Technical Outlook: Massive rally off of the lows yesterday, when a continuation back towards the February lows appeared imminent. SPX managed to recapture the 5-day moving average and now sets up for a test of 1947 and the 50-day moving average, both of which have converged together. Yesterday’s morning sell-off tested and held the 10

It has been a great month so far in The Splash Zone, despite the market craziness! Bring some stability to your own portfolio by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international

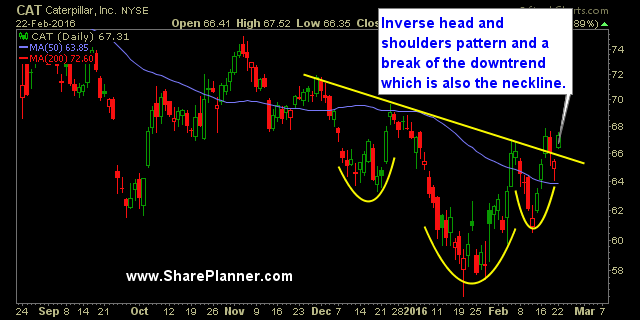

Wild day in the market but Costco (COST) seems to be the calm in the midst of the storm. I really like this setup here. You have a clear breakout above resistance which essentially represents the neckline of an inverse head and shoulders pattern. I’ve gone ahead and provided the ideal trade parameters that’d I’d

Technical Outlook: SPX pulled back hard yesterday, and gave up nearly all of the previous day’s rally. 1947, which is also the previous highs has rejected price and sent it lower. Discussion about a retest of 1812-1810 will really pick up steam today, as the market is now stuck between the two price points. SPX

It has been a great month so far in The Splash Zone, despite the market craziness! Bring some stability to your own portfolio by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international

Apparently asking other people, whether they be traders, investors or none of the above to bail you out of bad trades and financial decisions is becoming more commonplace these days. Here’s another trader who ‘allegedly’ made some horrific trades and now he is down and out. I didn’t see anything about what he actually lost

The bears are in full control of the market so far today. There is no mistaking that. But the internals don’t appear to be painting as bad of a picture at the moment. – Declining issues on NYSE is over 2000, just barely, but many of the similar sell-offs have been in the range of

Technical Outlook: SPY saw a strong gap up yesterday but remained essentially flat the rest of the day, with minimal upward momentum. Volume on SPY was atrocious, well below average, and nearly as weak as the levels seen last Thursday. SPX broke the closing highs from 1/29 but finished just a couple of points

It has been a great month so far in The Splash Zone, despite the market craziness! Bring some stability to your own portfolio by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone! With your membership, you will get each and every trade that I make with real-time text and email alerts (international

Shake Shack (I’ve yet to eat at one of these magnificent places) is finally breaking through some key resistance to the upside. First it broke the downtrend last week which was huge, and today it is gaping above and running beyond key price resistance. Both of these developments bode well and should see a run