Yet another short position added to the portfolio today. As it stands now I am 81% vested in this market, with everyone of my positions being short except for gold (GLD). As you can see the S&P is forming one heck of a head & shoulders pattern. Assuming it plays out as noted below,

Here a new position I added to the portfolio yesterday. Mindray Medical has a beauiful triple top in play, as the market has recently pulled back to near the neckline, which represents some pretty heavy resistance. My stop-loss for this stock is 33.39 while my target price is 28.23. Here’s the chart analysis on

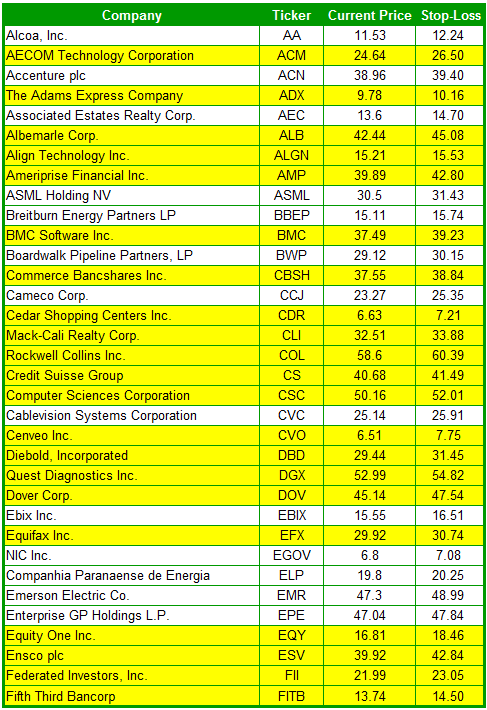

Final installment of my weekly short watch-list. If you missed the previous posts, you can find them by clicking on Part One or Part Two. For those that are wanting to know why I include any of the stocks listed below on my watch-list it is due to the following three reasons 1) Price

Alright folks…same song, second verse. The same criteria for the stocks below applies. I actually picked up shares of one of the stocks listed – Mindray Medical Int’l (MR) at 31.62. I’ll be posting a chart on it before the evening is out. By the way…great day in the market today for us bears, though

Here’s my Short-Watch-List for this week. Like a few weeks ago, the number of stocks that I am closely watching has absolutely blown-up. So I will be dividing this post up into three separate segments. There are a bunch of new names to the list below and it is worth talking the time to look

My latest position in this market is yet another short – this time it is Ensco (ESV) – an oil stock that has seen a nice bounce of late after confirming the eight-month double-top. This pattern is still valid, as it is very typical to see a stock retrace to the neckline/resistance before moving even

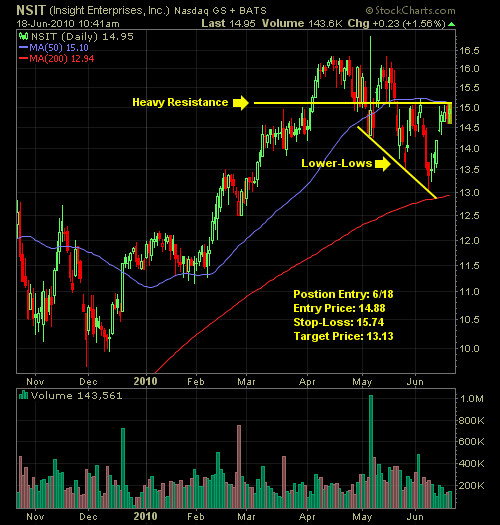

This stock is on a the brink of a brilliant short-setup and you might want to add this one to your watch-list. I’m in the process of looking through thousand charts for potential setups. This is one of the best ones that I have seen yet. If it breaks through the 14.80 level, then

Nice setup with heavy resistance just overhead that includes the 50-day MA. Also notice the set of lower lows. I’ve placed the stop-loss at 15.74 but may cut losses much sooner if the market keeps moving higher. My Chart on NSIT

Last week I had so many short setups in my stop-loss I had to divide it up into three posts. This week, I’ve narrowed it down to only ONE post. I’ve weeded out some of those that, with the recent market rally, don’t quite have the bearish case that they once did. But as

This long setup watch-list is looking more and more prudent by the day as the bulls are determined to push this market higher in the short-term. Remember, you’re not going to like every trade setup or see a trade in every symbol listed below. This is my personal watch-list and there are typically three