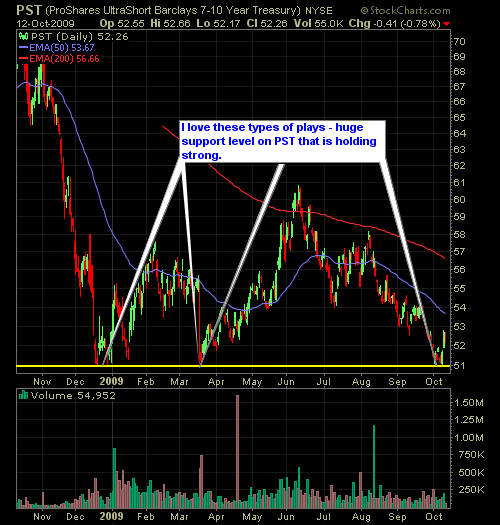

Here’s a chart on PST – the ProShares UltraShort of the 7-10 Year Treasury. As you can see it took a huge nose dive back in late 2008, but what I really like here is the huge role support has played at the $51 level nearly to perfection. On four separate occasions, the stock has

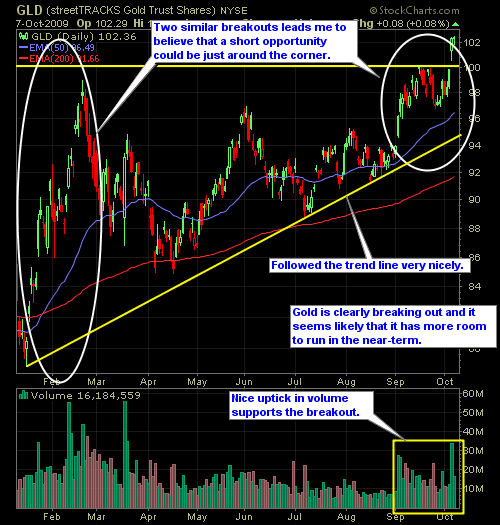

As you have all probably heard, whether you watch Fox News, CNBC, Bloomberg Radio, or any other form of media, gold is breaking out to new highs and everyone seems to be jumping on the bandwagon. The promoters of all those lame infomercials that you hear on TV about “Celebrity So-and-So” buying gold because they want to protect

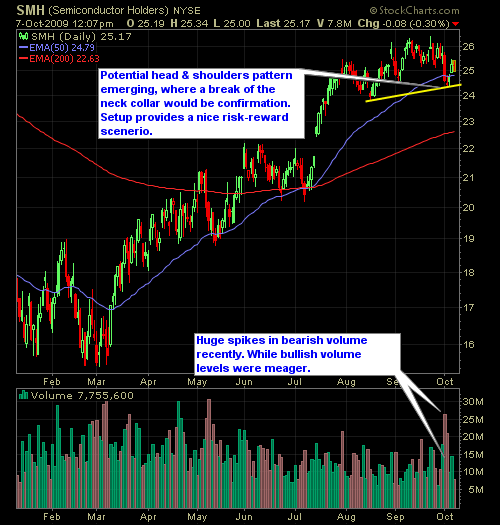

The Exchange Traded Fund (SMH) provides for a solid risk-reward play. The ETF buys companies that do business in the semi-conductor industry, and of late the industry has been showing noticeable weakness. First with the slip below the critical 50-day moving average, (though it is currently trading above it after the rallies on Monday

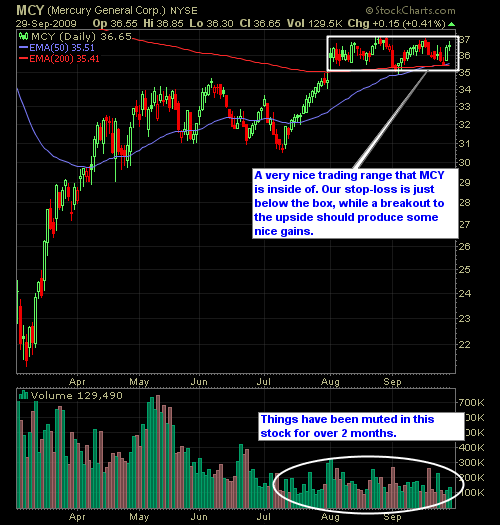

One more trade to add to the portfolio with Mercury General (MCY) at 36.50. If this stock can break out of the consolidated trading range that it has been in for the past two months, then we could see some serious upside.

Last week RIMM missed their revenue estimates big time, and as a result saw their stock price fall from the mid-80’s down into the 60’s. Today is the first day that it has showed any positive signs – showing strength at and around $66-67. This is a major support level for RIMM, and I have

Be sure to become a member if you haven't yet by Clicking Here. Today's trade setup offers an excellent risk/reward scenerio in an industry that has recently been showing some descent strength. Check it out!

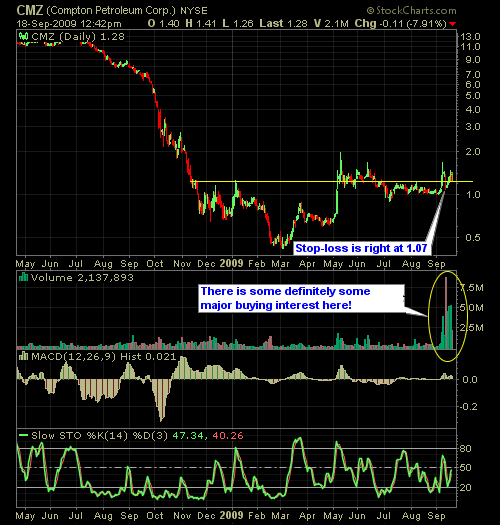

If you subscribed to our membership area (and you are without excuse since it’s FREE) you were alerted to Compton Petroleum (CMZ). I’m not typically a fan of stocks under $5 since 1) the opportunity for loss beyond the stop-loss is much higher then normal, and 2) for the wild price swings that come

Picked up Apple today at $175 on a breakout of consolidation. My stop loss is at $163.50. My initial target is rounded off at $200, but that isn't necessarily where I am going to close the position out at, but I will take some profits there if it can rally to that point. Stay tuned...I'll

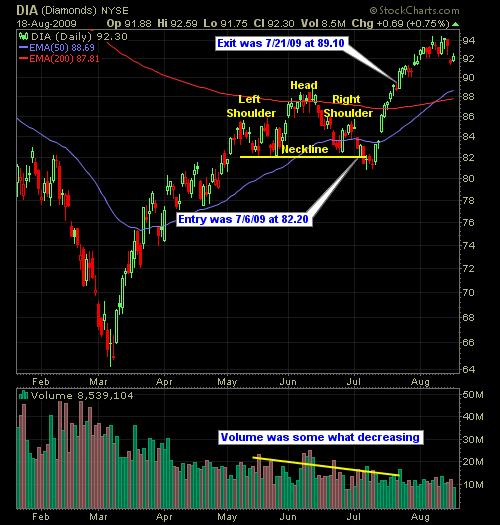

If you are a chart-reading enthusiast like myself, you know doubt are familiar with the head and shoulders pattern that started to form back in May and was completed in early July on all the major indices (minus the NASDAQ which managed only to form a Double-Top). There were undoubtedly thousands of traders watching this