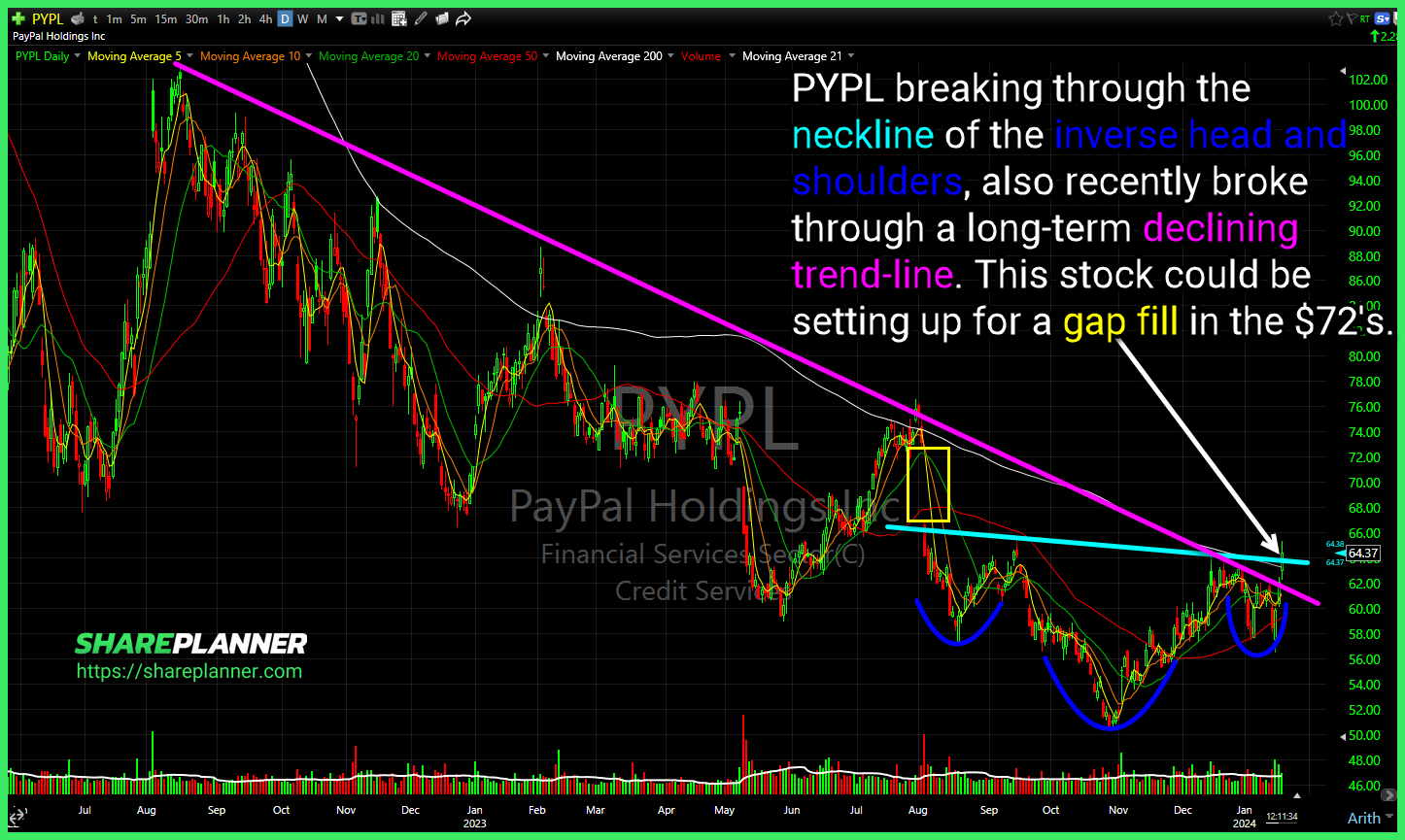

PayPal (PYPL) breaking through the neckline of the inverse head and shoulders, also recently broke through a long-term declining trend-line. This stock could be setting up for a gap fill in the $72's. Closed out this bounce play in Wayfair (W) today for a +12% profit. Nice to get some positive news that helps the

