New All-Time Highs – Everything is fine…or should I worry? It is like the market is a sling-shot. Last Wednesday’s sell-off represents the moment where the sling gets pulled back, really hard, and the subsequent six days of buying in the market represents the market ‘letting go of the drawn sling and watching it propel

Bitcoins grow on trees Stocks rise for a fifth straight day. For sure though, the talk of the town is the metaphoric rise in crypto-currencies, i.e. Bitcoin. I’m literally sitting in a coffee shop yesterday going through my charts, and a random stranger starts asking me what I think about bitcoin. I tell him to

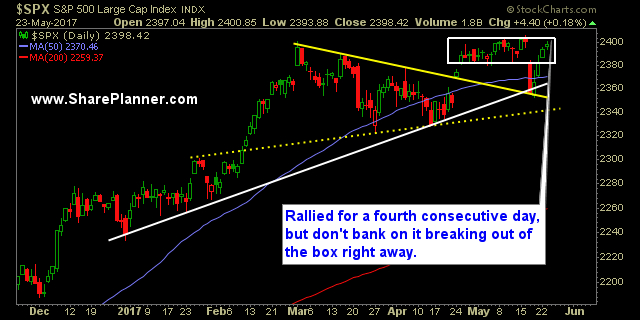

Back to the Dull Market Action Just as I was expecting, we are back to the market conditions that we saw prior to last Wednesday’s sell-off. The market has bounced hard off of those Wednesday’s lows and within four trading sessions, we are back inside of the box that price action has spent practically

Manchester terrorist attack adds additional volatility to the market The horror that terrorist groups keep bringing to the lives of people simply trying to live at peace and keep to themselves is startling. I'll never understand what could possess a person to bring such havoc to the lives of others - random people that have

Some bullish stock ideas to consider The bulls didn’t fold up shop this weekend amid some end of day headline risk this past Friday. Looking back, I would liked to still have UPRO in the portfolio, but the risk of holding it over the weekend with whatever might be ready to be thrown on

Political headline risk holding the market hostage Friday looked and felt great, until there was about 45 minutes left in the trading session, then when wheels were up on Air Force One, WaPo and the New York Times dropped simultaneous, rumored based articles that no one can verify independently.

The market that doesn’t hold a grudge With every crisis or potential crisis that occurs, the market has one of the shortest memories of all time. In some ways the market would make an excellent spouse, because when something doesn’t go right, it only holds it against your for a day, maybe a couple of

Fear grips traders and the VIX pops 46% I like buying the dip as much as anybody, and it has proven to be a really good strategy over the last eight years. But yesterday was not a day to buy the dip. The internals did not show an anemic sell-off that was going to quickly

The bears are gaining a foothold on the Trump Controversies My objective here isn’t to defend Donald Trump or prosecute him. I leave my personal opinions out of my trading simply because the market doesn’t care what I think when it comes to politics. So I have to look at price action for what it

It could be a confusing day for the bulls and bears as they deal with head fakes and traps of all types Strong day out of the market yesterday but what does it really mean for the market today and the days ahead. Should we expect to seek the bulls get head faked once again