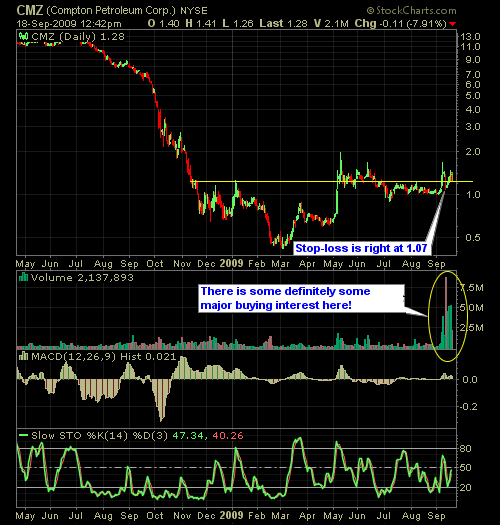

If you subscribed to our membership area (and you are without excuse since it’s FREE) you were alerted to Compton Petroleum (CMZ). I’m not typically a fan of stocks under $5 since 1) the opportunity for loss beyond the stop-loss is much higher then normal, and 2) for the wild price swings that come about with not logical reason whatsoever. With that said, I had a setup come across my screener in CMZ that I thought offered a great risk-to-reward opportunity.

As you can see in the chart below, this things has seen a huge surge in volume and thus buying interest without any notable news surrounding it. The price of CMZ recently broke through resistance and is basing right above that level in the 130’s and high 120’s. I bought into this today at 1.31 with a stop-loss at 1.07. I also have the intentins of buying more of this stock at 1.23 and 1.15 before I have a full position to work with. I’ll also buy more as the stock increases in value.

Nonetheless, I don’t go into this thinking I’m going to get rich off of this thing in fact I am fully accepting of the fact that I could get stopped out of CMZ over the course of the next couple of days – and that is okay. However, I think that there is a lot of upside to this stock, and if it plays out in my favor, should provide a very nice return.

Don’t expect me to put these types of stocks out all the time (i.e. penny-stock) because the success rate is erratic at best. But, I like what I saw in this setup and is one of the low-priced stocks that provided me with a definable risk-to-reward setup.

Here’s the CMZ chart…

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

As swing traders, we have to accept that losing will be a regular part of trading and one that we must accept. In this podcast episode, Ryan explains how a trader who isn't comfortable with losing is a losing trader. If you're not comfortable with losing in the stock market, you'll never find real success as a trader either.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.