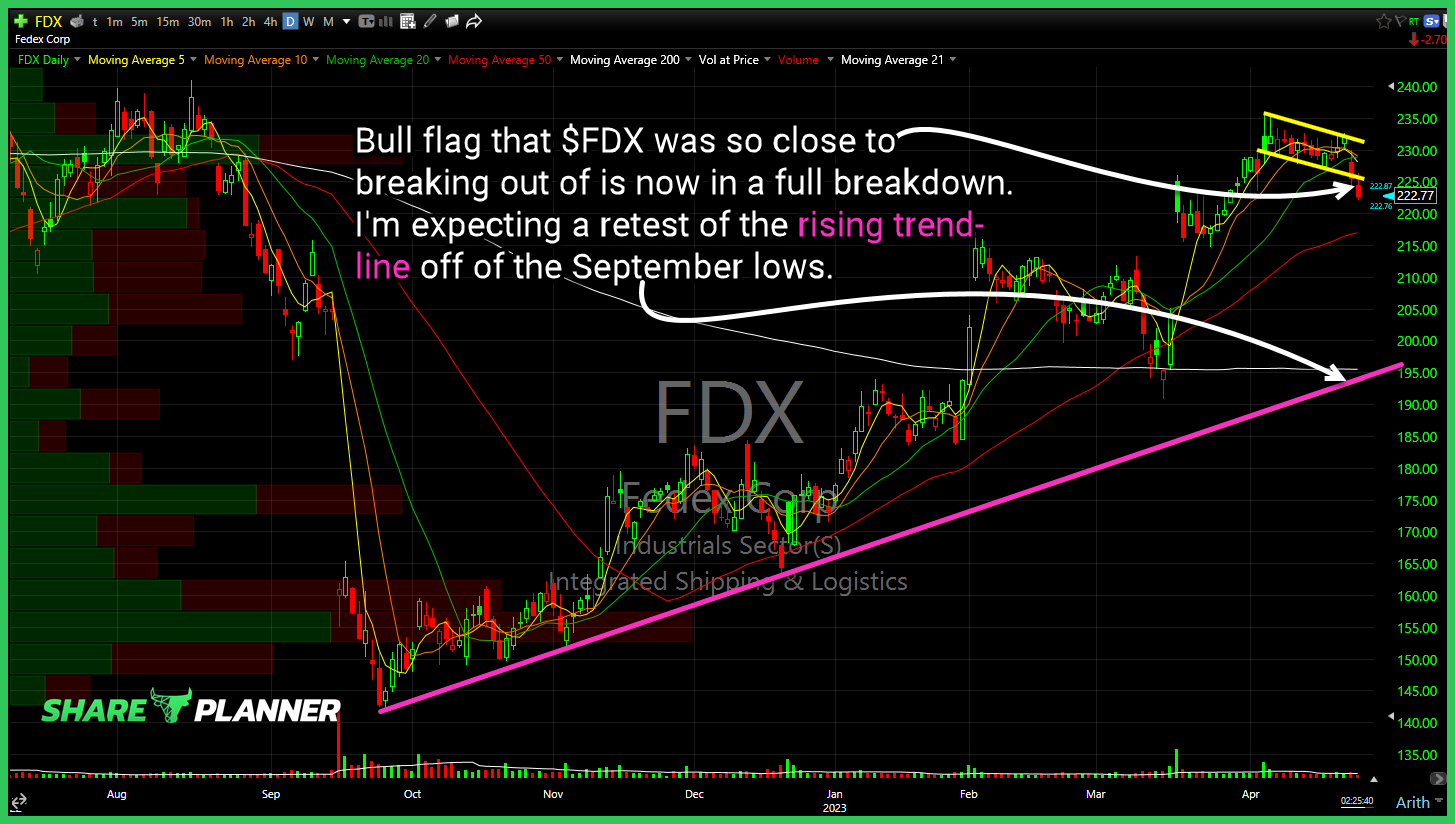

S&P 500 (SPY) Kinda looks like a rug pull if you ask me. Fedex (FDX) long-term trend-line worth watching especially as it is trying to hold it despite the massive gap lower. Diamond top on Alphabet (GOOGL) with a hard reversal and breakout to the upside which nullifies the pattern. Which is also

