As you have all probably heard, whether you watch Fox News, CNBC, Bloomberg Radio, or any other form of media, gold is breaking out to new highs and everyone seems to be jumping on the bandwagon. The promoters of all those lame infomercials that you hear on TV about “Celebrity So-and-So” buying gold because they want to protect their assets and livlihood are parading in the streets right about now. While I don’t doubt the long-term thesis in regards to the importance of buying gold, with all of the money that we are printing without any worthy backing, and that it ultimately leads to inflation, if not hyper-inflation, I also know that such a huge run up in price is hard to sustain without some type of pullback in the short-term.

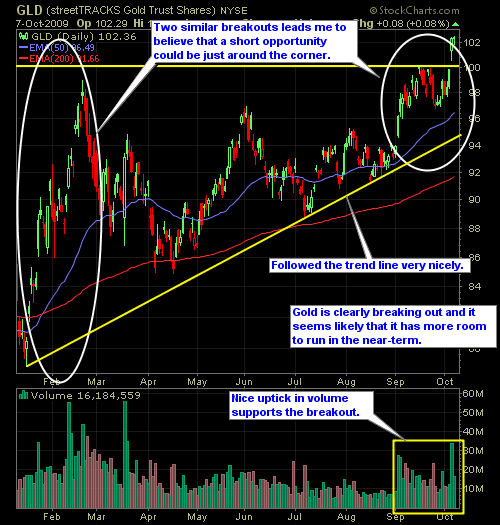

The chart on the gold ETF below (GLD) is showing a breakout to new highs, with volume supporting the surge in price. Gold related stocks such as AUY, RGLD, and GG are all hovering, similarly, near their highs, and continued strength in gold will insure that these stocks breakout to their own individual new-highs. While I don’t believe you should short gold at the moment, I do believe that if gold continues to $1,100 or 1,200 an ounce, that we could see a prime opportunity to benefit from the recoil that gold is bound to see.

So don’t jump in front of this freight train just yet, be patient and let the trade come to you rather then you coming to it.