Part two of the weekly short watch-list. If you missed the first one, you can find it by clicking here. As always – same guidelines apply. Here are the requirements for inclusion on this list: 1) Price and volume pattern is intriguing 2) Stock has been heavily sold-off in the recent days or weeks,

For once, I was able to weed out a large number of setups from my list, due largely to the strength in the markets from yesterday and again today. As a result, my short watch-list is just a shade under 100. But about 50 less from the watch-list I posted last week. Once again,

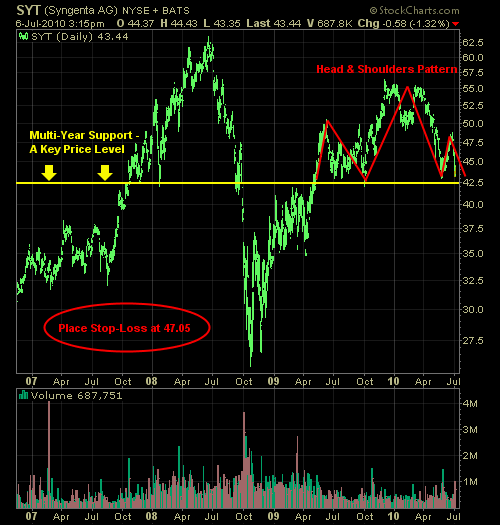

Syngenta (SYT) has multi-year support levels at the neckline of the head & shoulders pattern, making it a very intriguing setup to the short-side, should price break below it here in the near future. A break of the neckline could see price drop to $35 and as much as $30 before finally stabilizing. In recent

Its been a few weeks since the last time I posted my watch-list for long setups. They are, no doubt, few and far between, but I do have about 15 of them worth keeping an eye on. The basis for me adding them to my watch-list falls under three conditions: 1) Price and volume

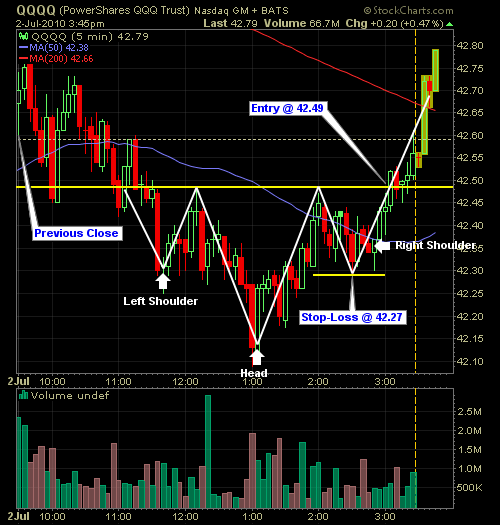

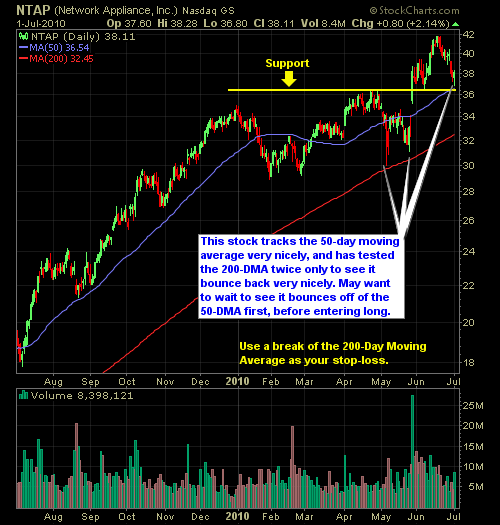

As promised, I’ll still be providing you with daily trade setups (along with my daily trading plan) prior to the market open each day. Here are the Long and Short setups for today. (I need to come up with a more creative name for this particular post type!) LONG: Network Appliance (NTAP)

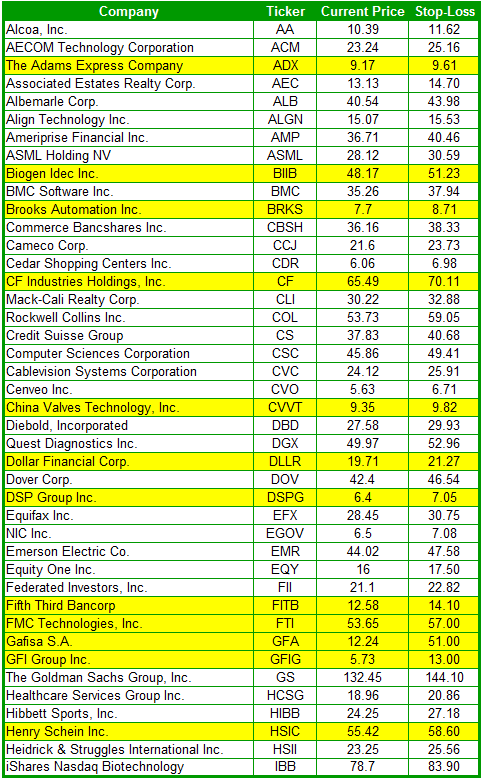

Here are the rest of the short setups for you to keep an eye on. Those in yellow represent new additions to the list. For those that are wanting to know why I include any of the stocks listed below on my watch-list, it is due to the following three reasons: 1) Price and

Its been a great two days for us bears, especially considering the gains from yesterday came from a late day breakdown that confirmed the 1040 break through on the S&P from the day prior. The thought of holding anything long in this market right now is a crazy notion, and one that I wouldn’t want

Now for Part Two of my watch-list for short-setups. If you missed the the first one, you can find it by clicking here. Same rules apply as before, be aware that all new additions on the list are highlighted in yellow. Overall, today was a good day for the portfolio – up a little

So if you thought last week’s list was long, well this one is even longer, but not by much, but I will be posting them throughout the day today. So be on the lookout for them – three parts in all. I’ve highlighted each stock that is new to the list in yellow, while also