I came across Blue Nile (NILE) this morning as I was going through my scans. NILE stuck out to me mainly because of the multi-year resistance levels that is seen just above the current price. Also this stock is in the beginning of a well-defined downtrend, and if it can break below the mid-40’s where

Stocks this morning are showing little gumption for a follow-through today on Friday’s rally. The bulls need to be careful here that they don’t allow for the selling to suddenly get out of hand. I’ve gone ahead and added to my portfolio this morning with a nice sized position in QQQQ (ETF that tracks the

My entry into ITW was late this afternoon, not with the prospect that I was going to make much off of it today, but but with the assumption that the rally would continue on into next week. I was pretty aggressive with my positioning today, going from 3% long to 57% long. I’ve got $52

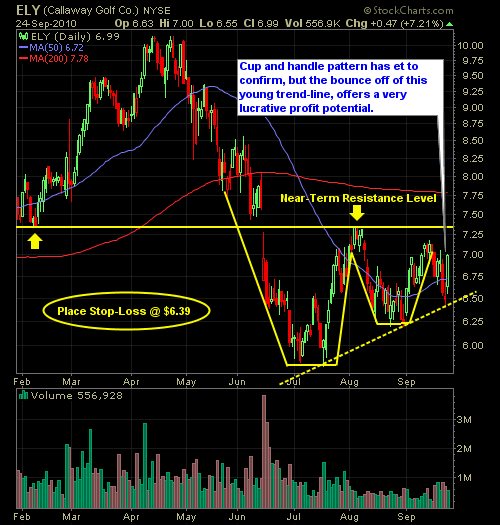

I bought this stock earlier this morning at 6.78. There is some short term resistance at $7.30, but if we can break through that level, we could see Callaway Golf (ELY) climb into the $8’s.

I really hate flying with this company, but I try to keep personal preferences out of the trade. That is why I am using the short-term cup and handle pattern to initiate a trade. My stop-loss is at $11.05, with an initial price target at $12.75, but would ultimately like to see this stock

Got in Chevron (CVX) at $80.02, using the consolidation just above the inverse head and shoulders breakout for my entry.

The market, for the first time this month has seen a fair amount of selling as it fell back below the 1130 breakout level on the S&P. The question on the minds of the bulls is whether this is something to be concerned about or to use as an opportunity for buying stocks on the

This is a stock that I have managed to consistently short with success over the past few years, and right now it is trading in a very defined trading range which makes this an even more intriguing setup for me. So at the close yesterday, I jumped on this stock at $34.79, just as it