It’s a later than usual posting but fortunately I guess it is better late than never. Having some server issues this morning (seems to be the theme of my life), nonetheless I am steadily working through them. Worth mentioning that I am long 3 positions (AMB, EXBD, TII) and short one other (ANGO). I’ll be

As I always do, I like to provide ya’ll with my stock watch-lists, on a fairly regular basis, with the desired stop-loss for each. Each of the stocks below have some very solid chart patterns that are ready or near ready to be shorted.The number to the right of each symbol is the stop-loss that

Finally, I was able to add two new positions to the portfolio in EXBD and WOOF. It seems like it has been forever since I have added a legitimate long position to the portfolio. Both stocks that I bought today have similar charts, posing major breakouts above resistance with the opportunity to move much higher.

Here are two trade setups that I like quite a bit. It can be hard to find stocks that hasn’t gone straight up of late and actually offer a descent risk-reward setup. They two stocks – EBAY and SPNC do just that. Take a look for yourself. Click Here to See the Long Setup in

Earlier today, I posted the screen results of 18 stocks trading at a steep discount relative to its share price; tonight I flip sides and give you three stocks that have technically broken down, and are prime for a short position with an excellent risk/reward setup. The only catch is the general markets. Any short

This stock here I came across yesterday. The symbol is DV and it just broke through some serious resistance levels. If you ask me, I think it is prime for another huge move upwards, assuming that the generally positive sentiment in this market holds up. It is also oversold on a short-term basis as it

Below are five trade setups that I really like. For the most part they are oversold, and have just recently make some huge strides in breaking through critical levels of resistance. These are your consummate breakout plays and could see some major gains going forward, especially if the bullish tendencies of the general markets can

Just as I promised last week, I told you that I would provide you with another 20 or so trade setups to the long-side (21 actually). I’m also currently working on some short setups for you as well, and will probably have for you this weekend or early next week. The 21 stocks below are

A couple of things to point out quickly here – I have sold out of BKS and UGI with gains of 12.3% and 5.8% respectively this morning. So right now, I am sitting on 100% cash. The market is extremely overbought, and I’m now looking for some kind of pullback before going long again. In

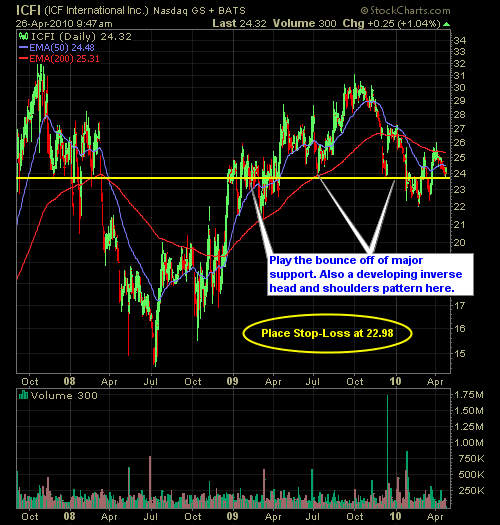

Last time I provided you with the shorts on my watch-list, today I’m giving you my long-setup list, and there are plenty of candidates out there. I plan on actually expanding this list over a couple of posts, because there are a ton of good setups out there. The problem is, that the market has gotten