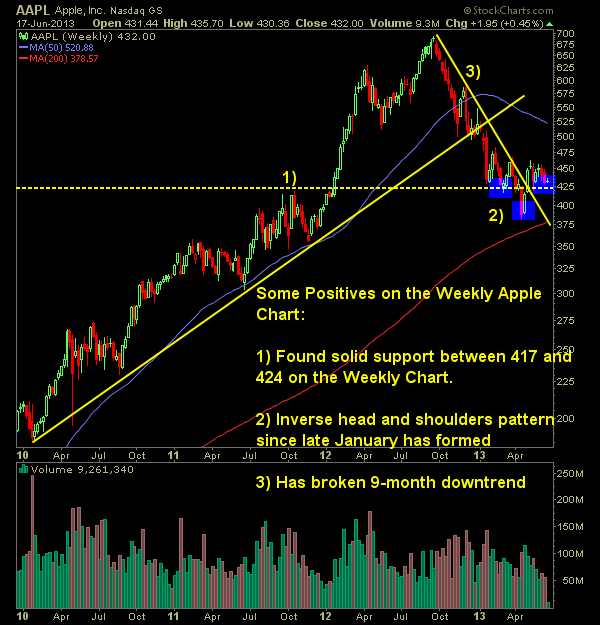

I wouldn’t say I’m a huge fan of the daily Apple chart, the weekly chart does look a whole heckuva lot better though. With the daily you have a dilapidated inverse head and shoulders pattern that has lost its once delightful promise. But with the weekly, it looks much tighter and less conflicted. Also hidden

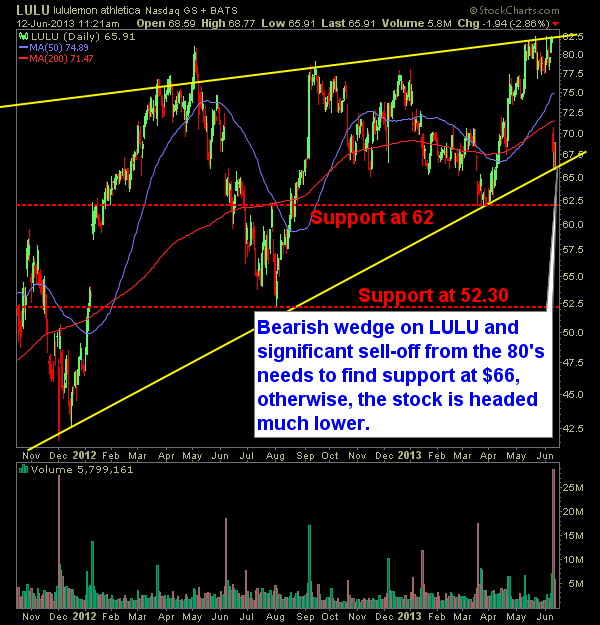

Its obvious that lululemon (LULU) has taken a beating since Tuesday, after releasing their earnings report (another example as to why I don’t hold through earnings), it has gone from trading in the mid-$80’s all the way down to the mid-$60’s. That’s what they call down here in Florida, a “cold front”. The stock is

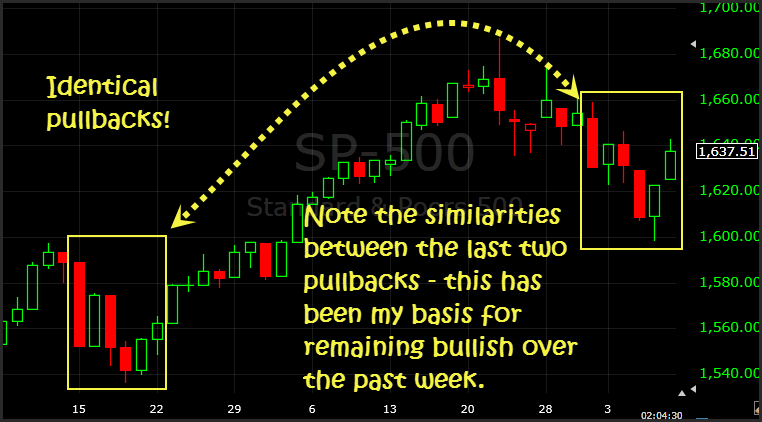

One of the hardest things about this market is that when it has been pulling back lately to not throw on some short positions and try and see how far I can ride lower with this market. Instead, I have used the opportunities that the pullbacks have brought to buy more positions at a cheaper

