Two days in a row,I had trades in Amazon.com (AMZN), and two days in a row I am able to book solid gains! If you were following my trades you should have been able to make more in profits then I did simply by being a bit more patient and holding your position a

Another video podcast posted tonight from the trade made in SPY earlier today. It wasn’t an overly exciting trade by any means but the profit opportunity was there and should have been seized upon. There was also some nice trading patterns that is worth mentioning from the intraday double bottom to the doji hammer

These video podcasts are starting to get easier and easier. I’m not known for being a great speaker, but hopefully in time these podcasts become less painful. With that said, we are analyzing the trade in DIA from last week. It was definitely not one of my better trades, as what started out good, turned

Here is our second installment of our short trade in DIA from 6/15/09. It was a profitable trade in that we managed to earn $130 for every $100 that was risked. And by dollars risked, I mean the amount of money that would have been lost if you were stopped out at our

We have had a number of traders ask us to provide them with our understanding of Risk-Reward Ratio. As a member (and it is FREE for everyone to join- So you are without excuse!) you know that we stress the risk-reward ratio in our day-trades and that our positions and the number of shares we

If you were a participant in today’s market, then you probably have whiplash from all of the swings in price that took place. This month in general has been very difficult for day-trading. I’m sure that there have been plenty of success stories but for us and our style, while we are profitable on the

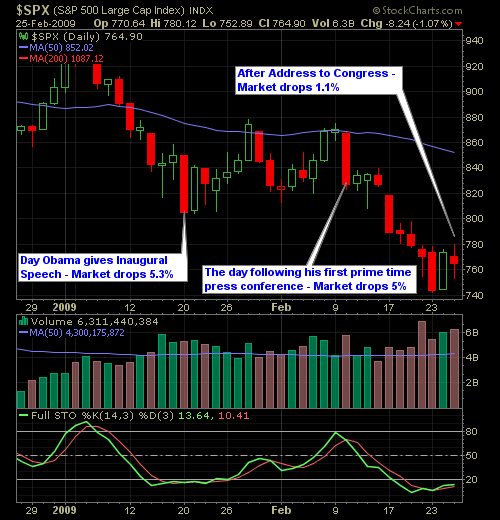

I know, I know – how unpatriotic of me it is to write an article such as the one I am about to write. But lets be frank – anytime President Barack Obama speaks before a national audience, the market tanks. Since he has been sworn in as President, Obama has had three press conferences,

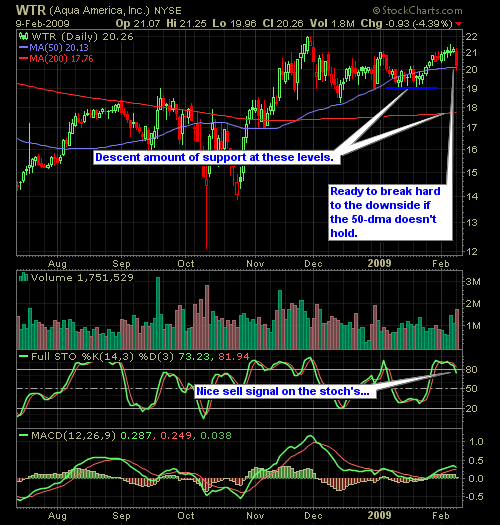

Stock Market is getting extremely overbought, and news of the “umpteen-trillion-dollar”stimulus plan is likely already priced into the markets, there are some descent shorting opportunities beginning with Aqua America (WTR) and Royal Gold (RGLD) other stock worth noting, but won’t be detailed here are Emergent BioSolutions (EBS) and Finish Line (FINL). Each one of these

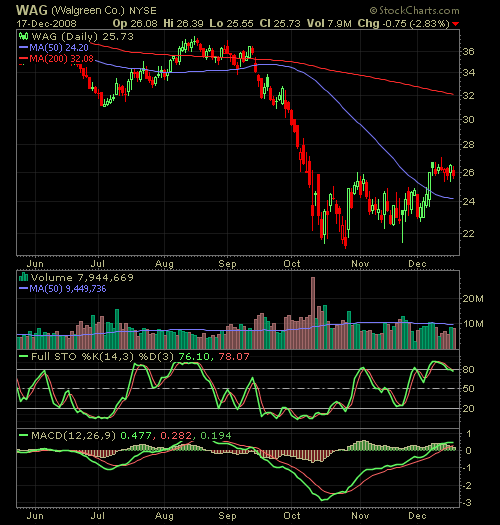

Its hard to find anything in today’s market that is actually doing good to the longside – and when a certain industry or stock does overachieve, it doesn’t last for long. But scanning various screens, industries, and individual stocks over the past month has found a few industries and stocks that are doing quite well

For the past four or five months our morning trade setups have primarily been short setups, but today the focus will be stocks with long setups. The market is showing strength in recent weeks, and I wouldn’t be surprised to see this last through the end of the year (sometimes referred to as a “Santa