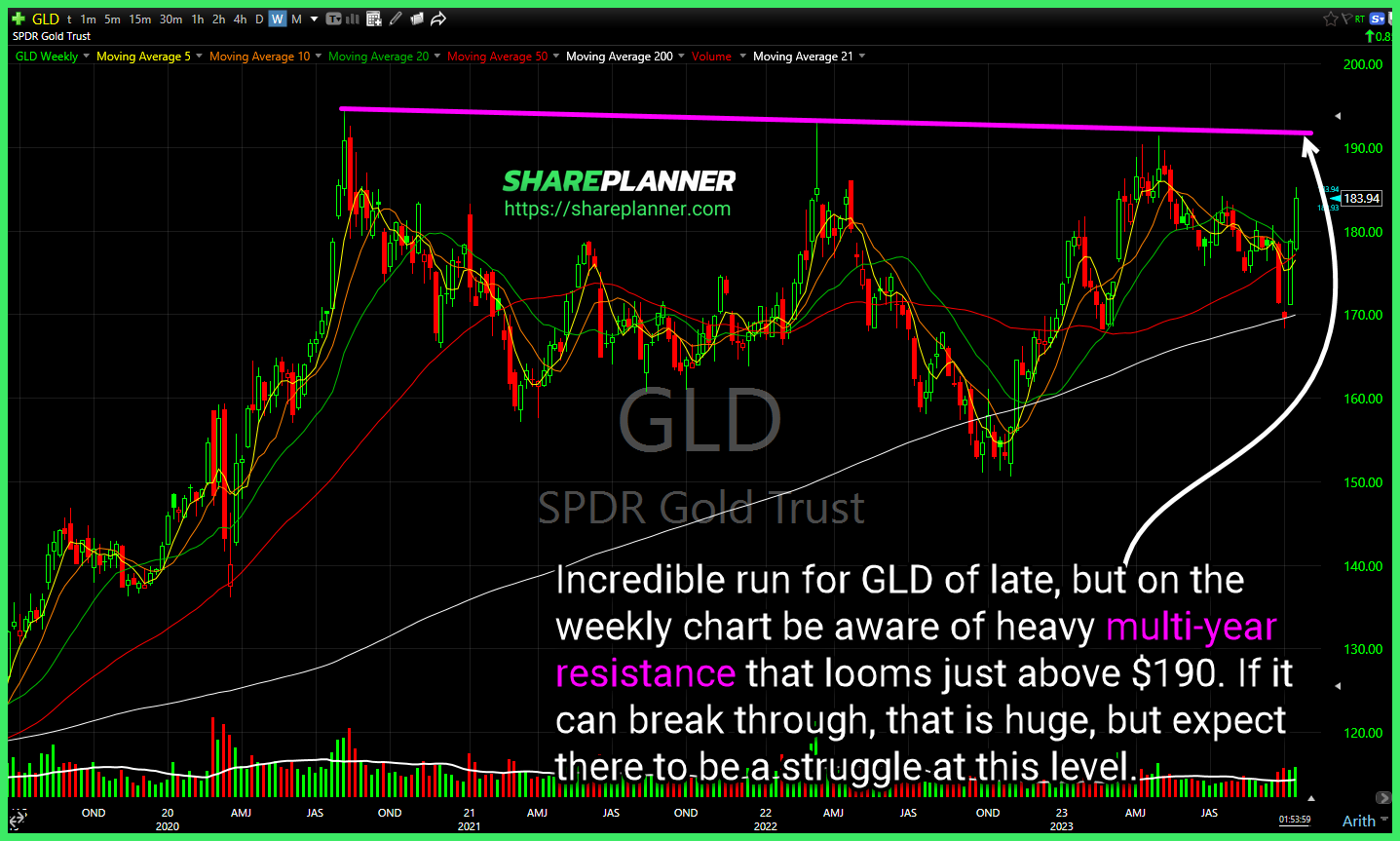

Incredible run for $GLD of late, but on the weekly chart be aware of heavy multi-year resistance that looms just above $190. If it can break through, that is huge, but expect there to be a struggle at this level. Just when you think $PYPL can't go any lower, it breaks another important support level,

Bull flag that Fedex (FDX) was so close to breaking out of is now in a full breakdown. I'm expecting a retest of the rising trend-line off of the September lows. Snowflake (SNOW) testing the triangle resistance after testing its support yesterday. Massive head and shoulders pattern formed on the US Dollar (DXY)

Keep an eye on $FSLR and this developing head and shoulders pattern. Not confirmed, but getting close.