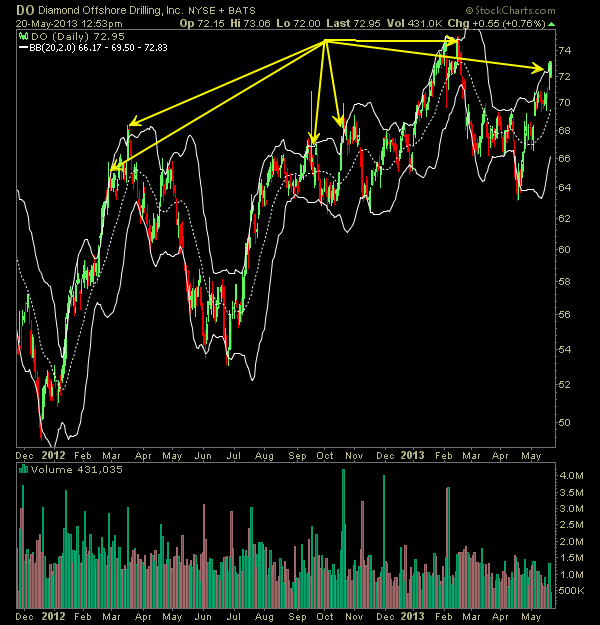

When Stocks Move Below a Bollinger Band The last eleven trading sessions in this market has been anything but easy. Anyone suggesting otherwise is not being completely honest. Sure there is money to be made trading stocks, but the back drop of the Fed looms heavy on market participants and what they might do to

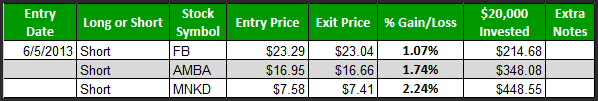

I’ve gotta hand it to Oscar (@fuinhaz) the guy knows how to use the market’s weakness to his advantage. He pulled off three day-trades today, and killed it on all three attempts. These aren’t illiquid stocks either. You have Ambarella (AMBA) with 4 million shares, the glorious Facebook (FB) with 53 million shares traded

Apple (AAPL) has been by far one of the most hated stocks of 2013 – but that may soon change. Whether it is from $7.00 to $4.43, $70 down to 43.30 or in the case of Apple (AAPL) going from $700 to today’s price of $443.30 in the past 10 months or so, investors

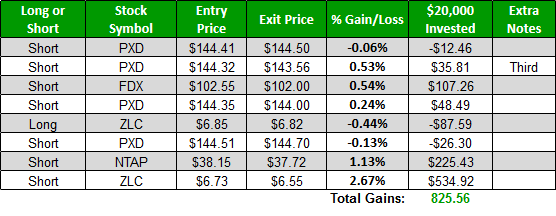

We've finished up with the month of May and Oscar (aka @Fuinhaz) had a terrific month of day-trading with a 61.7% win rate among 47 trades in all. You can't ask for a better month than that, and if you put $20,000 on each trade made, your $60 investment into the SharePlanner Splash Zone would

SharePlanner has recently launched a partnership with DittoTrade that I am thrilled to announce. Now, as a subscriber to our two newsletters, The Splash Zone and the Investment System, you will be able to autotrade them seemlessly with DittoTrade. They offer you low commissions and great fills on my alerts when I place. So if

Oscar (aka Fuinhaz) is the head day-trader at SharePlanner and boy did he prove why today. On a day in which the market headed decidedly lower, Fuinhaz managed to capture winner after winner. Most traders are bleeding through their nose by the surprise that the market gave them today, but with 5 winning trades and

On Friday, I saw that DO was way outside of the upper Bollinger Band and based on past precedence, the last five times the stock had done that, it had led to near immediate sell-offs in the stock. Despite having only gotten in the stock the day prior, I decided to sell my position in