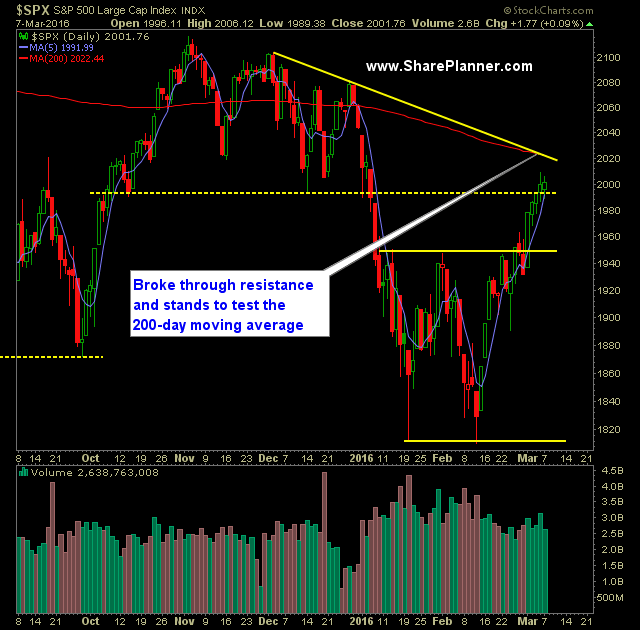

Technical Outlook:

- SPX rose for the fifth straight day, being saved in the last 5 minutes of trading with a nice pop.

- The 5-day moving average continues to hold strong since last Tuesday’s mega-rally.

- SPY rallied straight into resistance yesterday at $200’s but didn’t break higher. Volume was low and back to the levels we saw on Thursday and Friday last week.

- VIX continues to bounce off of the trend line from the October lows.

- Some consolidation on the 30 minute chart that is creating a descending triangle pattern.

- The trend-line off of the February lows is still holding strong. A move today below 1989 would break it on SPX

- Watch the 10-day moving average today which should fall somewhere around 1970. This has been a strong rallying point for the bulls since the rally began off of the 2/11 lows.

- T2108 (% of stocks trading above their 40-day moving average) is trading at 85.87 which is now the highest level it has been trading at since February 2012.

- SPX crossed back over the 2000 level for the first time since early January.

- The 200-day moving average for SPX looms large for the market and currently sits at 2022.

- Oil continues to breakout, popping another 4.8% yesterday and rising for the fifth time in the last six trading sessions on above average volume. It was the first legitimate higher-high for the commodity (USO) since May of 2015.

My Trades:

- Added one new swing position to the portfolio yesterday (short)

- Did not close out any positions yesterday.

- Currently 10% long / 10% short / 80% Cash

- Remain long GLD at $119.64.

- Will look to add 1-2 new positions and follow the market’s direction

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today’s episode, I talk about the merits of trading just one stock and the potential hazards it poses and why it leaves you looking for “a trade setup” rather than “the trade setup”.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

X: https://x.com/shareplanner

INSTAGRAM: https://instagram.com/shareplanner

FACEBOOK: https://facebook.com/shareplanner

STOCKTWITS: https://stocktwits.com/shareplanner

TikTok: https://tiktok.com/@shareplanner

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.