Two key support levels could offer up some support on the weekly for $UPS.

$FDX attempting to break the 200-day MA and the declining trend-line.

$MULN Cup and handle pattern that needs to turnaround fast if it is going to keep the pattern in place.

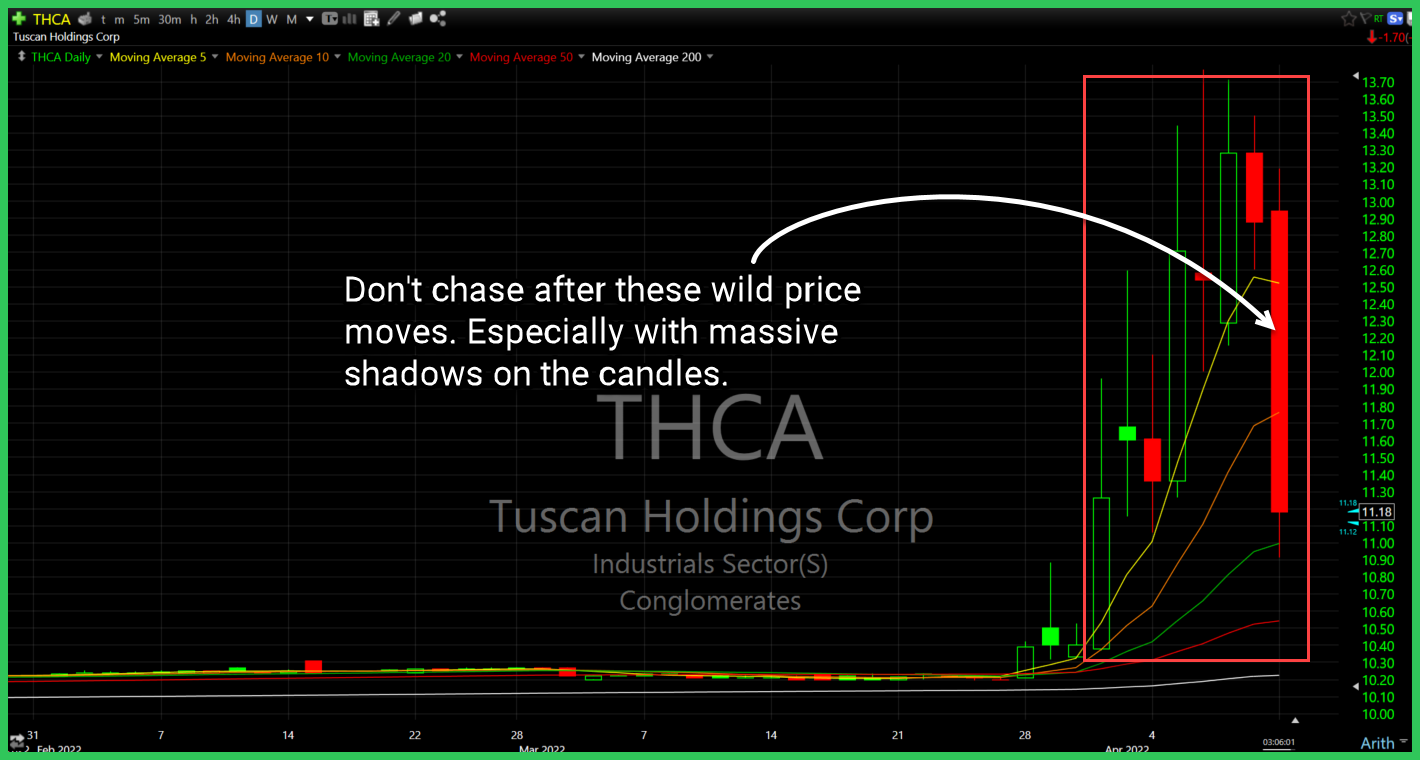

$THCA – “Don’t go chasing waterfalls”

$CMG with declining resistance broken